Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6325

Pages:82

Published On:October 2025

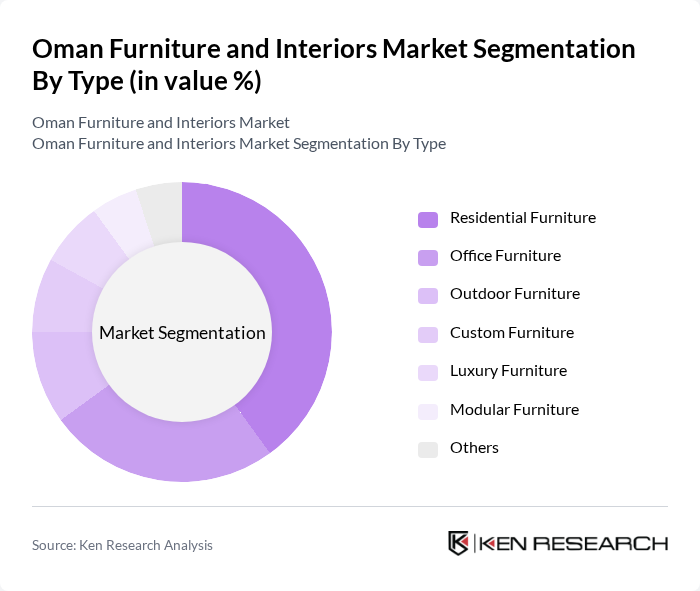

By Type:The market is segmented into various types of furniture, including residential, office, outdoor, custom, luxury, modular, and others. Each sub-segment caters to different consumer needs and preferences, with residential furniture being the most significant due to the growing housing sector and urbanization trends.

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. The residential segment dominates the market, driven by increasing home ownership and renovation activities, while the commercial sector is also growing due to the expansion of businesses and office spaces.

The Oman Furniture and Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ameen Furniture, Al Harthy Furniture, Al Mufeed Furniture, Al Shanfari Furniture, IKEA Oman, Home Centre Oman, Royal Furniture, Al Futtaim Furniture, Al Muna Furniture, Al Mufeed Interiors, Al Muna Home, Al Jazeera Furniture, Al Mufeed Home, Al Mufeed Design, Al Mufeed Decor contribute to innovation, geographic expansion, and service delivery in this space.

The Oman furniture and interiors market is poised for significant transformation as urbanization, rising incomes, and real estate growth converge. In the future, the market is expected to witness a shift towards more sustainable and customizable furniture options, driven by consumer preferences for eco-friendly materials and personalized designs. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse products, enhancing market dynamics and encouraging innovation among local manufacturers and retailers.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Luxury Furniture Modular Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Showrooms |

| By Material | Wood Metal Plastic Fabric |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Contemporary Traditional Industrial Scandinavian |

| By Brand | Local Brands International Brands Luxury Brands Emerging Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Design Enthusiasts |

| Commercial Interior Design Projects | 100 | Commercial Property Managers, Architects |

| Online Furniture Retail Trends | 80 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Furniture Styles | 120 | General Consumers, Trend Analysts |

| Impact of Sustainability on Furniture Choices | 90 | Sustainability Advocates, Eco-conscious Consumers |

The Oman Furniture and Interiors Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for modern and luxury furniture among consumers.