Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1111

Pages:95

Published On:January 2026

By Type:The home healthcare market is segmented into various types, including Medical Equipment, Home Health Aides, Telehealth Services, Home Modifications, and Others. Among these, Medical Equipment is the leading segment, driven by the increasing demand for advanced medical devices that facilitate home care. The rise in chronic diseases necessitates the use of specialized equipment, making this segment crucial for the market's growth.

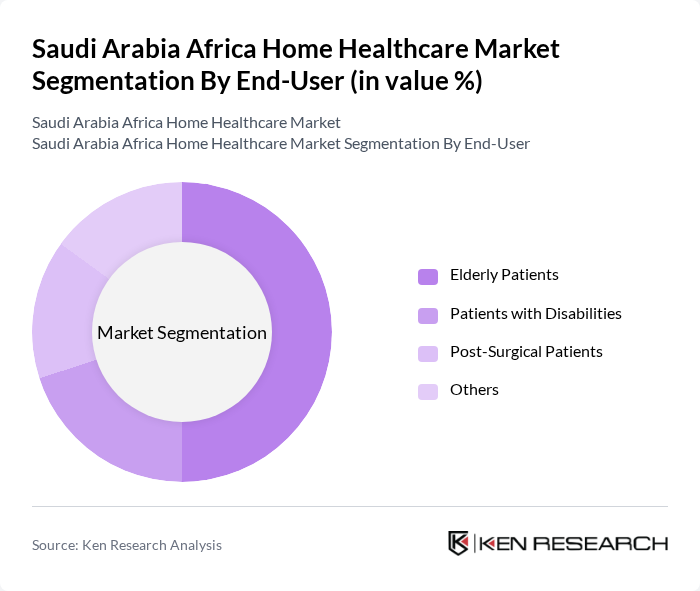

By End-User:The end-user segmentation includes Elderly Patients, Patients with Disabilities, Post-Surgical Patients, and Others. The Elderly Patients segment dominates the market, as this demographic often requires ongoing medical care and assistance, making home healthcare services essential for their well-being. The increasing aging population in Saudi Arabia significantly contributes to the growth of this segment.

The Saudi Arabia Africa Home Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Home Healthcare Saudi Arabia, Al Nahdi Medical Company, Saudi German Hospital, Dallah Healthcare Company, Al-Faisal Holding, Al-Muhaidib Group, Al-Hokair Group, Al-Jazeera Healthcare, Al-Muhaidib Medical Company, Al-Salam Hospital, Al-Mawaddah Hospital, Al-Mansour Medical Company, Al-Muhaidib Healthcare, Al-Mahmal Medical Services, Al-Muhaidib Home Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home healthcare market in Saudi Arabia appears promising, driven by the growth of digital health ecosystems and the expansion of virtual hospital services. The launch of the Regulatory Healthcare Sandbox in the future aims to foster innovation in telemedicine and AI integration, enhancing service delivery. Additionally, the establishment of Seha Virtual Hospital, connecting 224 hospitals, will facilitate remote consultations, further supporting the home healthcare sector's growth and accessibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Equipment Home Health Aides Telehealth Services Home Modifications Others |

| By End-User | Elderly Patients Patients with Disabilities Post-Surgical Patients Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Service Type | Skilled Nursing Care Physical Therapy Occupational Therapy Speech Therapy Others |

| By Payment Source | Private Insurance Government Programs Out-of-Pocket Payments Others |

| By Technology Adoption | Mobile Health Applications Remote Patient Monitoring Electronic Health Records Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Home Healthcare Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Healthcare Service Providers | 100 | Healthcare Administrators, Service Managers |

| Patients Receiving Home Care | 150 | Patients, Family Caregivers |

| Healthcare Professionals | 80 | Nurses, Physical Therapists, Occupational Therapists |

| Insurance Companies | 50 | Claims Managers, Policy Underwriters |

| Government Health Officials | 30 | Health Policy Makers, Regulatory Officers |

The Saudi Arabia Africa Home Healthcare Market is valued at approximately USD 4 billion, driven by factors such as the increasing prevalence of chronic diseases, a growing geriatric population, and advancements in remote patient monitoring technologies.