Region:Middle East

Author(s):Shubham

Product Code:KRAD1533

Pages:94

Published On:December 2025

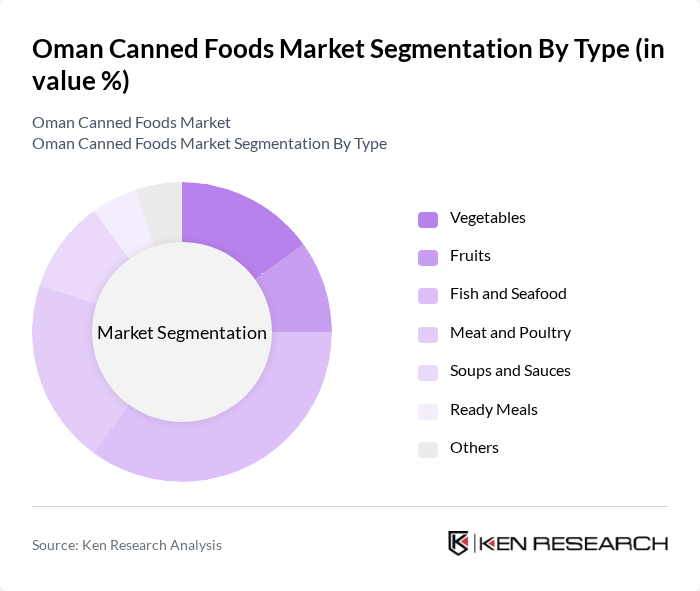

By Type:The canned foods market in Oman is segmented into various types, including vegetables, fruits, fish and seafood, meat and poultry, soups and sauces, ready meals, and others. Among these, the fish and seafood segment is particularly dominant due to the country's rich marine resources and cultural preferences for seafood. The increasing health consciousness among consumers also drives the demand for canned fish products, which are perceived as nutritious and convenient.

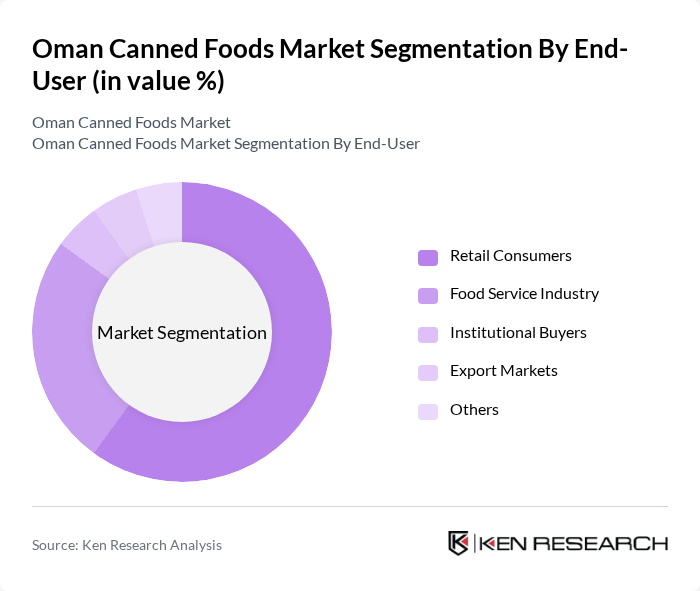

By End-User:The end-user segmentation of the canned foods market includes retail consumers, the food service industry, institutional buyers, export markets, and others. Retail consumers dominate the market, driven by the increasing trend of convenience foods and busy lifestyles. The food service industry is also growing, as restaurants and cafes increasingly incorporate canned products into their menus for efficiency and cost-effectiveness.

The Oman Canned Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Canned Foods Company, Al Ahlia Canned Foods, Al Jazeera Canned Foods, Oman Fisheries Company, Dhofar Canned Foods, Al Waha Canned Foods, Muscat Canned Foods, Al Muna Canned Foods, Oman Food Investment Holding Company, Al Fajr Canned Foods, Al Noor Canned Foods, Al Mufeed Canned Foods, Al Makhazen Canned Foods, Al Huda Canned Foods, Al Saffar Canned Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman canned foods market appears promising, driven by initiatives aimed at enhancing food security and self-sufficiency. The aquaculture sector is projected to expand significantly, targeting 100,000 tonnes per year in the future, which will bolster seafood availability for canning. Additionally, the government's sustainable agriculture strategy aims to improve production systems, ensuring a steady supply of raw materials for the canned food industry while promoting environmental sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Vegetables Fruits Fish and Seafood Meat and Poultry Soups and Sauces Ready Meals Others |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Export Markets Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Wholesale Distributors Others |

| By Packaging Type | Cans Glass Jars Pouches Tetra Packs Others |

| By Flavor Profile | Savory Sweet Spicy Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Canned Foods | 150 | Store Managers, Category Buyers |

| Consumer Preferences in Canned Food | 200 | Household Consumers, Food Enthusiasts |

| Manufacturing Insights on Canned Food Production | 100 | Production Managers, Quality Control Officers |

| Market Trends in Canned Food Exports | 80 | Export Managers, Trade Analysts |

| Health and Nutrition Perspectives on Canned Foods | 70 | Nutritionists, Health Food Advocates |

The Oman Canned Foods Market is valued at approximately USD 660 million. This valuation reflects the growing demand for convenience foods, driven by urbanization and rising disposable incomes among consumers.