Region:Middle East

Author(s):Shubham

Product Code:KRAD3456

Pages:89

Published On:November 2025

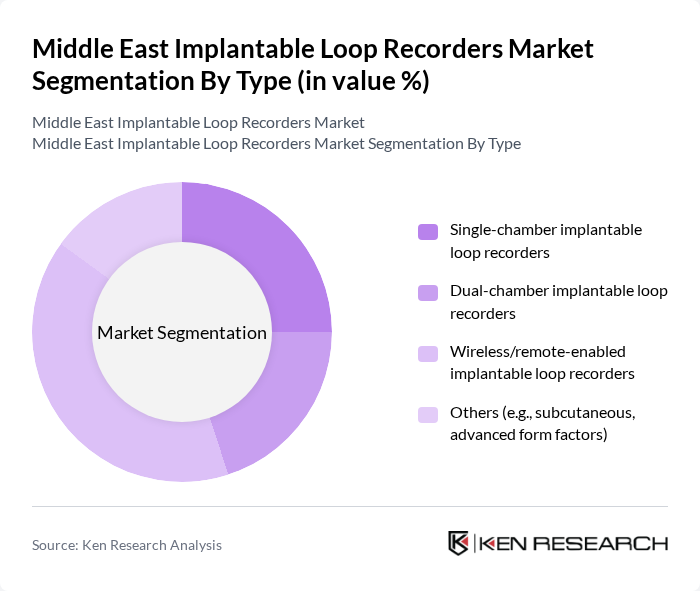

By Type:The market is segmented into various types of implantable loop recorders, including single-chamber, dual-chamber, wireless/remote-enabled, and others. Among these, wireless/remote-enabled implantable loop recorders are gaining significant traction due to their convenience and advanced monitoring capabilities. The increasing demand for remote patient monitoring solutions is driving the growth of this sub-segment, as healthcare providers and patients seek more efficient ways to manage cardiac health. Miniaturization and integration with cloud-based platforms are further enhancing the adoption of wireless-enabled devices .

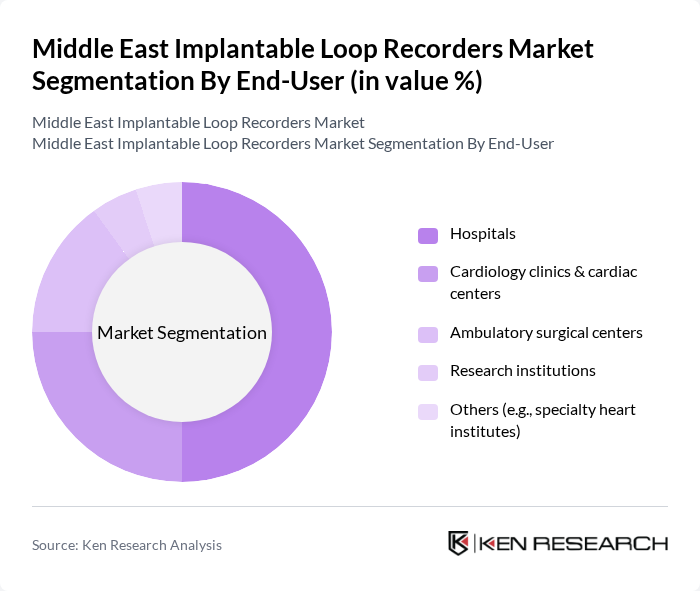

By End-User:The end-user segmentation includes hospitals, cardiology clinics & cardiac centers, ambulatory surgical centers, research institutions, and others. Hospitals are the leading end-users, primarily due to their comprehensive cardiac care services and advanced diagnostic capabilities. The increasing number of cardiac procedures performed in hospitals, along with the integration of advanced monitoring technologies, is propelling the demand for implantable loop recorders in this segment. Cardiology clinics and cardiac centers are also expanding their adoption due to the growing burden of arrhythmias and the availability of specialized expertise .

The Middle East Implantable Loop Recorders Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Philips Healthcare, iRhythm Technologies, Inc., Cardiac Insight Inc., LivaNova PLC, AtriCure, Inc., ZOLL Medical Corporation, GE Healthcare, Siemens Healthineers AG, Nihon Kohden Corporation, EBR Systems, Inc., MicroPort Scientific Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East implantable loop recorders market appears promising, driven by ongoing advancements in healthcare technology and an increasing focus on patient-centric solutions. As healthcare infrastructure expands, particularly in emerging economies, the adoption of these devices is expected to rise. Additionally, the integration of artificial intelligence in diagnostic tools will enhance the accuracy of monitoring, leading to better patient outcomes. Overall, the market is poised for growth as healthcare providers adapt to evolving patient needs and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-chamber implantable loop recorders Dual-chamber implantable loop recorders Wireless/remote-enabled implantable loop recorders Others (e.g., subcutaneous, advanced form factors) |

| By End-User | Hospitals Cardiology clinics & cardiac centers Ambulatory surgical centers Research institutions Others (e.g., specialty heart institutes) |

| By Distribution Channel | Direct sales (manufacturers to providers) Medical device distributors Online medical device platforms Others (e.g., group purchasing organizations) |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia) Others (e.g., Iran, Turkey, Israel) |

| By Patient Demographics | Adults Pediatric Geriatric Others (e.g., high-risk cardiac patients) |

| By Technology | Conventional implantable loop recorders Advanced implantable loop recorders with telemetry/remote monitoring Others (e.g., AI-enabled, miniaturized devices) |

| By Application | Arrhythmia detection & monitoring Syncope evaluation Post-operative cardiac monitoring Others (e.g., cryptogenic stroke, unexplained palpitations) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Clinics | 80 | Cardiologists, Clinic Managers |

| Hospitals with Cardiac Units | 70 | Procurement Managers, Department Heads |

| Medical Device Distributors | 50 | Sales Managers, Product Specialists |

| Health Insurance Providers | 40 | Policy Analysts, Claims Managers |

| Regulatory Bodies | 30 | Regulatory Affairs Specialists, Compliance Officers |

The Middle East Implantable Loop Recorders Market is valued at approximately USD 50 million, driven by the rising prevalence of cardiac arrhythmias, advancements in medical technology, and increased awareness of early heart condition detection.