Region:Middle East

Author(s):Dev

Product Code:KRAB1877

Pages:86

Published On:January 2026

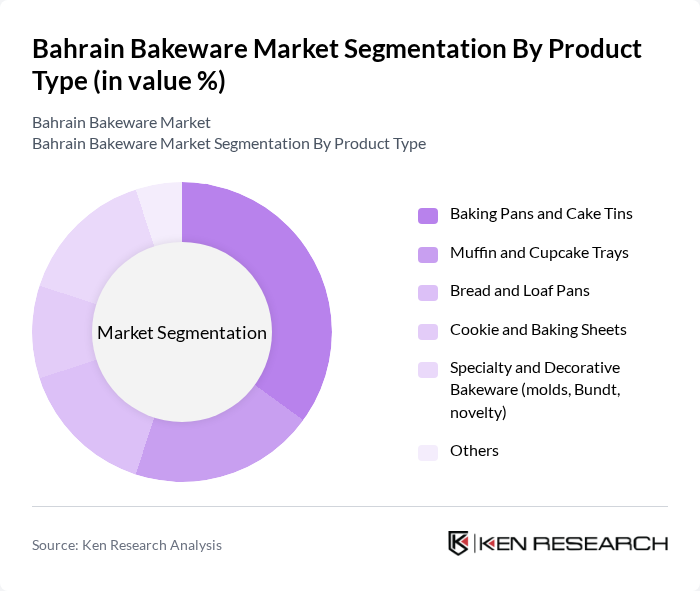

By Product Type:The product type segmentation includes various categories such as Baking Pans and Cake Tins, Muffin and Cupcake Trays, Bread and Loaf Pans, Cookie and Baking Sheets, Specialty and Decorative Bakeware, and Others. Among these, Baking Pans and Cake Tins are leading the market due to their essential role in home baking and their widespread use in preparing cakes, pastries, and everyday oven dishes. The increasing trend of baking at home, driven by social media recipes and home?based bakery businesses, has reinforced demand for versatile cake and pan sets, particularly non?stick and easy?release formats. Consumers are increasingly investing in high-quality bakeware that ensures even cooking, durability, and compatibility with modern ovens and dishwashers, which drives the demand for this sub?segment.

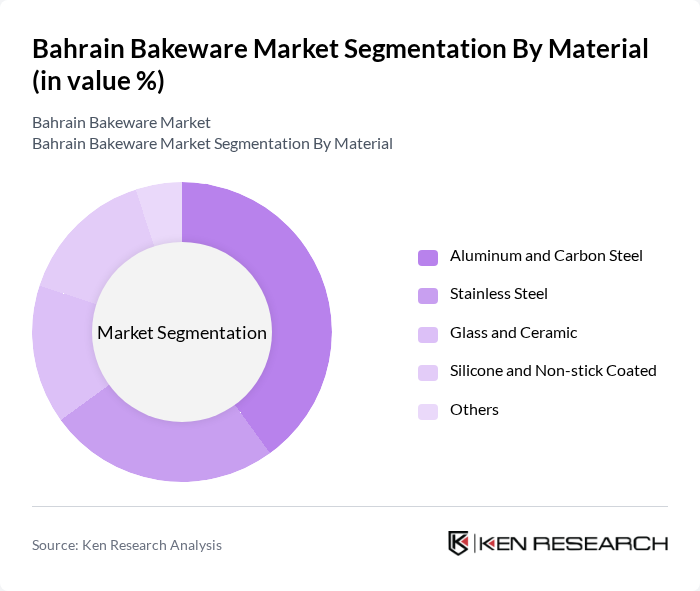

By Material:The material segmentation includes Aluminum and Carbon Steel, Stainless Steel, Glass and Ceramic, Silicone and Non-stick Coated, and Others. The Aluminum and Carbon Steel segment is currently dominating the market due to their excellent heat conductivity, relatively low weight, and affordability compared with alternative materials, making them the preferred choice for everyday baking trays, cake tins, and loaf pans. Consumers prefer these materials for their durability, resistance to warping, and ease of use—often in combination with non?stick coatings—which aligns with the growing trend of home baking, time?saving cooking solutions, and the demand for reliable bakeware that performs consistently across gas and electric ovens.

The Bahrain Bakeware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal, Pyrex, Wilton, Nordic Ware, KitchenCraft, Prestige, Home Centre (Landmark Group), IKEA Bahrain, Carrefour / Majid Al Futtaim (Private Label Bakeware), Lulu Hypermarket (Private Label Bakeware), Local Specialty Kitchenware Retailers, Online Marketplaces (Amazon, Noon, Namshi and others), Regional GCC Bakeware Importers and Distributors, Hospitality-focused Kitchen Equipment Suppliers, Emerging Local and Boutique Bakeware Brands contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain bakeware market is poised for continued growth, driven by evolving consumer preferences and technological advancements in product design. As more individuals embrace baking as a hobby, the demand for innovative and high-quality bakeware will likely increase. Additionally, the integration of smart technology in kitchen tools may further enhance user experience. Local manufacturers are expected to focus on sustainability and eco-friendly materials, aligning with global trends towards environmentally conscious consumerism, which will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Baking Pans and Cake Tins Muffin and Cupcake Trays Bread and Loaf Pans Cookie and Baking Sheets Specialty and Decorative Bakeware (molds, Bundt, novelty) Others |

| By Material | Aluminum and Carbon Steel Stainless Steel Glass and Ceramic Silicone and Non-stick Coated Others |

| By End-User | Household / Domestic Commercial Bakeries and Pastry Shops Hotels, Restaurants, and Cafés (HoReCa) Catering Services and Institutional Kitchens Others |

| By Distribution Channel | Hypermarkets / Supermarkets Specialty Kitchenware Stores Home & Lifestyle Retailers Online Channels (e-commerce and marketplaces) Wholesale and B2B Channels Others |

| By Price Range | Economy Mid-range Premium Luxury / Professional-grade |

| By Coating / Surface Type | Non-stick Coated Uncoated / Natural Finish Ceramic-coated Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakeware Sales | 90 | Store Managers, Category Buyers |

| Consumer Preferences in Bakeware | 140 | Home Bakers, Cooking Enthusiasts |

| Distribution Channels for Bakeware | 75 | Wholesale Distributors, Importers |

| Online Bakeware Purchases | 110 | E-commerce Managers, Digital Marketing Specialists |

| Market Trends and Innovations | 55 | Product Development Managers, Industry Analysts |

The Bahrain Bakeware Market is valued at approximately USD 50 million, reflecting a growing interest in home baking and the demand for premium bakeware products, driven by social media trends and increased disposable income among consumers.