Region:Middle East

Author(s):Rebecca

Product Code:KRAC8597

Pages:85

Published On:November 2025

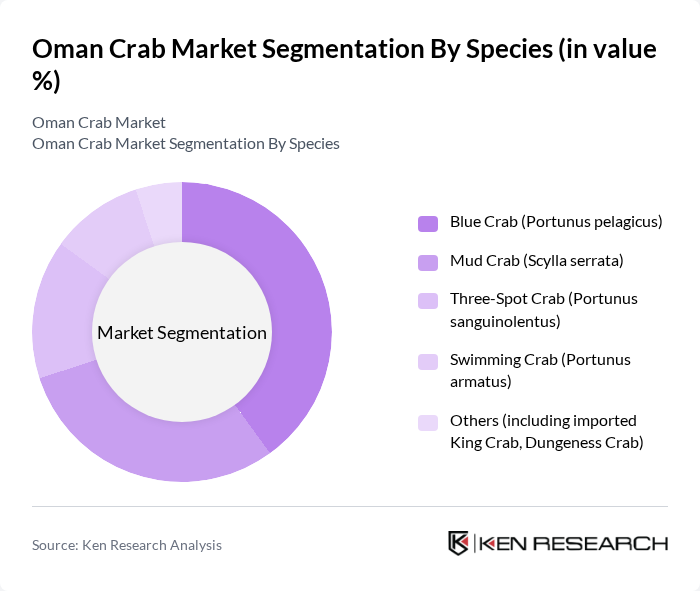

By Species:The species segment covers the main crab types harvested and traded in Oman. The dominant species are Blue Crab (), Mud Crab (), Three-Spot Crab (), and Swimming Crab (). Blue Crab is widely preferred for its flavor and abundance, while Mud Crab is valued for its larger size and higher market price. The “Others” category includes limited imports of premium varieties such as King Crab and Dungeness Crab, which are primarily used in high-end food service and specialty retail .

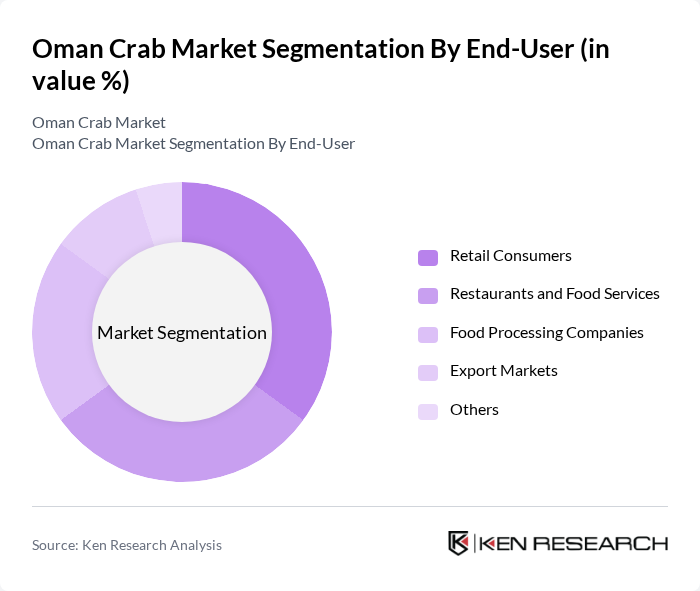

By End-User:The end-user segment includes retail consumers, restaurants and food services, food processing companies, export markets, and others. Retail consumers are increasingly purchasing fresh and processed crab for home cooking, supported by expanding supermarket and fish market channels. Restaurants and food services are broadening their seafood menus to cater to evolving consumer tastes, while food processing companies are incorporating crab meat into ready-to-eat and value-added products. Export markets remain a key outlet, particularly to neighboring Gulf countries .

The Oman Crab Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Fisheries Co SAOG, Al Bahja Group, Dhofar Fisheries Co LLC, Muscat Seafood LLC, Al Jazeera Fisheries LLC, Sea Harvest Oman LLC, Oman Marine Products Co LLC, Al Waha Fisheries LLC, Gulf Seafood LLC, Oman Aquaculture Co SAOC, Al Noor Fisheries LLC, Muscat Fish Market, Al Muna Fisheries LLC, Oman Seafood Exporters LLC, Blue Water LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman crab market is poised for growth, driven by increasing consumer preferences for sustainable seafood and the expansion of aquaculture. As the government continues to support sustainable fishing practices, the market is likely to see a rise in both domestic consumption and export opportunities. Technological advancements in crab farming and processing will further enhance product quality and availability, positioning Oman as a key player in the regional seafood market, particularly in emerging markets in Asia and the Middle East.

| Segment | Sub-Segments |

|---|---|

| By Species | Blue Crab (Portunus pelagicus) Mud Crab (Scylla serrata) Three-Spot Crab (Portunus sanguinolentus) Swimming Crab (Portunus armatus) Others (including imported King Crab, Dungeness Crab) |

| By End-User | Retail Consumers Restaurants and Food Services Food Processing Companies Export Markets Others |

| By Distribution Channel | Direct Sales (B2B/B2G) Online Retail Supermarkets and Hypermarkets Fish Markets Others |

| By Region | Muscat Salalah Sohar Sur Al Batinah Others |

| By Product Form | Live Crab Fresh Crab Frozen Crab Processed Crab Products (e.g., crab meat, value-added) Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Fishermen Insights | 100 | Crab Fishermen, Fishery Managers |

| Seafood Retail Market | 80 | Retail Managers, Seafood Buyers |

| Processing Facility Operations | 60 | Plant Managers, Quality Control Supervisors |

| Consumer Preferences | 120 | End Consumers, Seafood Enthusiasts |

| Regulatory Insights | 40 | Government Officials, Policy Makers |

The Oman Crab Market is valued at approximately USD 8 million, driven by increasing consumer demand for seafood, particularly crabs, due to their nutritional benefits and the popularity of crab-based cuisine in both domestic and export markets.