Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4880

Pages:85

Published On:December 2025

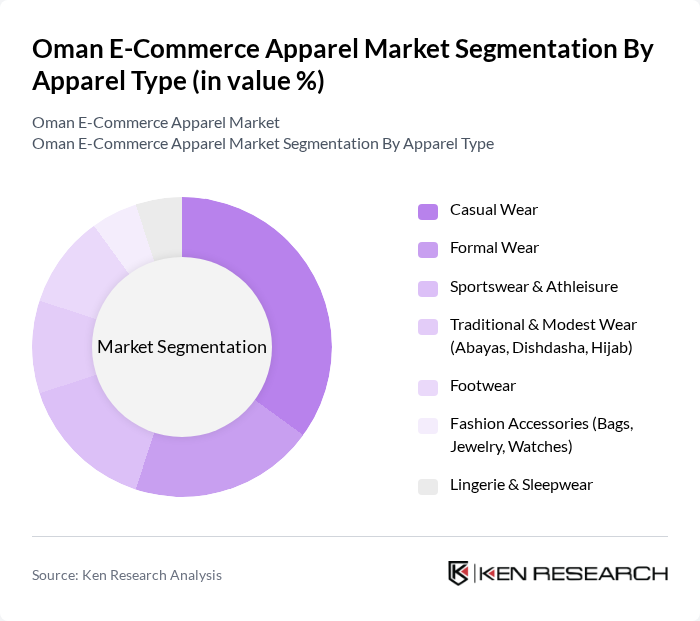

By Apparel Type:The apparel type segmentation includes various categories such as Casual Wear, Formal Wear, Sportswear & Athleisure, Traditional & Modest Wear (Abayas, Dishdasha, Hijab), Footwear, Fashion Accessories (Bags, Jewelry, Watches), and Lingerie & Sleepwear. Fashion and apparel form one of the leading B2C e-commerce categories in Oman, with fashion-related items accounting for a substantial share of online spending. Among these, Casual Wear is the leading sub-segment, driven by the increasing trend of comfortable, everyday clothing, rising acceptance of smart-casual dress codes, and the influence of social media and global fast-fashion platforms. The rise of remote and hybrid working, along with a young, fashion-conscious population, is encouraging consumers to opt for versatile and stylish casual options that can be worn both at home and outside, contributing to its dominance in the online apparel market.

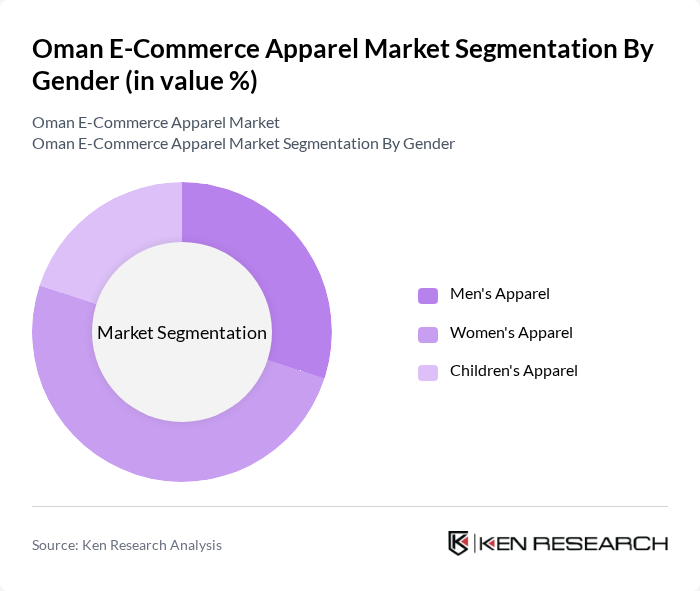

By Gender:The gender segmentation includes Men's Apparel, Women's Apparel, and Children's Apparel. Women's Apparel is the leading sub-segment, reflecting the growing focus on fashion, modest yet contemporary styling, and personal expression among women in Oman. The increasing availability of diverse regional and international brands, wider size ranges, and trend-led collections tailored to women's preferences—especially through regional platforms like Namshi, Noon, Shein, and Vogacloset—has significantly boosted this segment, making it a key driver in the e-commerce apparel market.

The Oman E-Commerce Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Namshi, Ounass, Noon, Amazon (Amazon.ae serving Oman), Shein, Vogacloset, Max Fashion (Landmark Group), Centrepoint (Landmark Group), H&M, Zara, Splash Fashion, Redtag, Debenhams (franchise / online in Oman), Brands For Less (BFL Group), Nesto Hypermarket (online fashion section) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman e-commerce apparel market appears promising, driven by technological advancements and changing consumer behaviors. As mobile commerce continues to grow, more consumers will engage in shopping via smartphones, enhancing accessibility. Additionally, the integration of augmented reality in online shopping experiences is expected to attract tech-savvy consumers, providing them with innovative ways to visualize products before purchase. These trends indicate a dynamic shift towards a more interactive and personalized shopping environment.

| Segment | Sub-Segments |

|---|---|

| By Apparel Type | Casual Wear Formal Wear Sportswear & Athleisure Traditional & Modest Wear (Abayas, Dishdasha, Hijab) Footwear Fashion Accessories (Bags, Jewelry, Watches) Lingerie & Sleepwear |

| By Gender | Men's Apparel Women's Apparel Children's Apparel |

| By Age Group | Kids (0-12 years) Teens & Young Adults (13-24 years) Adults (25-44 years) Seniors (45+ years) |

| By Price Range | Value / Budget Mid-Range Premium Luxury & Designer |

| By Online Channel Type | Pure-Play Fashion E-Tailers General Marketplaces Brand.com & Retailer Apps Social Commerce (Instagram, Snapchat, TikTok Shops) |

| By Fulfilment Model | Cross-Border E-Commerce Domestic E-Commerce Omnichannel Click-and-Collect |

| By City Tier | Muscat Other Tier-1 Cities (Salalah, Sohar) Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Apparel Retailers | 60 | eCommerce Managers, Marketing Directors |

| Consumer Shopping Behavior | 120 | Online Shoppers, Fashion Enthusiasts |

| Supply Chain Insights | 50 | Logistics Coordinators, Inventory Managers |

| Market Trends Analysis | 40 | Industry Analysts, Retail Consultants |

| Brand Perception Studies | 70 | Brand Managers, Customer Experience Specialists |

The Oman E-Commerce Apparel Market is valued at approximately USD 0.35 billion, reflecting significant growth driven by increased internet penetration, mobile commerce, and changing consumer preferences towards online shopping.