Region:Middle East

Author(s):Dev

Product Code:KRAC2039

Pages:98

Published On:October 2025

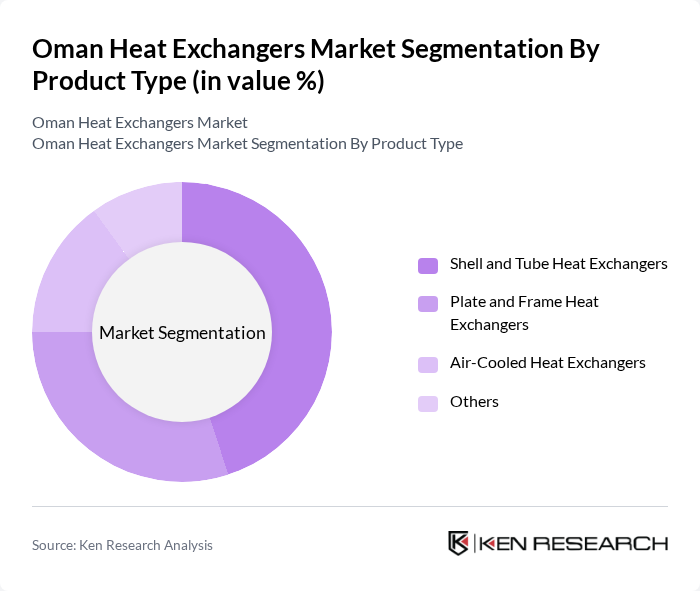

By Product Type:The product type segmentation covers key heat exchanger designs tailored to diverse industrial requirements. The primary subsegments include Shell and Tube Heat Exchangers, Plate and Frame Heat Exchangers, Air-Cooled Heat Exchangers, and Others. Shell and Tube Heat Exchangers hold the largest market share, favored for their versatility and reliability in high-pressure, high-temperature applications, especially within oil and gas and power generation sectors. Plate and Frame Heat Exchangers are gaining traction for their compactness and efficiency in HVAC and chemical processing, while Air-Cooled Heat Exchangers are increasingly used in environments where water scarcity or ambient cooling is required.

By Material:The material segmentation reflects the range of construction materials used for heat exchangers, including Stainless Steel, Alloys, Copper, Aluminum, Carbon Steel, and Others. Stainless Steel leads due to its superior corrosion resistance and durability, making it ideal for harsh industrial environments and processes involving aggressive chemicals or high salinity. Alloys are preferred for specialized applications requiring enhanced mechanical properties, while Copper and Aluminum are selected for their thermal conductivity in HVAC and light industrial sectors. Carbon Steel remains relevant for cost-sensitive, moderate-duty applications.

The Oman Heat Exchangers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alfa Laval, Danfoss A/S, API Heat Transfer, Güntner Group GmbH, Kelvion Holding GmbH, SPX Corporation, Hisaka Works, Ltd., GEA Group AG, Xylem Inc., Tranter, Inc., HRS Heat Exchangers, Babcock & Wilcox Enterprises, Inc., Chart Industries, Inc., Thermax Limited, Swep International AB contribute to innovation, geographic expansion, and service delivery in this space.

The Oman heat exchangers market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize energy efficiency, the integration of IoT technologies in heat exchanger systems is expected to enhance operational performance. Furthermore, the government's focus on renewable energy projects will likely create new avenues for growth, positioning Oman as a regional hub for innovative heat exchange solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Shell and Tube Heat Exchangers Plate and Frame Heat Exchangers Air-Cooled Heat Exchangers Others |

| By Material | Stainless Steel Alloys Copper Aluminum Carbon Steel Others |

| By End Use | Oil and Gas Chemical and Petrochemical HVAC and Refrigeration Power Generation Desalination Food and Beverage Pharmaceuticals Others |

| By Application | Process Cooling Heat Recovery Refrigeration District Cooling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Heat Exchangers | 60 | Engineering Managers, Project Directors |

| Power Generation Facilities | 50 | Operations Managers, Maintenance Supervisors |

| Manufacturing Industry Applications | 40 | Production Managers, Quality Control Engineers |

| HVAC System Suppliers | 40 | Sales Managers, Product Development Engineers |

| Energy Efficiency Consultants | 40 | Consultants, Sustainability Officers |

The Oman Heat Exchangers Market is valued at approximately USD 120 million, reflecting a robust growth trajectory driven by increasing demand for energy-efficient solutions across various industries, including oil and gas, chemical processing, and HVAC systems.