Region:Asia

Author(s):Geetanshi

Product Code:KRAB6310

Pages:98

Published On:October 2025

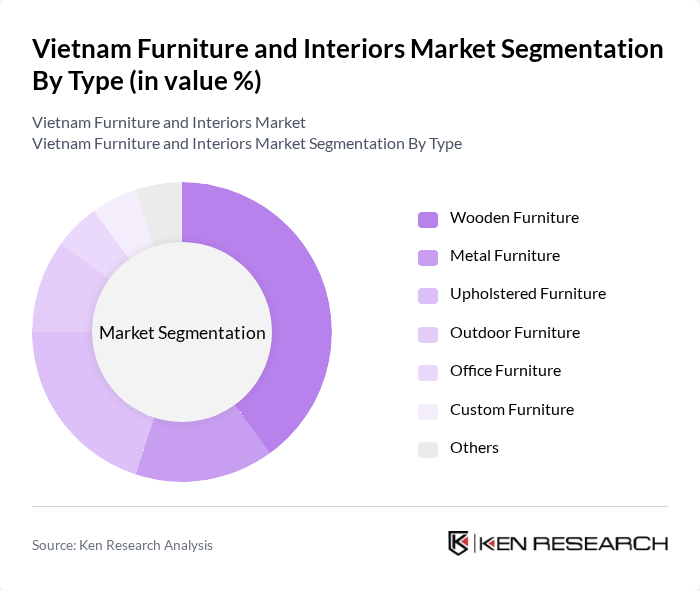

By Type:The market is segmented into various types of furniture, including Wooden Furniture, Metal Furniture, Upholstered Furniture, Outdoor Furniture, Office Furniture, Custom Furniture, and Others. Among these, Wooden Furniture is the most dominant segment due to its traditional appeal and durability. The preference for wooden furniture is driven by consumer perceptions of quality and aesthetics, making it a staple in both residential and commercial spaces.

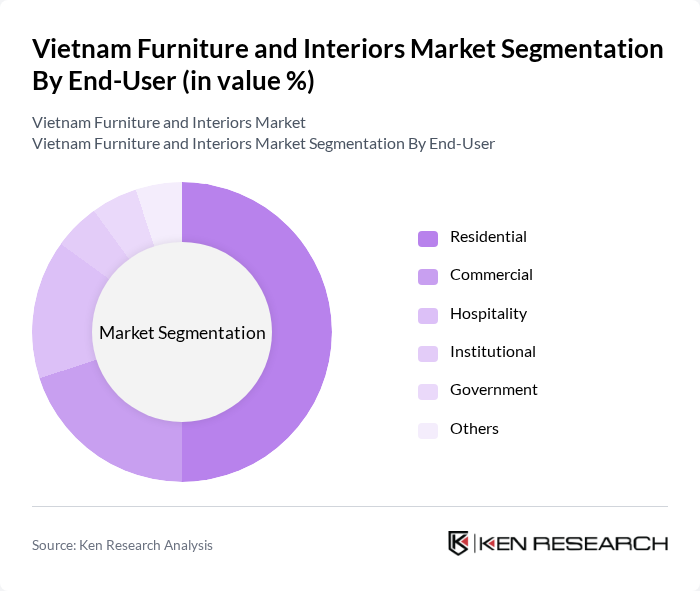

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, Institutional, Government, and Others. The Residential segment is the largest, driven by increasing home ownership and renovation activities. Consumers are increasingly investing in stylish and functional furniture for their homes, reflecting a shift towards personalized living spaces.

The Vietnam Furniture and Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Scanteak, Hòa Phát Furniture, Xuân Hòa, N?i Th?t Hòa Bình, Lotte Mart, Vincom Retail, Fami, Duy Tan Plastic, Thien Thanh Furniture, An Cuong Wood Working, MobiFone Furniture, Phu Tai Furniture, Tuan Anh Furniture, Binh Minh Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam furniture and interiors market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative and space-efficient furniture solutions will rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Companies that adapt to these trends and invest in sustainable practices will likely capture a larger market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Metal Furniture Upholstered Furniture Outdoor Furniture Office Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Institutional Government Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Wood Metal Plastic Fabric Others |

| By Style | Modern Traditional Rustic Contemporary Others |

| By Application | Home Decor Office Setup Outdoor Spaces Commercial Spaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 150 | Homeowners, Interior Designers |

| Commercial Furniture Sector | 100 | Office Managers, Facility Coordinators |

| Custom Furniture Solutions | 80 | Architects, Custom Furniture Designers |

| Online Furniture Retail | 120 | E-commerce Managers, Digital Marketing Specialists |

| Sustainable Furniture Initiatives | 70 | Sustainability Officers, Product Development Managers |

The Vietnam Furniture and Interiors Market is valued at approximately USD 15 billion, driven by rising disposable incomes, urbanization, and a growing middle class investing in home and office furnishings.