Region:Middle East

Author(s):Dev

Product Code:KRAE0266

Pages:87

Published On:December 2025

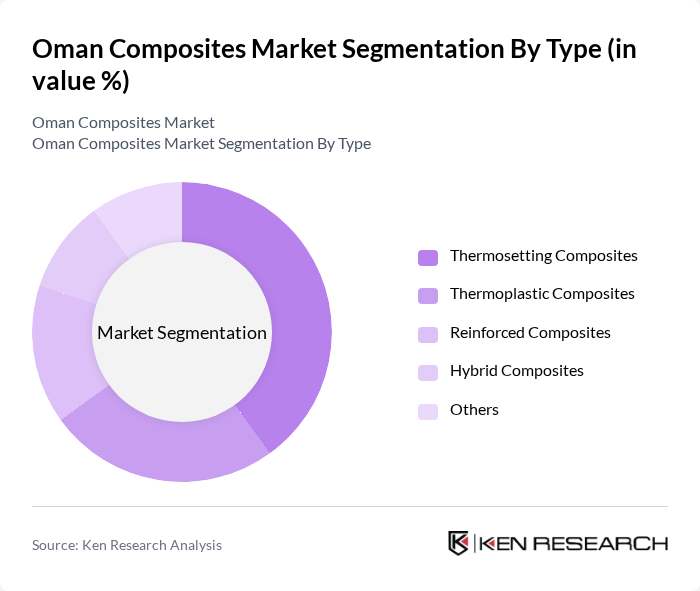

By Type:The Oman Composites Market is segmented into various types, including thermosetting composites, thermoplastic composites, reinforced composites, hybrid composites, and others. Among these, thermosetting composites are currently dominating the market due to their superior mechanical properties and thermal stability, making them ideal for applications in construction and automotive sectors. The increasing demand for lightweight and durable materials in these industries is driving the growth of thermosetting composites.

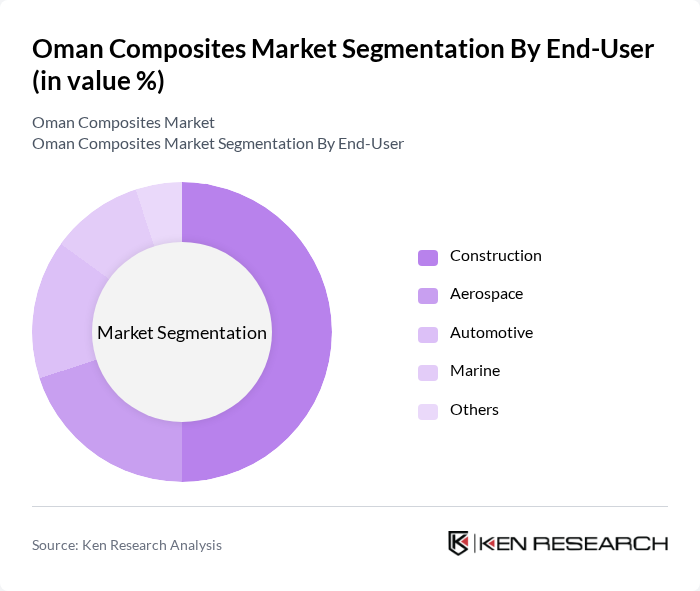

By End-User:The market is also segmented by end-user industries, including aerospace, automotive, construction, marine, and others. The construction sector is the leading end-user of composites, driven by the ongoing infrastructure projects and the government's Vision 2040 initiative. The demand for lightweight, durable, and sustainable materials in construction applications is propelling the growth of composites in this sector.

The Oman Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Composite Materials Company, Gulf Composite Solutions, Oman Fiber Optic Company, Al Jazeera International Group, Oman Air Conditioning and Refrigeration Company, Muscat Composites, Oman Engineering Company, Al Mufeed Composites, Oman Plastics Industry, National Composites Company, Oman Oil Refineries and Petroleum Industries Company, Al Batinah Composites, Oman Cement Company, Al Harthy Composites, Oman National Engineering and Investment Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman composites market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As the government continues to promote the use of advanced materials, the market is likely to witness a shift towards eco-friendly composites. Additionally, the integration of smart technologies into composite materials is expected to enhance their functionality, making them more appealing across various sectors, including construction, automotive, and renewable energy applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermosetting Composites Thermoplastic Composites Reinforced Composites Hybrid Composites Others |

| By End-User | Aerospace Automotive Construction Marine Others |

| By Application | Structural Components Electrical Components Thermal Management Aesthetic Applications Others |

| By Manufacturing Process | Hand Lay-Up Resin Transfer Molding Filament Winding Compression Molding Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Form | Sheets Rods Tubes Custom Shapes Others |

| By Market Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Composites | 100 | Project Managers, Procurement Officers |

| Automotive Composite Applications | 80 | Design Engineers, Production Managers |

| Aerospace Composite Materials | 60 | Quality Assurance Managers, R&D Directors |

| Marine Composites Market | 50 | Manufacturing Supervisors, Product Development Engineers |

| Consumer Goods Composites | 70 | Marketing Managers, Supply Chain Analysts |

The Oman Composites Market is valued at approximately USD 7 billion, reflecting a significant growth trend driven by infrastructure investments and the adoption of modern construction methods under the government's Vision 2040 initiative.