Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8227

Pages:83

Published On:November 2025

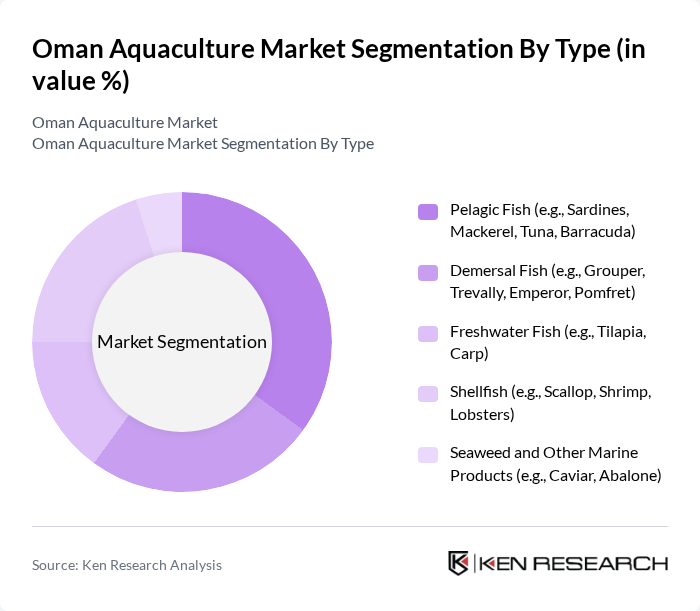

By Type:The aquaculture market is segmented into Pelagic Fish, Demersal Fish, Freshwater Fish, Shellfish, and Seaweed and Other Marine Products. Each sub-segment addresses distinct consumer preferences and market demands. Pelagic fish, such as sardines, mackerel, and tuna, are especially popular due to their high nutritional value and strong demand in both domestic and export markets. Shellfish, including shrimp and lobsters, maintain significant market share driven by premium pricing and popularity in food service sectors. Recent government investments have expanded species diversity, with notable growth in abalone, sea bream, and freshwater tilapia production .

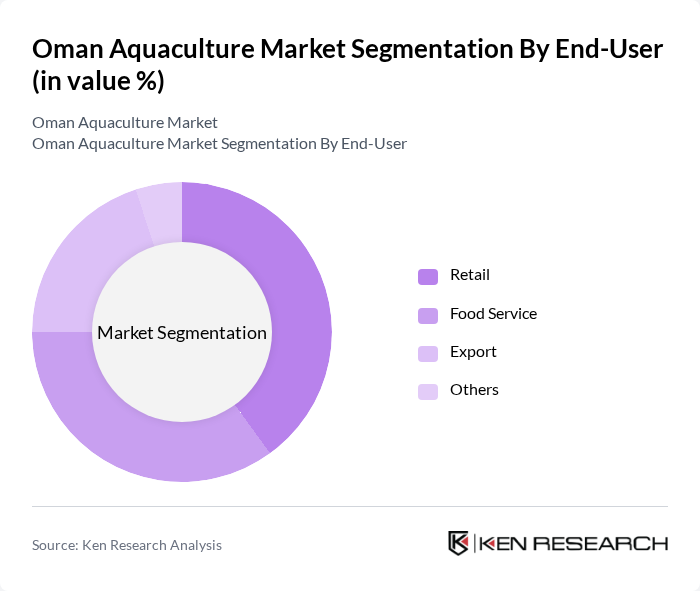

By End-User:The aquaculture market is segmented by end-user into Retail, Food Service, Export, and Others. The retail segment is experiencing rapid growth, fueled by rising consumer awareness of seafood’s health benefits and increased availability of fresh and processed products in supermarkets. The food service sector remains a key driver, with hotels and restaurants seeking premium seafood to meet evolving customer demands. Export markets are vital for high-value products, especially shellfish and pelagic fish, which are in strong demand internationally due to Oman’s reputation for quality and sustainable practices .

The Oman Aquaculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Fisheries Company SAOG, Al Bahja Group, Dhofar Fisheries & Food Industries Company SAOG, Oman Aquaculture Development Company (OADC), Blue Waters LLC, Al Waha Fisheries LLC, Sea Harvest Oman LLC, Oman Marine Products LLC, Al Jazeera Fisheries LLC, Gulf Fisheries Company LLC, Oman Seafood Company LLC, Al Noor Fisheries LLC, Oman Aquaculture Development Company (OADC), Muscat Aquaculture LLC, Al Hail Fisheries LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman aquaculture market appears promising, driven by increasing domestic demand and government initiatives aimed at enhancing production capabilities. As the population grows and consumer preferences shift towards sustainable seafood, local aquaculture is expected to play a vital role in meeting these needs. Moreover, technological advancements and investments in infrastructure will likely improve efficiency and yield, positioning Oman as a key player in the regional seafood market while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Pelagic Fish (e.g., Sardines, Mackerel, Tuna, Barracuda) Demersal Fish (e.g., Grouper, Trevally, Emperor, Pomfret) Freshwater Fish (e.g., Tilapia, Carp) Shellfish (e.g., Scallop, Shrimp, Lobsters) Seaweed and Other Marine Products (e.g., Caviar, Abalone) |

| By End-User | Retail Food Service Export Others |

| By Farming Method | Intensive Farming (e.g., Pond, Biofloc, Marine Cage) Extensive Farming Semi-Intensive Farming Others |

| By Region | Muscat Dhofar Al Batinah Eastern Region (e.g., Sur, Al Ashkharah) Al Dakhiliyah Others |

| By Distribution Channel | Direct Sales Online Sales Wholesale Others |

| By Product Form | Fresh Frozen Processed Others |

| By Certification | Organic Certification Sustainability Certification Quality Assurance Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fish Farming Operations | 45 | Aquaculture Farm Managers, Production Supervisors |

| Shrimp Farming Sector | 38 | Farm Owners, Technical Advisors |

| Aquaculture Feed Suppliers | 28 | Sales Managers, Product Development Specialists |

| Seafood Distribution Channels | 32 | Logistics Coordinators, Retail Buyers |

| Consumer Preferences in Seafood | 42 | Household Decision Makers, Health-conscious Consumers |

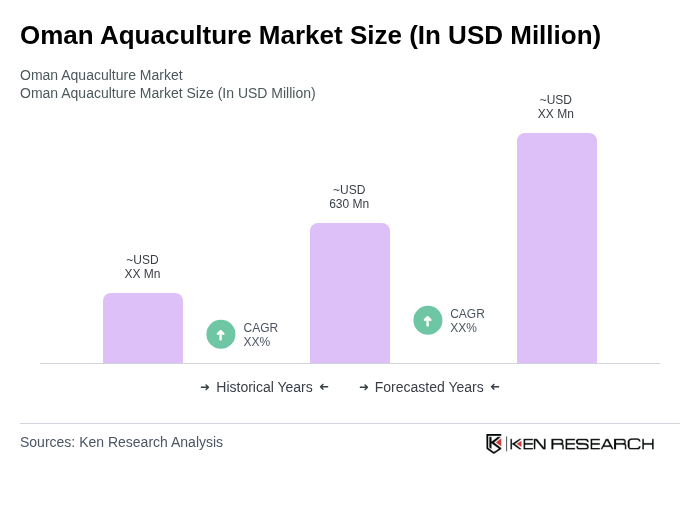

The Oman Aquaculture Market is valued at approximately USD 630 million, reflecting a robust growth trajectory driven by increasing domestic seafood demand, government initiatives, and investments in advanced aquaculture technologies.