Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3056

Pages:82

Published On:October 2025

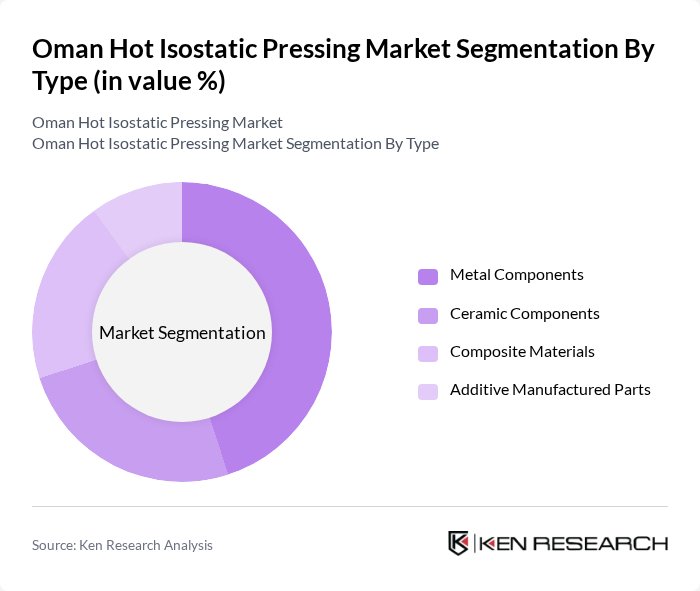

By Type:

The hot isostatic pressing market can be segmented into four main types: Metal Components, Ceramic Components, Composite Materials, and Additive Manufactured Parts. Among these, Metal Components dominate the market due to their extensive use in aerospace and automotive applications, where high strength and reliability are critical. The demand for lightweight and high-performance materials has also led to increased adoption of Composite Materials, particularly in the aerospace sector. Ceramic Components are gaining traction in medical applications, while Additive Manufactured Parts are emerging as a significant segment due to advancements in 3D printing technologies.

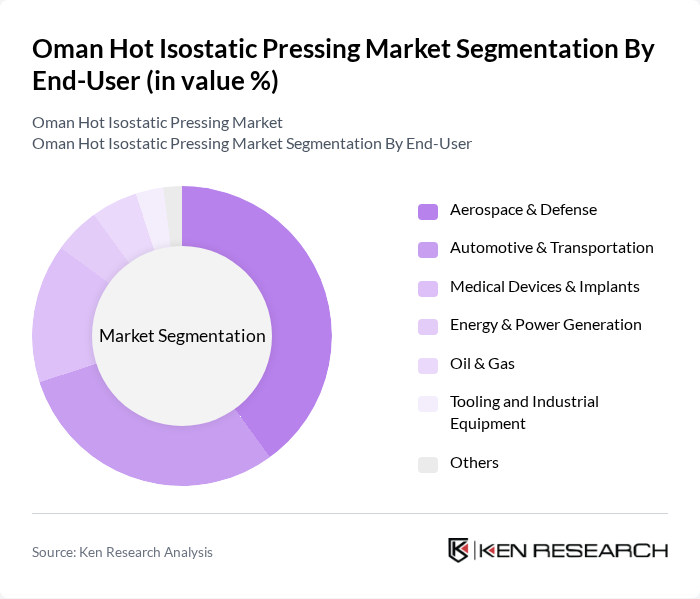

By End-User:

The end-user segmentation of the hot isostatic pressing market includes Aerospace & Defense, Automotive & Transportation, Medical Devices & Implants, Energy & Power Generation, Oil & Gas, Tooling and Industrial Equipment, and Others. The Aerospace & Defense sector is the leading end-user, driven by the need for lightweight and high-strength components. The Automotive & Transportation sector follows closely, as manufacturers seek to enhance vehicle performance and safety. Medical Devices & Implants are also significant, with increasing demand for biocompatible materials. The Oil & Gas sector is gradually adopting this technology for improved equipment reliability.

The Oman Hot Isostatic Pressing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bodycote plc, American Isostatic Presses Inc., Quintus Technologies AB, EPSI, DORST Technologies GmbH, Höganäs AB, Pressure Technology Inc., Kobe Steel, Ltd., Nikkiso Co., Ltd., MTI Corporation, TAV Vacuum Furnaces, Elnik Systems LLC, FREY & Co. GmbH, Paulo, Burloak Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman hot isostatic pressing market appears promising, driven by increasing demand for high-performance materials and technological advancements. As industries such as aerospace and automotive continue to expand, the need for innovative manufacturing processes will grow. Furthermore, the government's support for sustainable practices and investment in advanced technologies will likely enhance market dynamics. In future, the integration of automation and smart manufacturing solutions is expected to reshape the landscape, fostering greater efficiency and competitiveness in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Metal Components Ceramic Components Composite Materials Additive Manufactured Parts |

| By End-User | Aerospace & Defense Automotive & Transportation Medical Devices & Implants Energy & Power Generation Oil & Gas Tooling and Industrial Equipment Others |

| By Application | Turbine Blades & Engine Components Automotive Structural Parts Industrial Molds & Dies Orthopedic & Dental Implants Energy Sector Components Others |

| By Material Type | Steel Alloys Titanium Alloys Nickel Alloys Cobalt Alloys Ceramics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Customer Segment | Large Enterprises SMEs Government Agencies Research Institutes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Component Manufacturers | 100 | Production Managers, Quality Assurance Engineers |

| Automotive Parts Manufacturers | 80 | Operations Directors, Process Engineers |

| Medical Device Producers | 60 | Regulatory Affairs Specialists, R&D Managers |

| Energy Sector Equipment Suppliers | 50 | Supply Chain Managers, Technical Sales Representatives |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Collaborators |

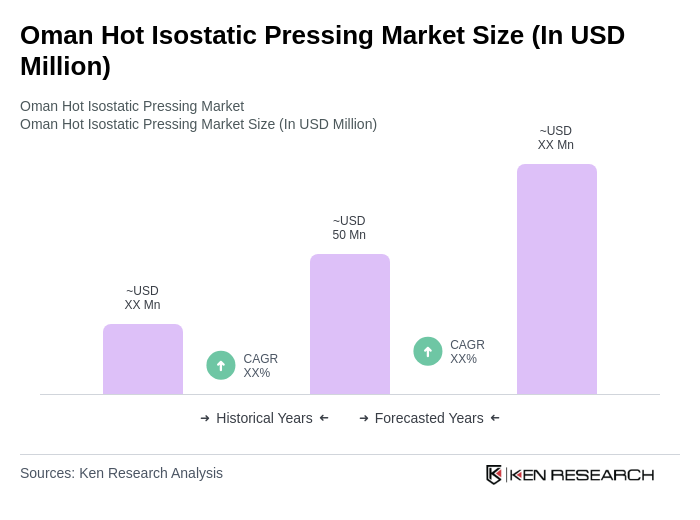

The Oman Hot Isostatic Pressing Market is valued at approximately USD 50 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for high-performance materials across various industries, including aerospace, automotive, and medical sectors.