Region:Middle East

Author(s):Dev

Product Code:KRAB1729

Pages:91

Published On:January 2026

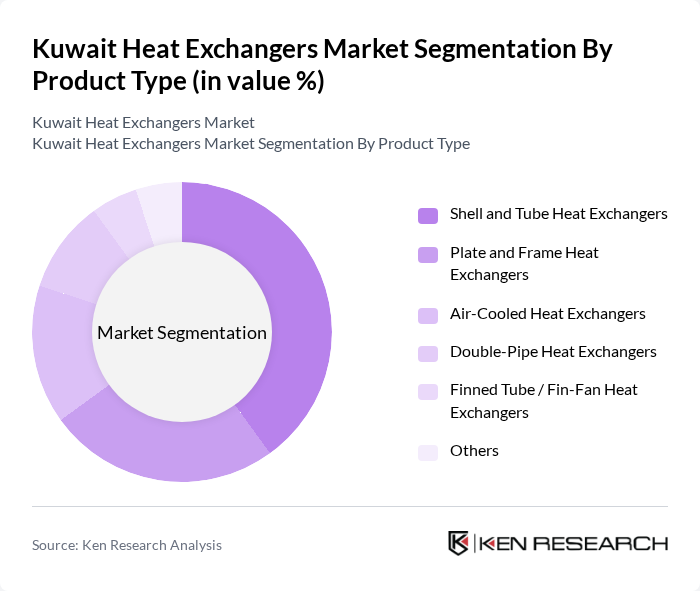

By Product Type:The product type segmentation includes various types of heat exchangers that cater to different industrial needs. The subsegments are Shell and Tube Heat Exchangers, Plate and Frame Heat Exchangers, Air-Cooled Heat Exchangers, Double-Pipe Heat Exchangers, Finned Tube / Fin-Fan Heat Exchangers, and Others. Among these, Shell and Tube Heat Exchangers dominate the market due to their versatility, robust mechanical design, and efficiency in handling high-pressure and high-temperature applications, particularly in the oil and gas and petrochemical sectors where they are widely specified for process, utility, and heat recovery duties.

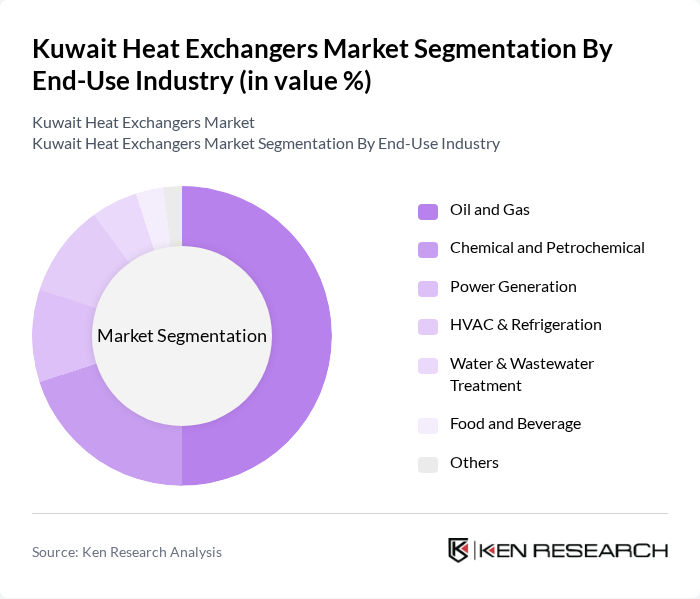

By End-Use Industry:The end-use industry segmentation encompasses various sectors utilizing heat exchangers, including Oil and Gas, Chemical and Petrochemical, Power Generation, HVAC & Refrigeration, Water & Wastewater Treatment, Food and Beverage, and Others. The Oil and Gas sector is the leading segment, driven by the need for efficient thermal management in upstream processing, refining, and gas treatment operations, which are critical for maintaining operational efficiency, process reliability, and safety in Kuwait’s hydrocarbon?based economy.

The Kuwait Heat Exchangers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alfa Laval, Kelvion, GEA Group, Danfoss, Hisaka Works, Xylem Inc., API Heat Transfer, SPX FLOW, Tranter, HRS Heat Exchangers, Thermx, Sondex (Danfoss Sondex), Babcock & Wilcox, Hamon, and local/regional fabricators (e.g., Gulf Heat Transfer, Al Zour Fabrication) contribute to innovation, geographic expansion, and service delivery in this space, often supplying equipment for oil and gas, power, district cooling, and industrial projects across Kuwait and the wider Middle East.

The Kuwait heat exchangers market is poised for significant transformation, driven by technological advancements and a strong push towards sustainability. As industries increasingly adopt compact and efficient designs, the integration of IoT technologies will enhance operational efficiency and predictive maintenance. Furthermore, the government's commitment to renewable energy projects will create new avenues for growth, fostering innovation in heat exchanger applications. This evolving landscape presents a unique opportunity for stakeholders to capitalize on emerging trends and align with national energy goals.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Shell and Tube Heat Exchangers Plate and Frame Heat Exchangers Air-Cooled Heat Exchangers Double-Pipe Heat Exchangers Finned Tube / Fin-Fan Heat Exchangers Others |

| By End-Use Industry | Oil and Gas Chemical and Petrochemical Power Generation HVAC & Refrigeration Water & Wastewater Treatment Food and Beverage Others |

| By Application | Heating Cooling Heat Recovery Condensation & Evaporation District Energy & Desalination Others |

| By Material of Construction | Stainless Steel Carbon Steel Copper & Copper Alloys Nickel Alloys Others |

| By Flow Arrangement | Parallel Flow Counter Flow Cross Flow Others |

| By Design Configuration | Fixed Tube Sheet U-Tube Floating Head Others |

| By Maintenance Approach | Scheduled (Preventive) Maintenance Predictive / Condition-Based Maintenance Reactive (Corrective) Maintenance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Heat Exchanger Usage | 120 | Operations Managers, Process Engineers |

| Petrochemical Industry Applications | 90 | Plant Managers, Technical Directors |

| Power Generation Facilities | 80 | Energy Managers, Maintenance Supervisors |

| HVAC Systems in Commercial Buildings | 70 | Facility Managers, HVAC Engineers |

| Research & Development in Heat Transfer Technologies | 60 | R&D Managers, Product Development Engineers |

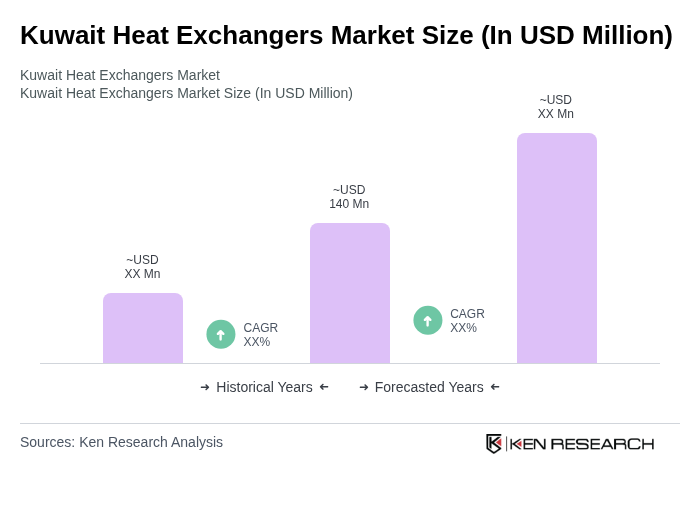

The Kuwait Heat Exchangers Market is valued at approximately USD 140 million, reflecting its significant role within the broader Middle East heat exchangers market, which is driven by sectors such as oil and gas, power generation, and industrial projects.