Region:Middle East

Author(s):Shubham

Product Code:KRAD5551

Pages:83

Published On:December 2025

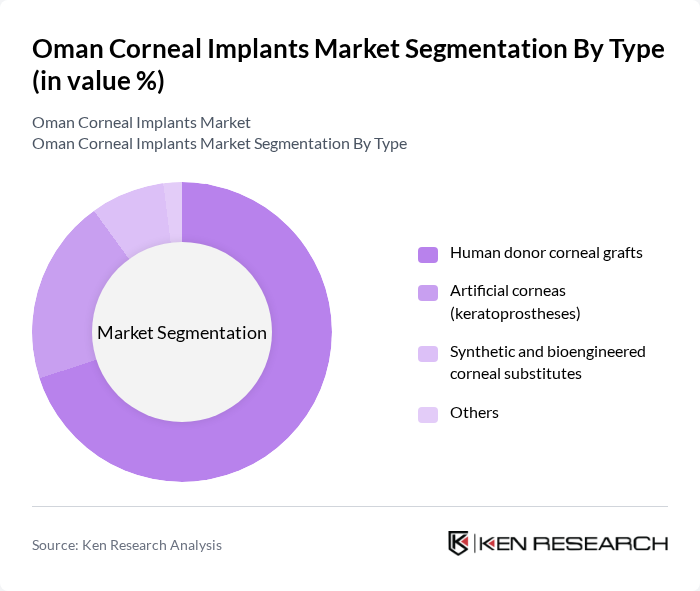

By Type:The market is segmented into various types of corneal implants, including human donor corneal grafts, artificial corneas (keratoprostheses), synthetic and bioengineered corneal substitutes, and others. Among these, human donor corneal grafts are the most widely used due to their effectiveness and acceptance in clinical practice. The increasing number of eye surgeries and the growing prevalence of corneal diseases have led to a higher demand for these grafts, making them a dominant segment in the market.

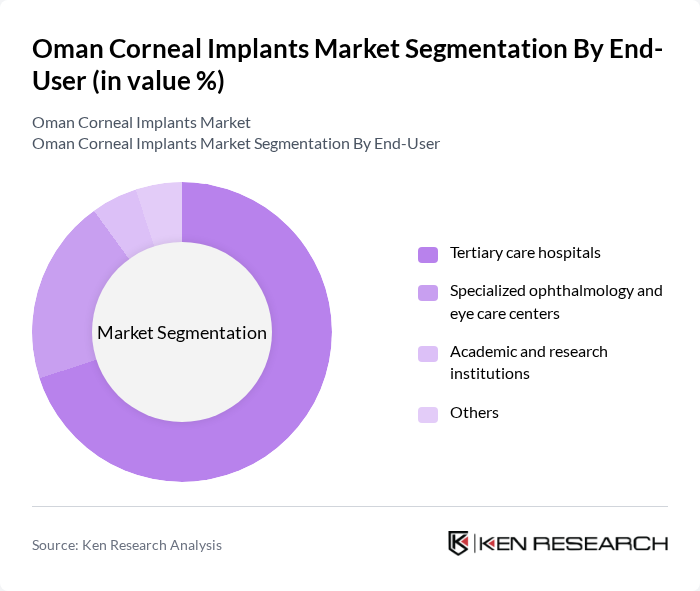

By End-User:The end-user segmentation includes tertiary care hospitals, specialized ophthalmology and eye care centers, academic and research institutions, and others. Tertiary care hospitals dominate this segment due to their advanced facilities and comprehensive eye care services. These hospitals are equipped with the latest technology and skilled professionals, making them the preferred choice for patients requiring corneal implants.

The Oman Corneal Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Inc., Bausch & Lomb Incorporated, Alcon Inc., CorneaGen, Inc., Lions World Vision Institute, KeraLink International, SightLife, Eye Bank Association of America, FCI Ophthalmics, Inc., Gebauer Medizintechnik GmbH, Presbia PLC, Mediphacos Ltda., Ocular Therapeutix, Inc., Santen Pharmaceutical Co., Ltd., DIOPTEX GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Oman corneal implants market is poised for significant growth, driven by technological advancements and increasing healthcare investments. The government’s focus on enhancing healthcare infrastructure is expected to facilitate better access to eye care services. Additionally, the integration of telemedicine in ophthalmology will likely improve patient outreach and follow-up care. As awareness of eye health continues to rise, the market is anticipated to evolve, addressing both patient needs and healthcare challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Human donor corneal grafts Artificial corneas (keratoprostheses) Synthetic and bioengineered corneal substitutes Others |

| By End-User | Tertiary care hospitals Specialized ophthalmology and eye care centers Academic and research institutions Others |

| By Distribution Channel | Direct tenders and institutional procurement Distributor-led hospital supply Cross-border sourcing via regional hubs (UAE, Saudi Arabia, others) Others |

| By Region | Muscat Governorate Dhofar (including Salalah) Al Batinah (including Sohar) Other governorates |

| By Patient Demographics | Pediatric patients Adult patients Geriatric patients Others |

| By Surgical Procedure | Penetrating keratoplasty (PK) Deep anterior lamellar keratoplasty (DALK) Endothelial keratoplasty (DSEK/DMEK) Others |

| By Technology Used | Conventional/manual keratoplasty techniques Femtosecond laser–assisted corneal surgery Advanced keratoprosthesis and implant platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologist Insights | 120 | Ophthalmologists, Eye Surgeons |

| Patient Experience Surveys | 150 | Patients with Corneal Implants |

| Healthcare Provider Feedback | 80 | Hospital Administrators, Clinic Managers |

| Market Trend Analysis | 60 | Healthcare Analysts, Policy Makers |

| Regulatory Insights | 50 | Health Regulators, Compliance Officers |

The Oman Corneal Implants Market is valued at approximately USD 2 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of corneal diseases and advancements in surgical techniques.