Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7347

Pages:95

Published On:December 2025

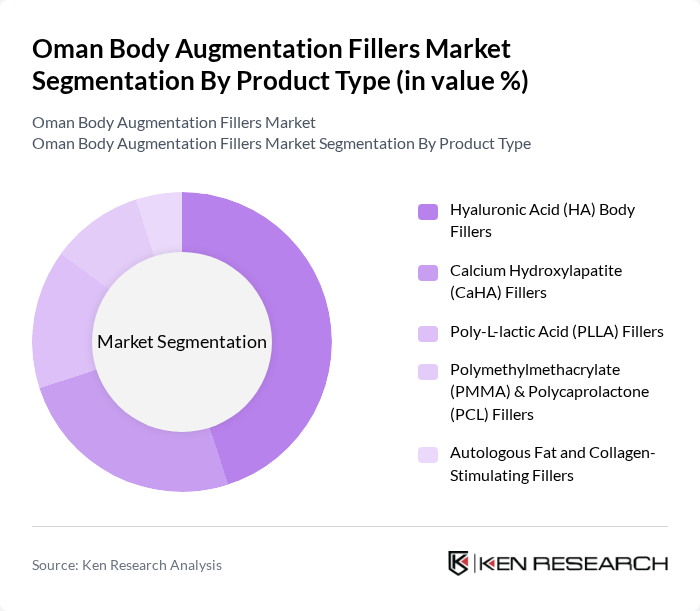

By Product Type:The market is segmented into various product types, including Hyaluronic Acid (HA) Body Fillers, Calcium Hydroxylapatite (CaHA) Fillers, Poly-L-lactic Acid (PLLA) Fillers, Polymethylmethacrylate (PMMA) & Polycaprolactone (PCL) Fillers, and Autologous Fat and Collagen-Stimulating Fillers. Among these, Hyaluronic Acid (HA) Body Fillers dominate the market due to their widespread use, safety profile, and effectiveness in providing immediate results. The increasing preference for minimally invasive procedures has further propelled the demand for HA fillers, making them the leading choice for consumers seeking aesthetic enhancements.

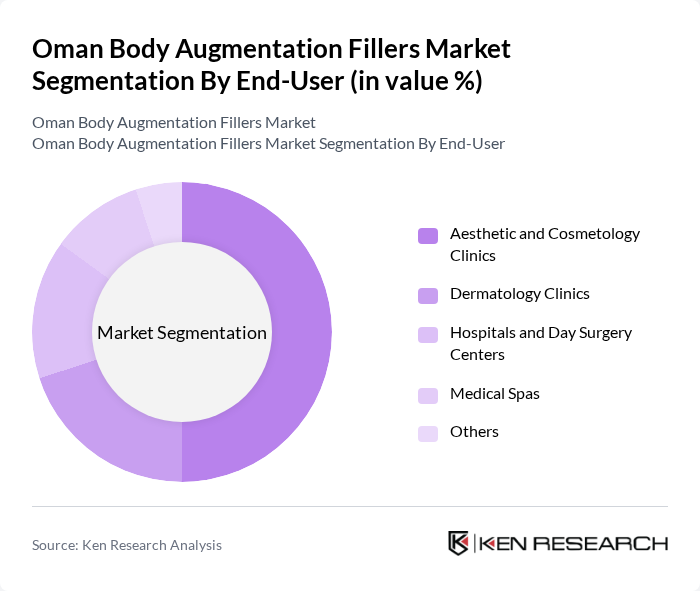

By End-User:The end-user segmentation includes Aesthetic and Cosmetology Clinics, Dermatology Clinics, Hospitals and Day Surgery Centers, Medical Spas, and Others. Aesthetic and Cosmetology Clinics are the leading end-users, driven by the increasing number of procedures performed in these specialized settings. The rise in consumer awareness regarding aesthetic treatments and the availability of advanced technologies in these clinics contribute to their dominance in the market.

The Oman Body Augmentation Fillers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allergan Aesthetics (an AbbVie Company), Galderma S.A., Merz Aesthetics GmbH, Teoxane Laboratories, Prollenium Medical Technologies Inc., Ipsen Pharma, Medytox Inc., Croma-Pharma GmbH, Sinclair Pharma Ltd. (Sinclair Aesthetics), Suneva Medical, Inc., Laboratoires Vivacy, LG Chem Ltd. (YVOIRE), Huons Global / Hugel Inc., BioScience GmbH, Laboratoires Fidia Farmaceutici S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman body augmentation fillers market appears promising, driven by a combination of technological advancements and changing consumer preferences. As the market evolves, there will be a notable shift towards natural-looking results, aligning with the growing demand for subtle enhancements. Additionally, the influence of social media will continue to shape beauty standards, encouraging more individuals to explore body augmentation options. The focus on patient education will also play a critical role in fostering trust and acceptance within the market, paving the way for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hyaluronic Acid (HA) Body Fillers Calcium Hydroxylapatite (CaHA) Fillers Poly-L-lactic Acid (PLLA) Fillers Polymethylmethacrylate (PMMA) & Polycaprolactone (PCL) Fillers Autologous Fat and Collagen-Stimulating Fillers |

| By End-User | Aesthetic and Cosmetology Clinics Dermatology Clinics Hospitals and Day Surgery Centers Medical Spas Others |

| By Application | Facial Contouring and Rejuvenation Breast and Buttock Augmentation Lip Augmentation Hand and Neck Rejuvenation Scar and Volume Restoration |

| By Distribution Channel | Direct Tender and Institutional Sales Distributors and Importers Retail and Hospital Pharmacies Online B2B Platforms Others |

| By Region | Muscat Salalah Sohar Nizwa Other Governorates |

| By Consumer Demographics | Age Group (18-30, 31-45, 46 and above) Gender (Male, Female) Income Level (Low, Middle, High) National vs Expatriate Patients |

| By Treatment Duration | Temporary Fillers (? 12 months) Semi-permanent Fillers (12–24 months) Long-acting and Permanent Fillers (> 24 months) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 60 | Dermatologists, Clinic Managers |

| Cosmetic Surgery Centers | 50 | Plastic Surgeons, Medical Directors |

| Beauty Salons and Spas | 50 | Salon Owners, Aesthetic Practitioners |

| Consumer Feedback on Fillers | 120 | Individuals who have used body fillers |

| Market Research Experts | 40 | Industry Analysts, Market Researchers |

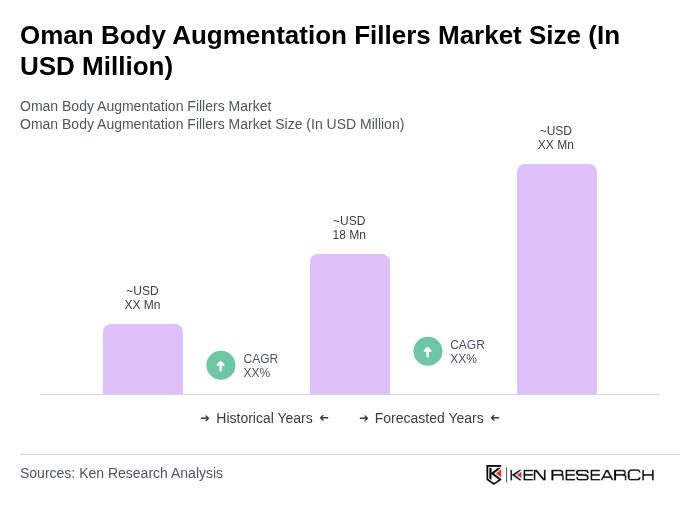

The Oman Body Augmentation Fillers Market is valued at approximately USD 18 million, reflecting a five-year historical analysis. This growth is attributed to rising consumer demand for aesthetic procedures and advancements in filler technology.