Region:Middle East

Author(s):Rebecca

Product Code:KRAC2281

Pages:97

Published On:January 2026

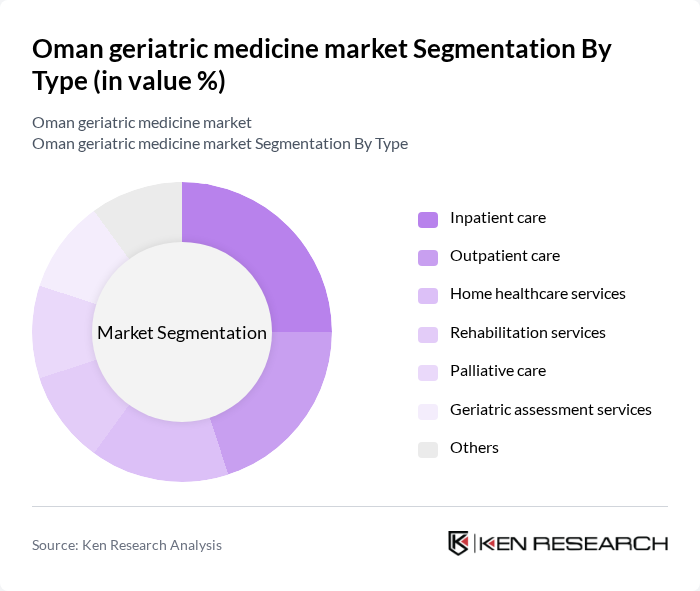

By Type:The market is segmented into various types of services catering to the geriatric population. The subsegments include inpatient care, outpatient care, home healthcare services, rehabilitation services, palliative care, geriatric assessment services, and others. Each of these services plays a crucial role in addressing the diverse healthcare needs of older adults, with a notable emphasis on personalized care and chronic disease management.

The inpatient care segment is currently dominating the market due to the high prevalence of chronic diseases among the elderly, necessitating hospitalization for comprehensive treatment. This segment is characterized by a growing number of specialized geriatric wards in hospitals, which provide tailored medical attention. Additionally, the increasing complexity of health issues faced by older adults drives the demand for inpatient services, as they require continuous monitoring and advanced medical interventions.

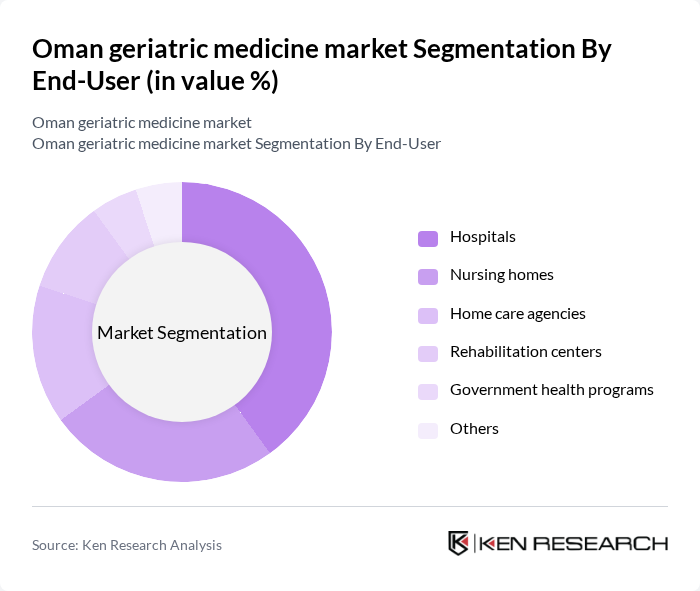

By End-User:The market is segmented based on end-users, which include hospitals, nursing homes, home care agencies, rehabilitation centers, government health services, private clinics, and others. Each end-user category plays a vital role in delivering geriatric care, with hospitals and nursing homes being the primary providers of specialized services for older adults.

The hospitals segment leads the market due to their capacity to provide comprehensive medical services, including emergency care, specialized treatments, and advanced diagnostic facilities. Hospitals are increasingly establishing geriatric departments to cater to the unique needs of older patients, which enhances their service offerings and attracts more patients seeking specialized care.

The Oman geriatric medicine market is characterized by a dynamic mix of regional and international players. Leading participants such as Sultan Qaboos University Hospital, Muscat Private Hospital, Al Nahda Hospital, Khoula Hospital, Royal Hospital, Aster DM Healthcare, Oman Medical Specialty Center, Al Noor Hospital, Badr Al Samaa Hospital, Dallah Hospital, Muscat Clinic, Al Harthy Hospital, Oman International Hospital, Al Shifa Hospital, Al Jazeera Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geriatric medicine market in Oman appears promising, driven by demographic changes and increasing healthcare investments. As the elderly population continues to grow, there will be a heightened focus on developing comprehensive care models that integrate technology and personalized medicine. Additionally, the government is likely to enhance funding for geriatric initiatives, fostering innovation and improving service delivery to meet the evolving needs of older adults in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient care Outpatient care Home healthcare services Rehabilitation services Palliative care Geriatric assessment services Others |

| By End-User | Hospitals Nursing homes Home care agencies Rehabilitation centers Government health services Private clinics Others |

| By Service Delivery Model | Traditional healthcare delivery Telehealth services Mobile health units Community-based services Integrated care models Others |

| By Geographic Distribution | Muscat Salalah Sohar Nizwa Sur Others |

| By Age Group | 70 years 80 years years and above Others |

| By Chronic Condition | Cardiovascular diseases Diabetes Dementia Arthritis Others |

| By Insurance Coverage | Public insurance Private insurance Out-of-pocket payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Geriatric Care Facilities | 100 | Facility Managers, Healthcare Administrators |

| Home Healthcare Services | 80 | Home Care Providers, Care Coordinators |

| Pharmaceuticals for Elderly | 70 | Pharmacists, Geriatricians |

| Rehabilitation Services | 60 | Physical Therapists, Occupational Therapists |

| Family Caregivers | 90 | Family Members, Caregivers of Elderly Patients |

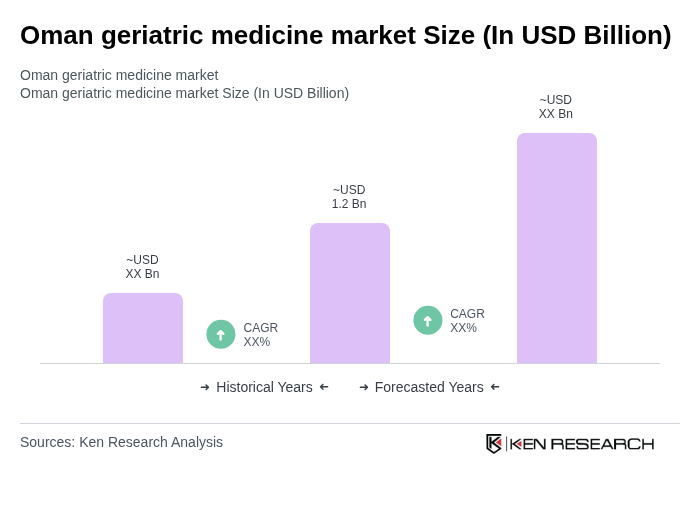

The Oman geriatric medicine market is valued at approximately USD 1.2 billion as of 2023. This valuation reflects a significant increase driven by the growing elderly population and rising healthcare expenditures focused on geriatric health issues.