Region:Middle East

Author(s):Dev

Product Code:KRAD7680

Pages:80

Published On:December 2025

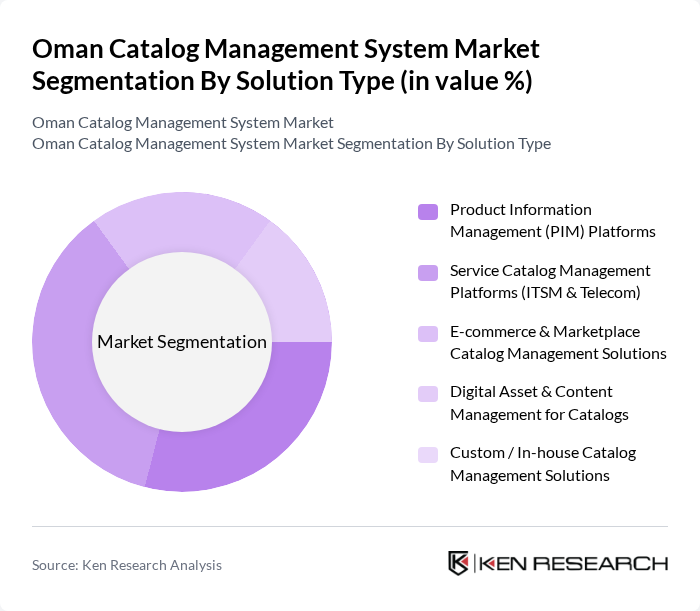

By Solution Type:The solution type segmentation includes various subsegments that cater to different aspects of catalog management. The key subsegments are Product Information Management (PIM) Platforms, Service Catalog Management Platforms (ITSM & Telecom), E-commerce & Marketplace Catalog Management Solutions, Digital Asset & Content Management for Catalogs, and Custom / In-house Catalog Management Solutions. Each of these subsegments plays a crucial role in addressing specific needs within the market.

The Product Information Management (PIM) Platforms subsegment is currently dominating the market due to the increasing demand for centralized data management solutions that enhance product visibility and consistency across various sales channels. Businesses are increasingly investing in PIM systems to streamline their operations, improve data accuracy, and enhance customer experiences. The rise of e-commerce and the need for effective product data management are driving this trend, making PIM platforms essential for organizations looking to maintain a competitive edge.

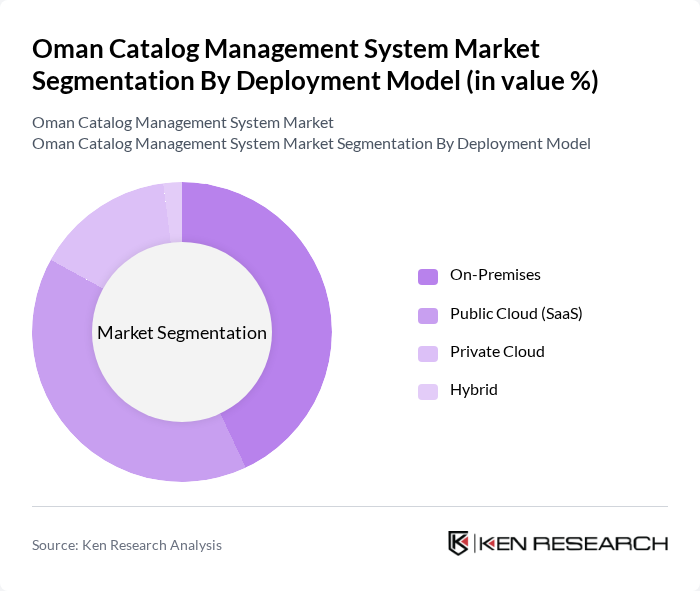

By Deployment Model:The deployment model segmentation includes On-Premises, Public Cloud (SaaS), Private Cloud, and Hybrid models. Each deployment model offers unique advantages, catering to different organizational needs and preferences regarding data security, scalability, and accessibility.

The Public Cloud (SaaS) model is leading the market due to its flexibility, cost-effectiveness, and ease of implementation. Organizations are increasingly opting for cloud-based solutions to reduce infrastructure costs and enhance collaboration among teams. The scalability offered by public cloud solutions allows businesses to adapt quickly to changing market demands, making it a preferred choice for many enterprises in Oman.

The Oman Catalog Management System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Salesforce, Inc., Adobe Inc., Informatica Inc., ServiceNow, Inc., Zoho Corporation Pvt. Ltd., Akeneo SAS, Salsify Inc., Syndigo LLC, Contentserv Group AG, Plytix ApS, Ooredoo Oman (Omani Digital Catalog & Service Management) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman catalog management system market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As businesses increasingly prioritize digital solutions, the integration of AI and machine learning into catalog management will enhance operational efficiency. Furthermore, the growing emphasis on personalized customer experiences will lead to the development of more tailored catalog solutions, ensuring that businesses can meet the diverse needs of their clientele effectively.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Product Information Management (PIM) Platforms Service Catalog Management Platforms (ITSM & Telecom) E?commerce & Marketplace Catalog Management Solutions Digital Asset & Content Management for Catalogs Custom / In?house Catalog Management Solutions |

| By Deployment Model | On-Premises Public Cloud (SaaS) Private Cloud Hybrid |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Industry Vertical | Retail & E-commerce Telecommunications & ICT Banking, Financial Services & Insurance (BFSI) Government & Public Sector Healthcare & Pharmaceuticals Oil, Gas & Industrial Others (Travel, Education, Logistics) |

| By Functional Capability | Catalog Creation & Onboarding (Data Modeling & Taxonomy) Catalog Enrichment & Maintenance (Governance & Quality) Catalog Syndication & Omnichannel Distribution Analytics, Search & Recommendation Integration & API Management |

| By Sales Channel | Direct Enterprise Sales System Integrators & IT Service Providers Cloud Marketplaces & SaaS Aggregators Others |

| By Customer Segment | B2B B2C B2G (Business-to-Government) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Catalog Management | 100 | Retail Managers, IT Directors |

| E-commerce Product Catalogs | 80 | E-commerce Managers, Digital Marketing Heads |

| Manufacturing Catalog Systems | 70 | Operations Managers, Supply Chain Analysts |

| Service Industry Catalog Management | 60 | Service Delivery Managers, IT Support Leads |

| Government and Public Sector Catalogs | 50 | Public Sector IT Managers, Procurement Officers |

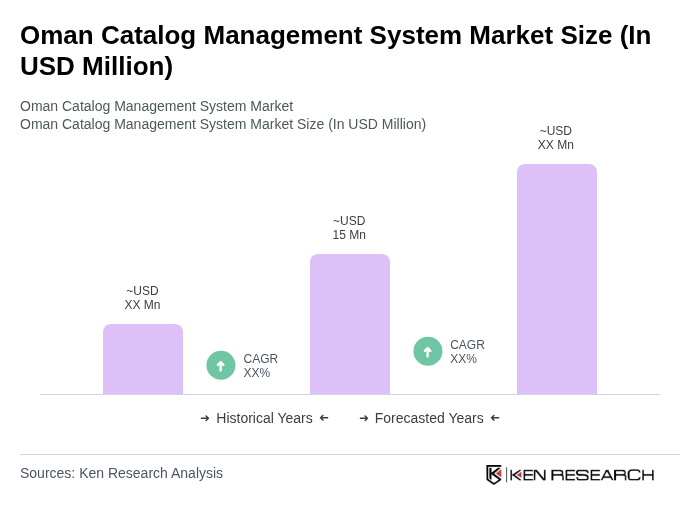

The Oman Catalog Management System market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing need for efficient data management and the adoption of digital transformation initiatives across various sectors.