Region:Middle East

Author(s):Dev

Product Code:KRAA9488

Pages:87

Published On:November 2025

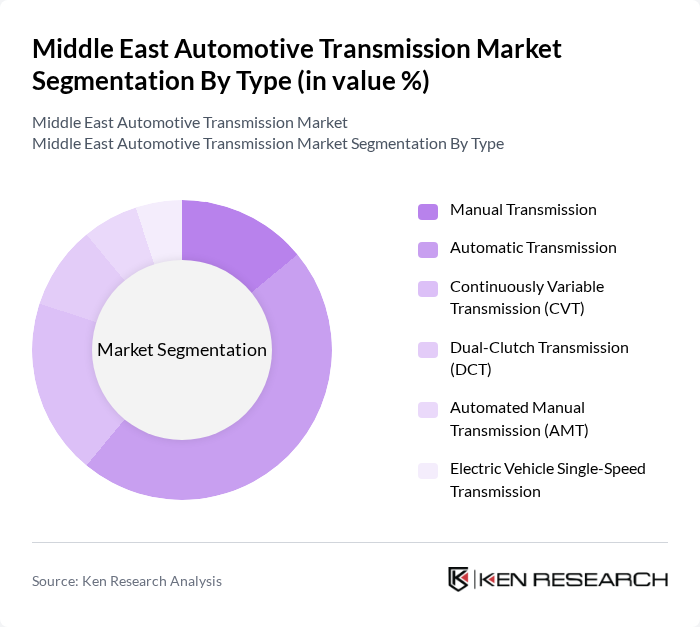

By Type:The market is segmented into Manual Transmission, Automatic Transmission, Continuously Variable Transmission (CVT), Dual-Clutch Transmission (DCT), Automated Manual Transmission (AMT), and Electric Vehicle Single-Speed Transmission. Among these, Automatic Transmission is the most popular due to ease of use and growing consumer preference for comfort and convenience. Demand for CVTs is also increasing as they provide better fuel efficiency and smoother driving, making them a preferred choice for many manufacturers .

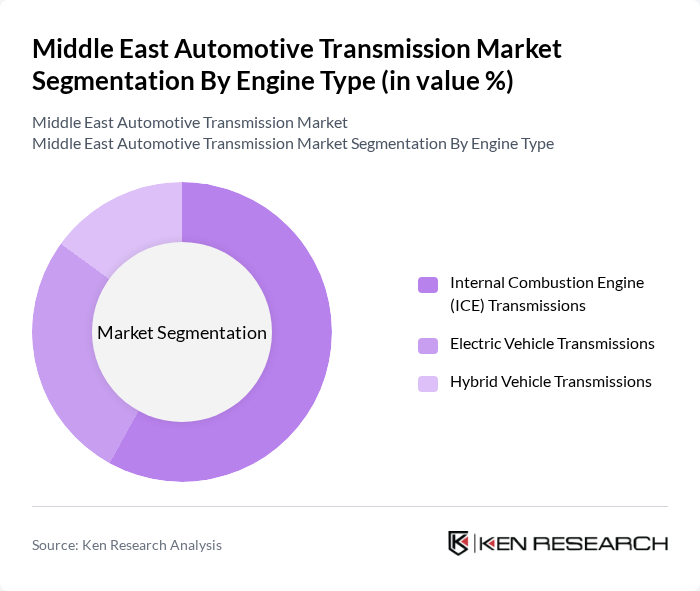

By Engine Type:Segmentation by engine type includes Internal Combustion Engine (ICE) Transmissions, Electric Vehicle Transmissions, and Hybrid Vehicle Transmissions. The Internal Combustion Engine segment remains dominant due to established infrastructure and consumer familiarity with traditional vehicles. However, Electric Vehicle Transmissions are rapidly gaining traction as manufacturers shift toward electric mobility, supported by government incentives and evolving consumer preferences .

The Middle East Automotive Transmission Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., BorgWarner Inc., Jatco Ltd., Eaton Corporation PLC, Getrag (Magna International), GKN Automotive, Continental AG, Allison Transmission, Inc., Denso Corporation, Schaeffler AG, Valeo SA, Magna International Inc., Hyundai Dymos Inc., and Allison Transmission Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East automotive transmission market is poised for significant transformation, driven by the increasing integration of electric and hybrid vehicles. As governments implement stricter emission regulations, manufacturers will focus on developing eco-friendly transmission solutions. Additionally, the rise of smart technologies in vehicles will enhance user experience and operational efficiency. Collaborations between automotive firms and tech companies will further accelerate innovation, ensuring the market adapts to evolving consumer preferences and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission Continuously Variable Transmission (CVT) Dual-Clutch Transmission (DCT) Automated Manual Transmission (AMT) Electric Vehicle Single-Speed Transmission |

| By Engine Type | Internal Combustion Engine (ICE) Transmissions Electric Vehicle Transmissions Hybrid Vehicle Transmissions |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) SUVs and Crossovers Sedans Luxury Vehicles |

| By Fuel Type | Gasoline Diesel Electric Hybrid |

| By Distribution Channel | OEM (Original Equipment Manufacturers) Aftermarket Authorized Service Centers |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Syria, Lebanon, Jordan, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Turkey |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 120 | Product Managers, R&D Engineers |

| Transmission Suppliers | 90 | Sales Directors, Technical Specialists |

| Automotive Dealerships | 75 | Sales Managers, Service Advisors |

| Aftermarket Service Providers | 55 | Workshop Managers, Parts Managers |

| Industry Experts and Analysts | 45 | Market Analysts, Automotive Consultants |

The Middle East Automotive Transmission Market is valued at approximately USD 9.2 billion, reflecting a five-year historical analysis. This valuation is driven by increasing demand for both passenger and commercial vehicles, along with advancements in transmission technology.