Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1111

Pages:92

Published On:November 2025

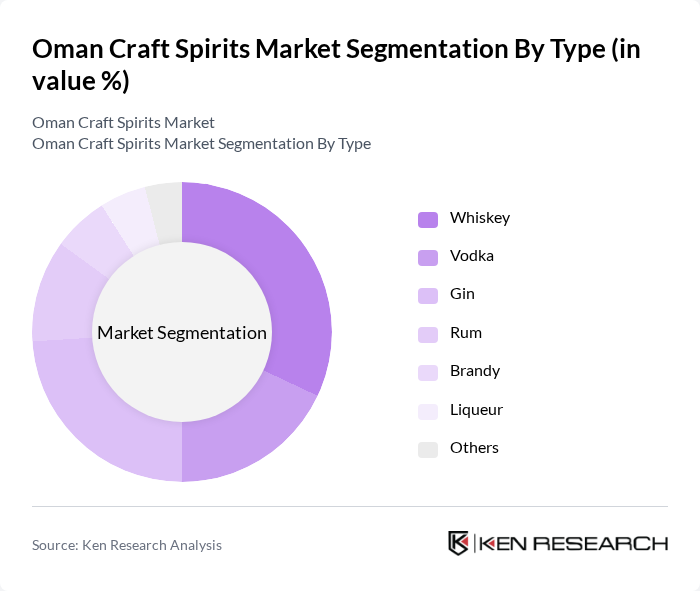

By Type:The market is segmented into various types of craft spirits, including whiskey, vodka, gin, rum, brandy, liqueur, and others. Whiskey and gin are particularly popular due to their versatility in cocktails and the growing trend of craft distilling. The demand for premium and flavored spirits is on the rise, reflecting changing consumer preferences toward unique and high-quality products, consistent with global and regional trends emphasizing innovation and premiumization .

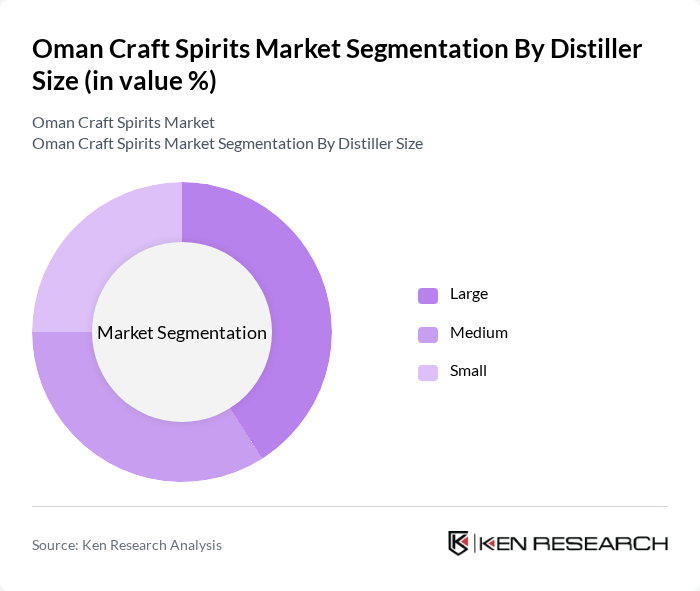

By Distiller Size:The market is categorized based on the size of distillers into large, medium, and small. Small distillers are gaining traction as they offer unique, handcrafted products that appeal to consumers seeking authenticity and local flavors. Medium-sized distillers balance quality and production capacity, while large distillers dominate in terms of volume and distribution capabilities. This segmentation reflects the global trend where small producers drive innovation, and large players expand distribution .

The Oman Craft Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Craft Distillers, Dhofar Beverages & Distillers LLC, Al Jazeera Spirits Company, Muscat Distilling Company, Oman Liquor Company SAOC, Al Harthy Beverages, Salalah Craft Spirits, Oman Artisan Spirits, Al Batinah Distillers, Muscat Craft Spirits, Al Dakhiliyah Distillers, Sohar Spirits, Nizwa Distilling Co., Al Sharqiyah Spirits, Oman Heritage Distillers contribute to innovation, geographic expansion, and service delivery in this space.

The Oman craft spirits market is poised for significant growth, driven by increasing consumer interest in unique, locally-produced beverages and a burgeoning tourism sector. As the government continues to support local producers through favorable policies, the market is likely to see a rise in innovative products that cater to evolving consumer preferences. Additionally, the craft cocktail culture is expected to flourish, further enhancing the visibility and appeal of Omani craft spirits in both local and international markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Whiskey Vodka Gin Rum Brandy Liqueur Others |

| By Distiller Size | Large Medium Small |

| By Application | Commercial Food Service Industry Residential Others |

| By End-User | Retail Consumers Bars and Restaurants Hotels and Resorts Corporate Events Others |

| By Distribution Channel | On-Trade (Hotels, Bars, Restaurants) Off-Trade (Supermarkets/Hypermarkets, Liquor Stores) Duty-Free Shops Online Retail Others |

| By Packaging Type | Glass Bottles Miniatures Gift Packs Others |

| By Price Range | Economy Mid-Range Premium Super Premium |

| By Flavor Profile | Herbal Spicy Fruity Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Distillery Owners | 50 | Founders, CEOs, and Production Managers |

| Retailers of Craft Spirits | 75 | Store Managers, Beverage Buyers |

| Consumers of Craft Spirits | 120 | Regular Consumers, Occasional Buyers |

| Industry Experts and Analysts | 40 | Market Analysts, Beverage Consultants |

| Regulatory Authorities | 20 | Policy Makers, Compliance Officers |

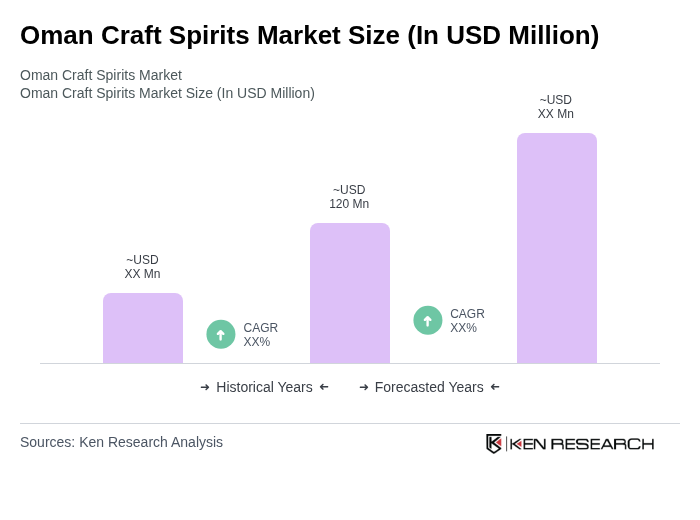

The Oman Craft Spirits Market is valued at approximately USD 120 million, reflecting a significant increase in consumer demand for premium and artisanal beverages, as well as the growth of local distilleries producing unique flavors.