Region:Middle East

Author(s):Rebecca

Product Code:KRAD1522

Pages:82

Published On:November 2025

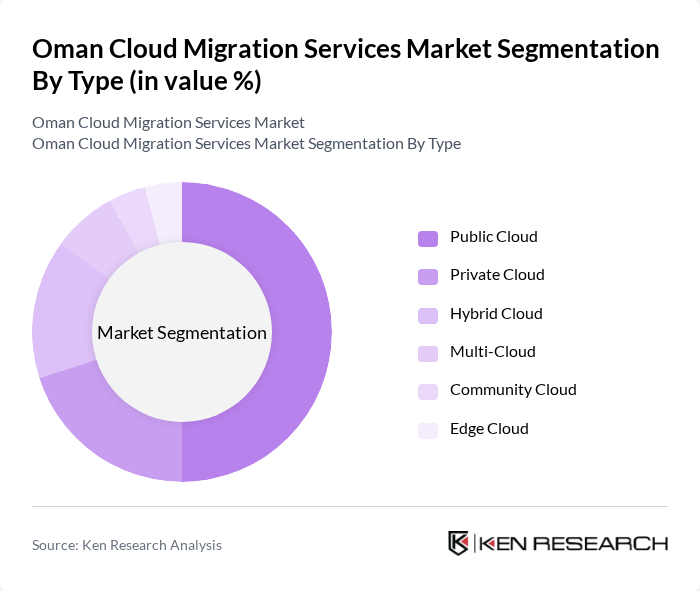

By Type:The market can be segmented into various types of cloud services, including Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, Community Cloud, and Edge Cloud. Each of these segments caters to different business needs and preferences, influencing their adoption rates.

ThePublic Cloudsegment is currently leading the market, accounting for nearly half of total revenues, driven by its cost-effectiveness, scalability, and rapid deployment capabilities. Businesses, especially SMEs and startups, prefer Public Cloud solutions for their flexibility and minimal upfront investment. The surge in remote work, digital collaboration tools, and the Omani government’s cloud-first initiatives have further accelerated Public Cloud adoption.

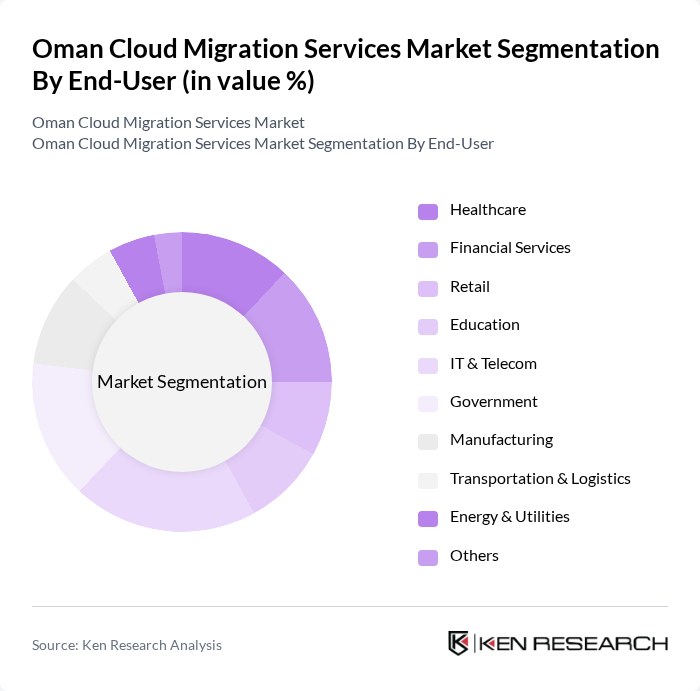

By End-User:The market can also be segmented based on end-users, including Healthcare, Financial Services, Retail, Education, IT & Telecom, Government, Manufacturing, Transportation & Logistics, Energy & Utilities, and Others. Each sector has unique requirements and challenges that influence their cloud migration strategies.

TheIT & Telecomsector is the largest contributor to the market, driven by the need for high-availability infrastructure, rapid deployment of digital services, and the expansion of 5G networks. TheHealthcaresector is also growing, propelled by digital health initiatives, secure patient data management, and telemedicine adoption. TheGovernmentsegment benefits from national digitalization policies and smart city projects, whileFinancial Servicesare leveraging cloud for advanced analytics and regulatory compliance.

The Oman Cloud Migration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Data Park, Gulf Business Machines (GBM Oman), Ooredoo Oman, Omantel, Microsoft Oman, Amazon Web Services (AWS) Oman, Oracle Oman, IBM Oman, CloudBox Technologies Oman, Huawei Oman, Cisco Systems Oman, VMware Oman, Alibaba Cloud Oman, DigitalOcean Oman, Veeam Software contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman cloud migration services market appears promising, driven by ongoing digital transformation initiatives and increased government support. As organizations continue to embrace cloud technologies, the focus will shift towards enhancing data security and compliance. Additionally, the rise of hybrid cloud solutions will enable businesses to leverage both public and private cloud environments, fostering greater flexibility and efficiency. This evolving landscape will likely attract more investments and innovations in cloud services, positioning Oman as a regional leader in cloud adoption.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Community Cloud Edge Cloud |

| By End-User | Healthcare Financial Services Retail Education IT & Telecom Government Manufacturing Transportation & Logistics Energy & Utilities Others |

| By Deployment Model | On-Premises Off-Premises Managed Services Hosted Services Others |

| By Service Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Data Migration & Management Security & Compliance Services Application Migration Others |

| By Industry Vertical | Telecommunications Manufacturing Government Transportation and Logistics Energy & Utilities Oil & Gas Others |

| By Cloud Service Model | Backup and Disaster Recovery Cloud Storage Cloud Hosting Data Analytics & AI Services Others |

| By Geographic Presence | Muscat Salalah Sohar Nizwa Duqm Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Cloud Adoption | 40 | IT Managers, Policy Makers |

| Healthcare Sector Migration | 40 | Healthcare IT Directors, Data Security Officers |

| Financial Services Cloud Solutions | 50 | IT Managers, Chief Technology Officers |

| Education Sector Cloud Integration | 40 | University IT Administrators, E-learning Coordinators |

| Retail Industry Cloud Services | 50 | Operations Managers, E-commerce Directors |

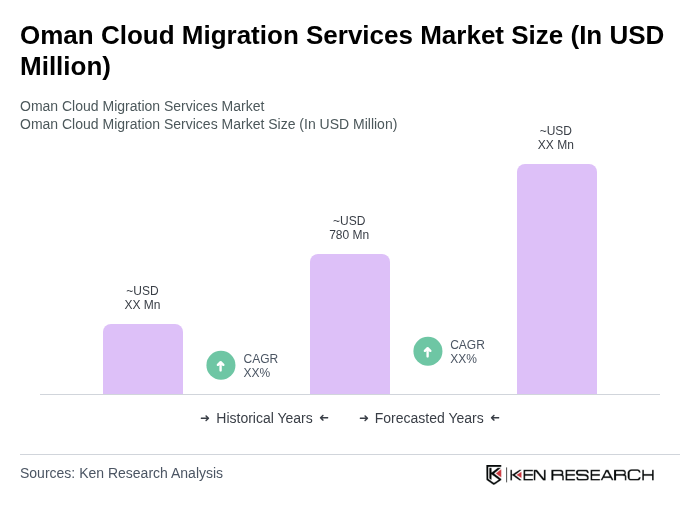

The Oman Cloud Migration Services Market is valued at approximately USD 780 million, reflecting significant growth driven by digital transformation initiatives across various sectors, including government, telecom, and manufacturing.