Region:Middle East

Author(s):Shubham

Product Code:KRAD1830

Pages:98

Published On:December 2025

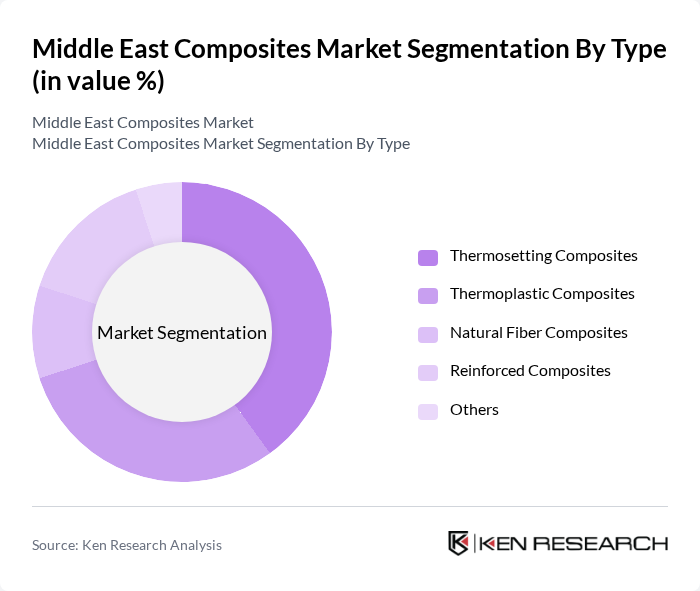

By Type:The composites market is segmented into various types, including thermosetting composites, thermoplastic composites, natural fiber composites, reinforced composites, and others. Among these, thermosetting composites are leading due to their superior mechanical properties and resistance to heat, making them ideal for applications in aerospace and automotive industries. Thermoplastic composites are also gaining traction due to their recyclability and ease of processing, appealing to manufacturers focused on sustainability.

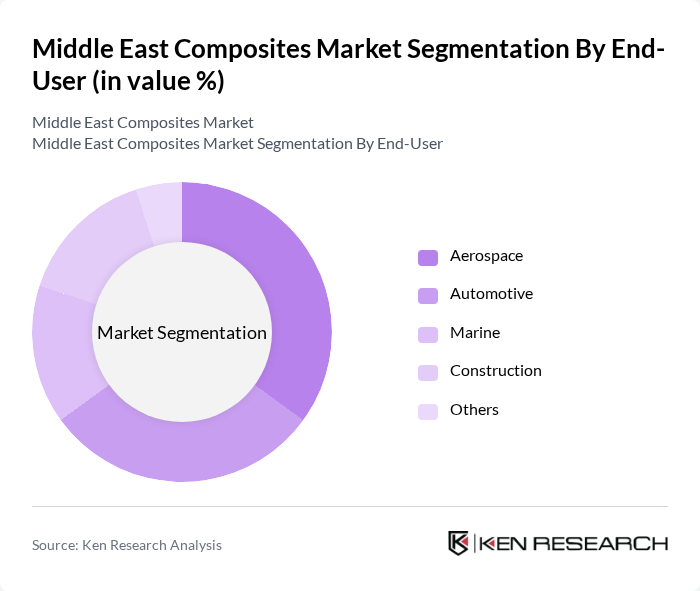

By End-User:The end-user segmentation includes aerospace, automotive, marine, construction, and others. The aerospace sector is the dominant end-user, driven by the demand for lightweight materials that enhance fuel efficiency and performance. The automotive industry is also significant, as manufacturers increasingly adopt composites to reduce vehicle weight and improve fuel economy, aligning with global sustainability trends.

The Middle East Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Hexcel Corporation, Solvay S.A., Owens Corning, Toray Industries, Mitsubishi Chemical Corporation, Teijin Limited, BASF SE, 3M Company, E. I. du Pont de Nemours and Company, SGL Carbon SE, AOC Resins, Jushi Group, Zoltek Companies, Inc., and Formosa Plastics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East composites market appears promising, driven by advancements in technology and increasing demand for sustainable materials. The advanced composites market is projected to reach USD 2.20 billion in the future, reflecting a growing emphasis on lightweight, high-strength materials across various sectors. Additionally, the biocomposites market, valued at USD 336.5 million in the future, is expected to expand as environmental concerns and regulatory pressures accelerate the adoption of sustainable materials. This trend is likely to create new opportunities for innovation and growth in the composites sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermosetting Composites Thermoplastic Composites Natural Fiber Composites Reinforced Composites Others |

| By End-User | Aerospace Automotive Marine Construction Others |

| By Application | Structural Components Electrical Insulation Thermal Management Aesthetic Finishes Others |

| By Manufacturing Process | Hand Lay-Up Resin Transfer Molding Filament Winding Compression Molding Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Investment Source | Private Investments Government Funding International Aid Venture Capital Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Composites Usage | 100 | Design Engineers, Aerospace Project Managers |

| Automotive Composite Applications | 120 | Manufacturing Engineers, Product Development Managers |

| Construction Material Composites | 80 | Architects, Construction Project Managers |

| Marine Composite Solutions | 70 | Marine Engineers, Procurement Specialists |

| Consumer Goods Composites | 90 | Product Designers, Supply Chain Managers |

The Middle East Composites Market is valued at approximately USD 6 billion, driven by rapid urbanization, infrastructure projects, and the demand for lightweight, durable materials suitable for harsh climates.