Region:Middle East

Author(s):Rebecca

Product Code:KRAD4339

Pages:95

Published On:December 2025

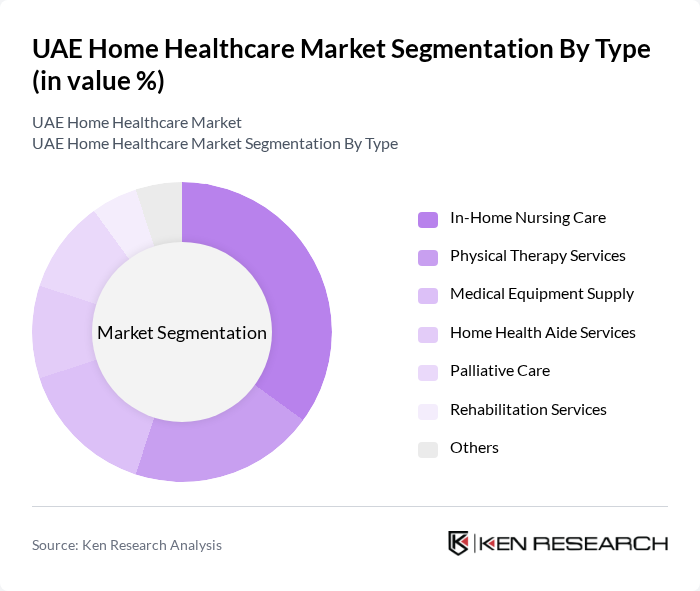

By Type:The market is segmented into various types of services, including In-Home Nursing Care, Physical Therapy Services, Medical Equipment Supply, Home Health Aide Services, Palliative Care, Rehabilitation Services, and Others. Among these, In-Home Nursing Care is the leading segment, driven by the increasing need for skilled nursing services at home, particularly for elderly patients and those with chronic illnesses. The demand for personalized care and the convenience of receiving treatment at home are key factors contributing to its dominance.

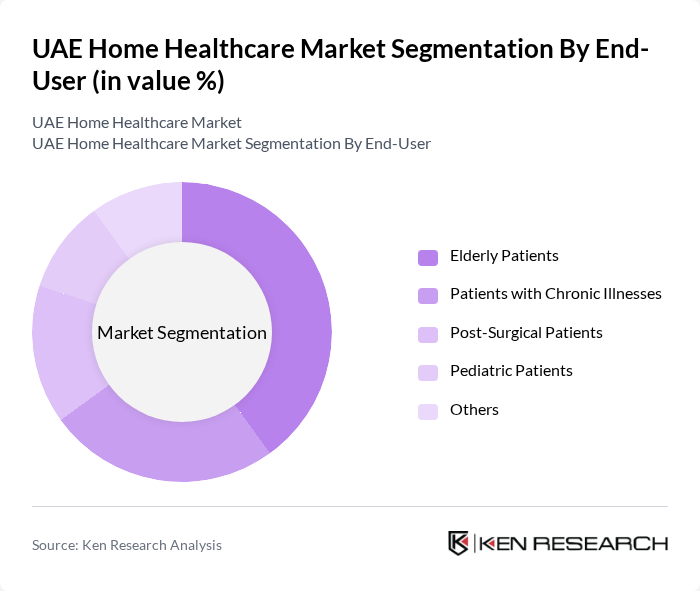

By End-User:The end-user segmentation includes Elderly Patients, Patients with Chronic Illnesses, Post-Surgical Patients, Pediatric Patients, and Others. The Elderly Patients segment holds the largest share, primarily due to the growing geriatric population in the UAE. This demographic is increasingly opting for home healthcare services to manage age-related health issues, thereby driving the demand for tailored healthcare solutions.

The UAE Home Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Homewatch CareGivers, Right at Home, Comfort Keepers, Visiting Angels, Amedisys, LHC Group, Brookdale Senior Living, Encompass Health, Interim HealthCare, Maxim Healthcare Services, Kindred Healthcare, Bayada Home Health Care, MedStar Health, Genesis HealthCare, VITAS Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE home healthcare market appears promising, driven by demographic shifts and technological innovations. As the aging population continues to grow, the demand for personalized and accessible healthcare solutions will increase. Additionally, the integration of artificial intelligence and machine learning into healthcare practices is expected to enhance service delivery. These trends indicate a shift towards more patient-centric care models, which will likely reshape the landscape of home healthcare in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Home Nursing Care Physical Therapy Services Medical Equipment Supply Home Health Aide Services Palliative Care Rehabilitation Services Others |

| By End-User | Elderly Patients Patients with Chronic Illnesses Post-Surgical Patients Pediatric Patients Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Service Model | Hourly Care Services Live-In Care Services Specialized Care Services Others |

| By Payment Model | Private Pay Insurance-Based Government Funded Others |

| By Technology Utilization | Remote Patient Monitoring Telehealth Platforms Mobile Health Applications Others |

| By Duration of Care | Short-Term Care Long-Term Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Nursing Services | 80 | Registered Nurses, Home Care Managers |

| Physical Therapy at Home | 70 | Physical Therapists, Rehabilitation Coordinators |

| Palliative Care Services | 60 | Palliative Care Specialists, Social Workers |

| Home Medical Equipment Supply | 50 | Medical Equipment Suppliers, Procurement Managers |

| Patient and Caregiver Experiences | 100 | Patients, Family Caregivers, Healthcare Advocates |

The UAE Home Healthcare Market is valued at approximately USD 1.5 billion, driven by factors such as an aging population, increasing chronic diseases, and a growing preference for home-based care solutions.