Region:Middle East

Author(s):Rebecca

Product Code:KRAC1072

Pages:91

Published On:October 2025

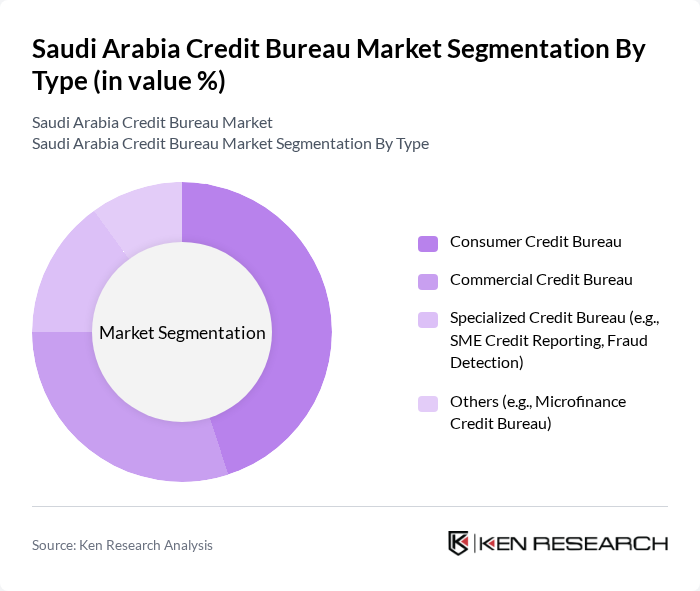

By Type:The market is segmented into various types, including Consumer Credit Bureau, Commercial Credit Bureau, Specialized Credit Bureau (e.g., SME Credit Reporting, Fraud Detection), and Others (e.g., Microfinance Credit Bureau). Among these, the Consumer Credit Bureau is the most dominant segment, driven by the increasing number of individual borrowers, the growing need for personal loans, and the expansion of digital lending platforms. The rise in consumer awareness regarding credit scores and their impact on borrowing has further fueled the demand for consumer credit reporting services. The adoption of digital credit solutions and embedded finance options is particularly strong in this segment .

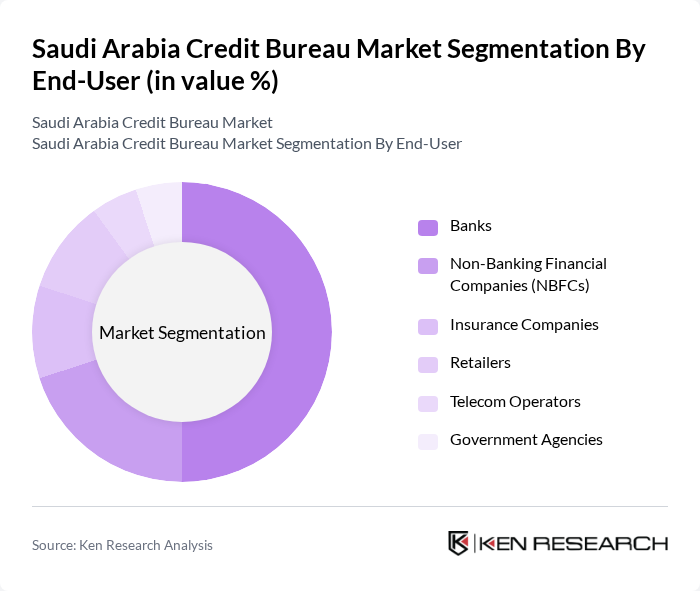

By End-User:The end-user segmentation includes Banks, Non-Banking Financial Companies (NBFCs), Insurance Companies, Retailers, Telecom Operators, and Government Agencies. The banking sector is the largest end-user, as banks rely heavily on credit bureaus for assessing the creditworthiness of borrowers. The increasing number of financial products and services offered by banks, coupled with the adoption of open banking and digital lending, has led to a higher demand for accurate credit information, making them the primary consumers of credit bureau services. NBFCs and fintechs are also rapidly increasing their share due to the growth of digital lending and alternative credit products .

The Saudi Arabia Credit Bureau Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Credit Bureau (SIMAH), Bayan Credit Bureau, Experian, TransUnion, Dun & Bradstreet, CRIF, Equifax, Creditinfo Group, Fintech Saudi, STC Pay, Al Rajhi Bank, Saudi National Bank (SNB), Riyad Bank, Arab National Bank, Banque Saudi Fransi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia credit bureau market appears promising, driven by technological advancements and regulatory support. The integration of artificial intelligence in credit scoring is expected to enhance accuracy and efficiency, while the shift towards open banking will facilitate better data sharing among financial institutions. Additionally, as e-commerce continues to grow, credit bureaus will play a crucial role in assessing creditworthiness for online transactions, further solidifying their importance in the financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Credit Bureau Commercial Credit Bureau Specialized Credit Bureau (e.g., SME Credit Reporting, Fraud Detection) Others (e.g., Microfinance Credit Bureau) |

| By End-User | Banks Non-Banking Financial Companies (NBFCs) Insurance Companies Retailers Telecom Operators Government Agencies |

| By Service Type | Consumer Credit Reporting Business Credit Reporting Fraud Detection & Prevention Services Credit Score Analytics Risk Management Solutions Others |

| By Data Source | Banks & Financial Institutions Utility Companies Telecom Companies Government Databases Others |

| By Geographic Coverage | Riyadh Jeddah Dammam Other Urban Areas Rural Areas |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Microenterprises Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Awareness | 120 | General Consumers, Young Professionals |

| Business Credit Utilization | 90 | Small Business Owners, Financial Managers |

| Banking Sector Insights | 60 | Credit Risk Analysts, Loan Officers |

| Regulatory Impact Assessment | 40 | Policy Makers, Financial Regulators |

| Technological Adoption in Credit Bureaus | 50 | IT Managers, Data Analysts in Financial Services |

The Saudi Arabia Credit Bureau Market is valued at approximately USD 115 million, reflecting a significant growth driven by increasing demand for credit information services and the expansion of financial institutions in the region.