Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1288

Pages:94

Published On:November 2025

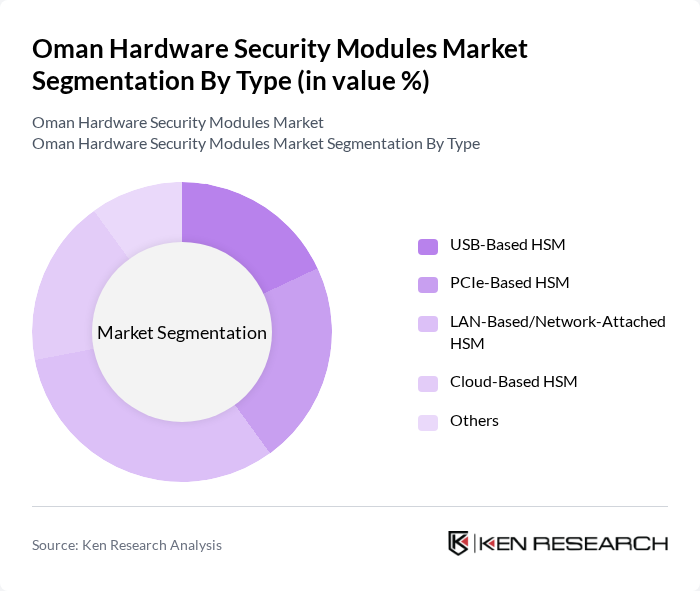

By Type:The market is segmented into USB-Based HSM, PCIe-Based HSM, LAN-Based/Network-Attached HSM, Cloud-Based HSM, and Others. Each type addresses distinct performance, scalability, and deployment requirements. USB-Based HSMs offer portability for small-scale applications, PCIe-Based HSMs deliver high-speed cryptographic processing for enterprise servers, LAN-Based/Network-Attached HSMs provide centralized, scalable security for multi-user environments, while Cloud-Based HSMs enable flexible, remote key management for organizations leveraging cloud infrastructure.

TheLAN-Based/Network-Attached HSMsegment leads the market, favored for its high performance and scalability in enterprise environments. This segment supports centralized security management and multi-user access, making it ideal for organizations undergoing digital transformation and seeking robust, networked cryptographic solutions. The rapid adoption of cloud-based HSMs is also notable, driven by the need for flexible, scalable security in remote and hybrid work settings.

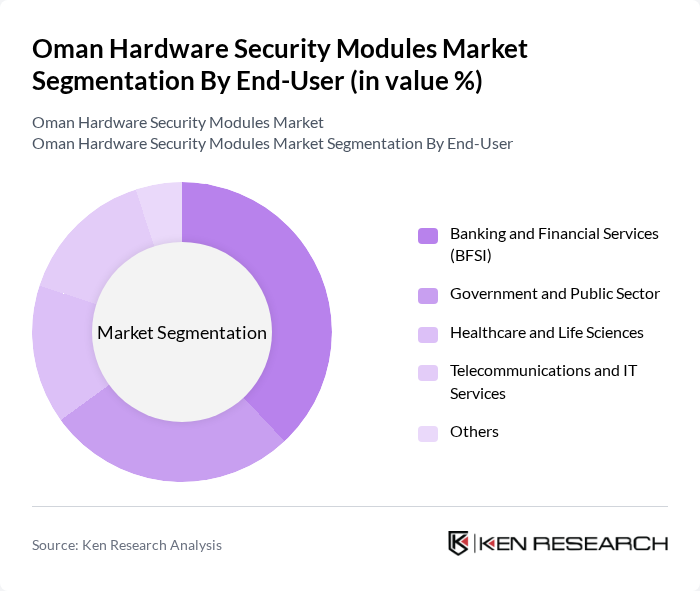

By End-User:The market is segmented by end-user industries: Banking and Financial Services (BFSI), Government and Public Sector, Healthcare and Life Sciences, Telecommunications and IT Services, and Others. Each sector’s regulatory and operational requirements shape HSM adoption patterns.

TheBanking and Financial Services (BFSI)sector remains the largest end-user, driven by strict regulatory requirements for data protection, high transaction volumes, and the need for secure payment processing and digital signature management. Government and public sector adoption is rising due to compliance mandates for critical infrastructure security, while healthcare and telecommunications sectors are investing in HSMs to protect sensitive patient and subscriber data.

The Oman Hardware Security Modules Market features a diverse mix of regional and international providers. Leading participants include Thales Group, International Business Machines Corporation (IBM), Oracle Corporation, Utimaco GmbH, Amazon Web Services (AWS), Microsoft Corporation (Azure), Securosys AG, Yubico AB, Futurex Inc., nCipher Security (part of Thales), Entrust Corporation, Atos SE, Open Text Corporation, Micro Focus International PLC, and Google Cloud (Cloud HSM Services). These companies drive innovation, expand geographic reach, and enhance service delivery through advanced cryptographic solutions and compliance-focused offerings.

The Oman Hardware Security Modules market is poised for significant growth as organizations increasingly prioritize cybersecurity in response to escalating threats. The integration of advanced technologies, such as artificial intelligence and machine learning, will enhance the capabilities of HSMs, making them more effective against sophisticated attacks. Additionally, the ongoing digital transformation initiatives by the government will further drive the adoption of HSMs, ensuring compliance with evolving regulatory standards and fostering a secure digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | USB-Based HSM PCIe-Based HSM LAN-Based/Network-Attached HSM Cloud-Based HSM Others |

| By End-User | Banking and Financial Services (BFSI) Government and Public Sector Healthcare and Life Sciences Telecommunications and IT Services Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Application | Payment Processing and Transaction Security Digital Signatures and Authentication Secure Key Management Data Encryption and SSL/TLS Others |

| By Industry Vertical | Retail and E-Commerce Energy and Utilities Education and Research Manufacturing and Industrial Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Security Compliance Level | FIPS 140-2 Certified FIPS 140-3 Certified Post-Quantum Cryptography Ready Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector HSM Usage | 60 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 40 | Data Protection Officers, IT Administrators |

| Telecommunications Security Solutions | 45 | Network Security Engineers, Operations Managers |

| Government Cybersecurity Initiatives | 40 | Cybersecurity Policy Makers, IT Directors |

| Retail Sector Payment Security | 50 | Payment Security Analysts, IT Managers |

The Oman Hardware Security Modules Market is valued at approximately USD 12 million, reflecting a five-year historical analysis and proportional estimation from the broader Middle East & Africa market. This growth is driven by increasing data security needs and regulatory compliance.