Region:Europe

Author(s):Dev

Product Code:KRAA3514

Pages:84

Published On:September 2025

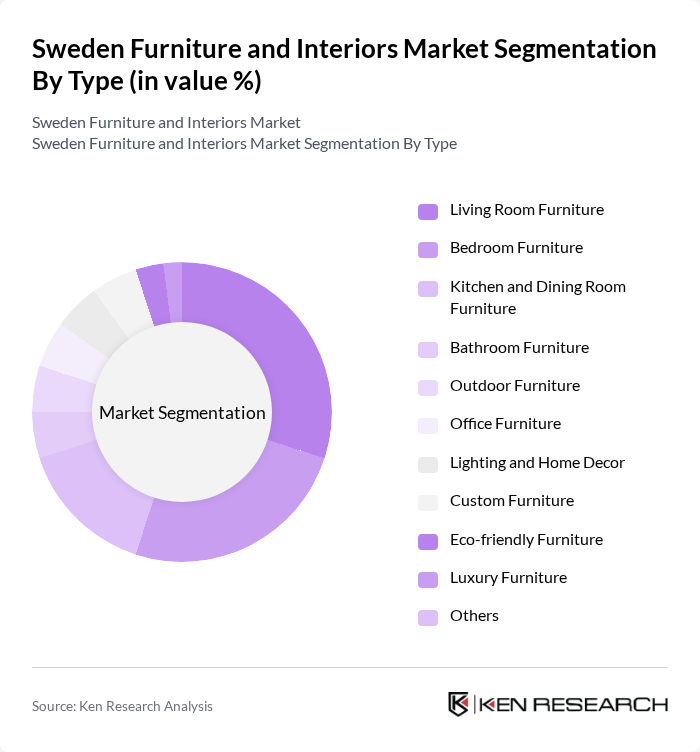

By Type:The furniture and interiors market can be segmented into various types, including Living Room Furniture, Bedroom Furniture, Kitchen and Dining Room Furniture, Bathroom Furniture, Outdoor Furniture, Office Furniture, Lighting and Home Decor, Custom Furniture, Eco-friendly Furniture, Luxury Furniture, and Others. Among these, Living Room Furniture and Bedroom Furniture are particularly dominant due to their essential roles in home furnishing and the growing trend of personalized interior design.

By End-User:The market can also be segmented by end-user categories, which include Residential, Commercial, Hospitality, and Government. The Residential segment is the largest, driven by the increasing trend of home renovations and the desire for personalized living spaces. The Commercial segment is also significant, as businesses invest in quality furniture to enhance their work environments.

The Sweden Furniture and Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Kinnarps, Nobia AB, Fagerhult, Swedese, Gärsnäs, Lammhults, String Furniture, Bolon, Design House Stockholm, Norrgavel, Blå Station, Bygghemma, Svenssons i Lammhult, Mio AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Sweden furniture and interiors market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative, space-efficient furniture will rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Sustainability will remain a key focus, with brands increasingly adopting eco-friendly practices to meet consumer expectations and regulatory standards, ensuring long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Kitchen and Dining Room Furniture Bathroom Furniture Outdoor Furniture Office Furniture Lighting and Home Decor Custom Furniture Eco-friendly Furniture Luxury Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Direct Sales |

| By Material | Wood Metal Plastic Fabric |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Functionality | Multi-functional Space-saving Ergonomic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 70 | Office Managers, Facility Managers |

| Custom Furniture Design Trends | 50 | Architects, Custom Furniture Makers |

| Sustainable Furniture Practices | 40 | Sustainability Officers, Product Designers |

| Online Furniture Shopping Behavior | 80 | eCommerce Managers, Digital Marketing Specialists |

The Sweden Furniture and Interiors Market is valued at approximately USD 8.7 billion, reflecting a significant growth trend driven by consumer demand for sustainable, stylish, and high-quality home furnishings.