Region:Middle East

Author(s):Shubham

Product Code:KRAC4900

Pages:84

Published On:October 2025

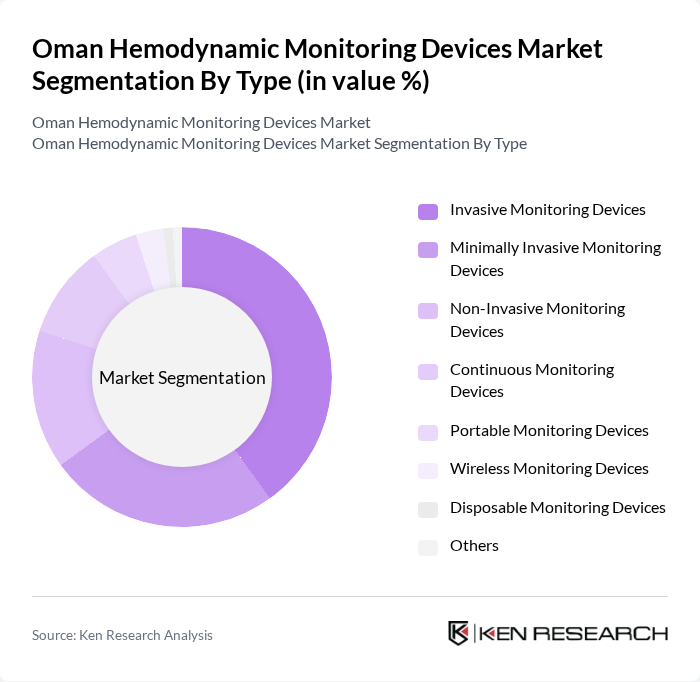

By Type:The hemodynamic monitoring devices market can be segmented into various types, including Invasive Monitoring Devices, Minimally Invasive Monitoring Devices, Non-Invasive Monitoring Devices, Continuous Monitoring Devices, Portable Monitoring Devices, Wireless Monitoring Devices, Disposable Monitoring Devices, and Others. Among these,Invasive Monitoring Devicesare currently leading the market due to their accuracy and reliability in critical care settings. The demand for these devices is driven by the need for precise measurements in high-risk patients, particularly in surgical and intensive care units. However, there is a notable increase in the adoption of minimally invasive and non-invasive devices, reflecting a broader industry trend toward reducing patient risk and improving recovery times .

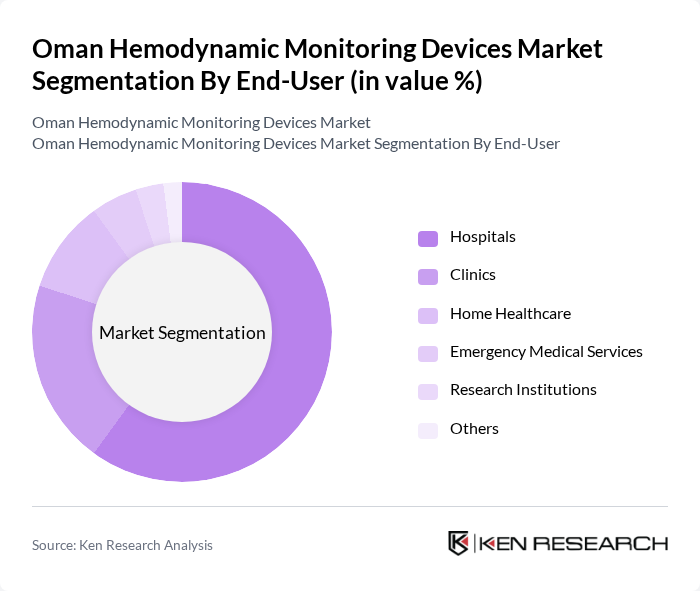

By End-User:The market can also be segmented by end-user, which includes Hospitals, Clinics, Home Healthcare, Emergency Medical Services, Research Institutions, and Others.Hospitalsare the leading end-user segment, primarily due to the high volume of patients requiring continuous monitoring and the availability of advanced medical technologies. The increasing number of surgical procedures and critical care admissions in hospitals further drives the demand for hemodynamic monitoring devices. There is also emerging adoption in home healthcare and emergency medical services, supported by portable and wireless device innovations .

The Oman Hemodynamic Monitoring Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, GE Healthcare, Siemens Healthineers, Medtronic, Edwards Lifesciences, Nihon Kohden Corporation, Abbott Laboratories, Boston Scientific Corporation, Zoll Medical Corporation, Drägerwerk AG & Co. KGaA, Masimo Corporation, Getinge AB, Stryker Corporation, Terumo Corporation, Mindray Medical International Limited, ICU Medical, Inc., Deltex Medical Group plc, Osypka Medical GmbH, PULSION Medical Systems SE, Cheetah Medical Inc., LiDCO Group plc, Schwarzer Cardiotek GmbH, Tensys Medical, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hemodynamic monitoring devices market in Oman appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence and data analytics into monitoring systems is expected to enhance patient care significantly. Additionally, the growing emphasis on personalized medicine will likely lead to tailored monitoring solutions, improving treatment efficacy. As healthcare infrastructure expands, the adoption of innovative monitoring technologies will become more prevalent, ultimately benefiting patient outcomes and healthcare efficiency in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Invasive Monitoring Devices Minimally Invasive Monitoring Devices Non-Invasive Monitoring Devices Continuous Monitoring Devices Portable Monitoring Devices Wireless Monitoring Devices Disposable Monitoring Devices Others |

| By End-User | Hospitals Clinics Home Healthcare Emergency Medical Services Research Institutions Others |

| By Application | Cardiac Surgery Critical Care Anesthesia Monitoring Postoperative Care Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Digital Monitoring Technology Analog Monitoring Technology Hybrid Monitoring Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments | 60 | Cardiologists, Cardiac Nurses |

| Critical Care Units | 50 | Intensive Care Unit Managers, Anesthesiologists |

| Healthcare Procurement | 40 | Procurement Officers, Supply Chain Managers |

| Medical Device Distributors | 40 | Sales Representatives, Distribution Managers |

| Regulatory Bodies | 40 | Healthcare Regulators, Policy Makers |

The Oman Hemodynamic Monitoring Devices Market is valued at approximately USD 10 million, reflecting a five-year historical analysis and proportional allocation from the Middle East & Africa regional market size.