Region:Middle East

Author(s):Dev

Product Code:KRAB8188

Pages:81

Published On:October 2025

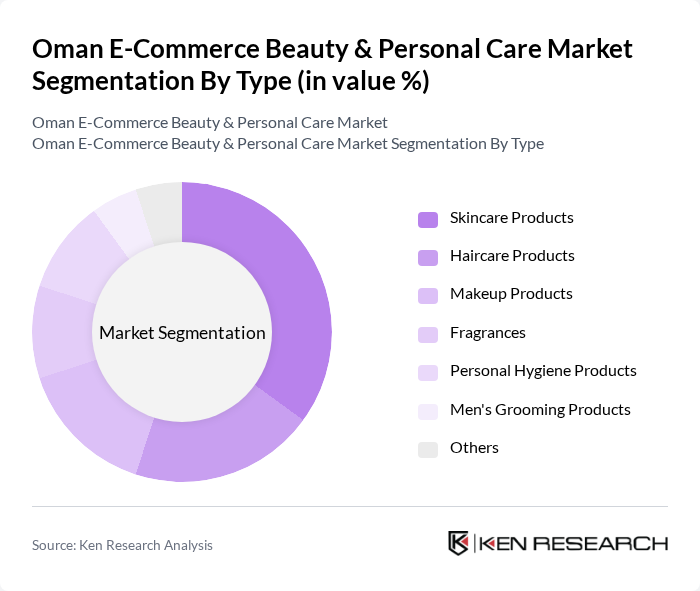

By Type:The market is segmented into various product types, including skincare products, haircare products, makeup products, fragrances, personal hygiene products, men's grooming products, and others. Among these, skincare products dominate the market due to the increasing awareness of skincare routines and the rising demand for natural and organic products. Consumers are increasingly investing in skincare, driven by a focus on health and wellness, which has led to a surge in product offerings and innovations in this segment.

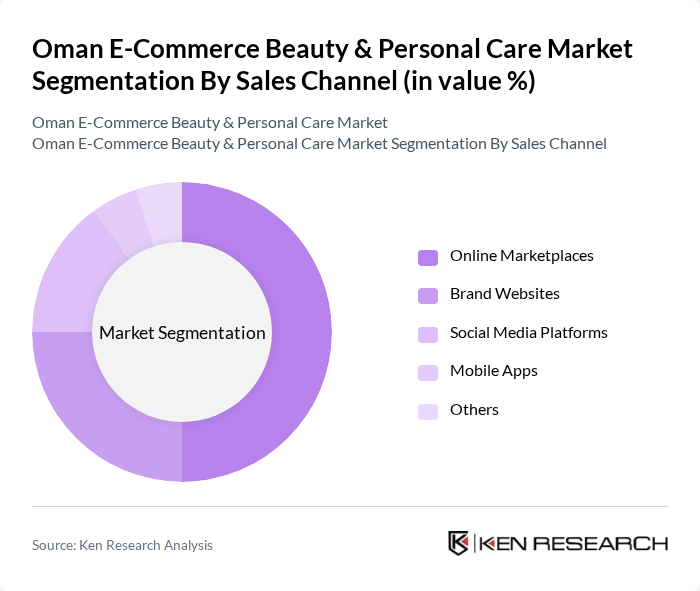

By Sales Channel:The sales channels for beauty and personal care products include online marketplaces, brand websites, social media platforms, mobile apps, and others. Online marketplaces are the leading sales channel, driven by their extensive reach and convenience. Consumers prefer these platforms for their variety and competitive pricing, which has led to a significant increase in online shopping behavior, especially among younger demographics.

The Oman E-Commerce Beauty & Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Harithy Company, Muscat Pharmacy, Al Nahda International, Al Ahlia Group, Al Jazeera International, Al Mufeedah Trading, Al Mufeedah Group, Al Shamsi Group, Al Zawawi Group, Al Futtaim Group, Al Maktoum Group, Al Mufeedah Trading Co., Al Mufeedah Group LLC, Al Shamsi Group LLC, Al Zawawi Group LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman e-commerce beauty and personal care market appears promising, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence in personalized shopping experiences is expected to enhance customer engagement. Additionally, the rise of eco-conscious consumers will likely push brands to adopt sustainable practices, further shaping the market landscape. As e-commerce platforms innovate and adapt, they will be well-positioned to capture a larger share of the growing beauty market in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Products Haircare Products Makeup Products Fragrances Personal Hygiene Products Men's Grooming Products Others |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences |

| By Packaging Type | Bottles Tubes Jars Sachets Others |

| By Price Range | Premium Mid-Range Budget |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Skincare | 150 | Beauty Enthusiasts, Skincare Users |

| Trends in Haircare Products | 100 | Haircare Professionals, Salon Owners |

| Purchasing Behavior for Cosmetics | 120 | Makeup Users, Retail Shoppers |

| Online Shopping Experiences | 80 | E-commerce Shoppers, Digital Consumers |

| Influence of Social Media on Beauty Purchases | 90 | Social Media Users, Beauty Influencers |

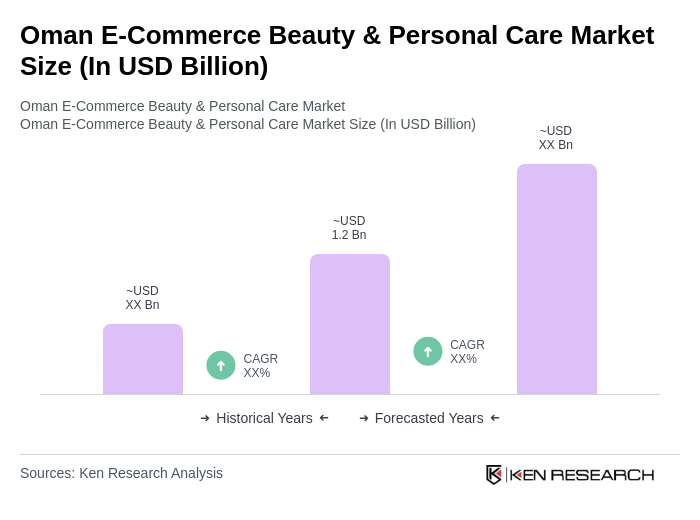

The Oman E-Commerce Beauty & Personal Care Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, rising disposable incomes, and a shift towards online shopping among consumers.