Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1064

Pages:88

Published On:October 2025

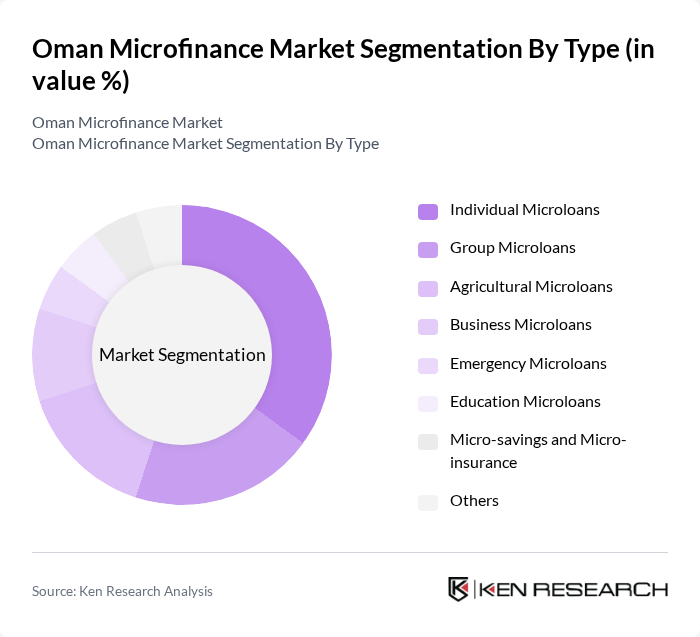

By Type:The microfinance market is segmented into Individual Microloans, Group Microloans, Agricultural Microloans, Business Microloans, Emergency Microloans, Education Microloans, Micro-savings and Micro-insurance, and Others. Individual Microloans remain the leading subsegment, driven by the increasing number of individuals seeking financial assistance for personal and business-related expenses. The flexibility, quick approval, and accessibility of these loans make them particularly appealing to first-time borrowers and micro-entrepreneurs. Group Microloans are also gaining traction, especially in rural areas, due to collective risk-sharing and community-based lending models , .

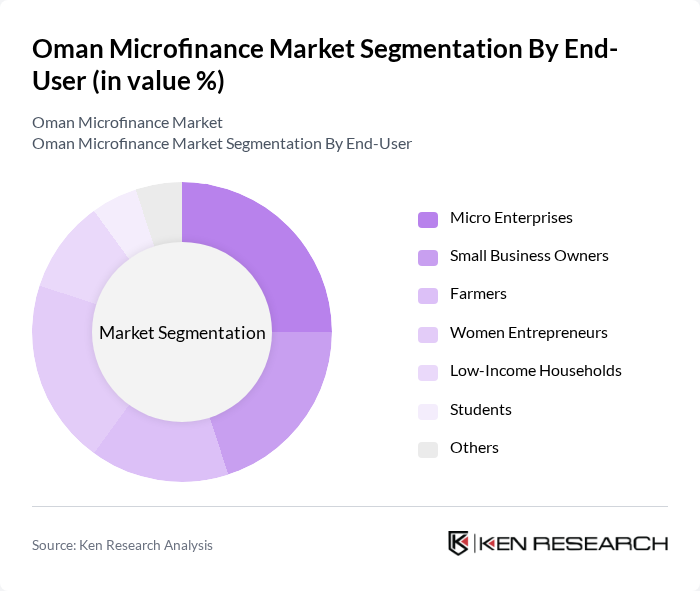

By End-User:The end-user segmentation of the microfinance market includes Micro Enterprises, Small Business Owners, Farmers, Women Entrepreneurs, Low-Income Households, Students, and Others. The segment of Women Entrepreneurs has gained significant traction, supported by targeted government and NGO initiatives aimed at empowering women through financial inclusion and entrepreneurship programs. Micro Enterprises and Small Business Owners also represent major segments, reflecting the growing role of microfinance in supporting local economic development and job creation. Farmers benefit from specialized agricultural microloans, which are increasingly tailored to seasonal and crop-specific needs , .

The Oman Microfinance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Development Bank, Alizz Islamic Bank, Bank Muscat, Oman Arab Bank, Dhofar Microfinance, Al Sharqiya Investment Holding, Oman Microfinance Company, Muscat Finance, Al Batinah Development and Investment Company, Al Madina Investment, Al Noor Financial Investment, Oman National Investments Development Company (Tanmia), Sohar International Bank, Oman International Bank, Al Mazyona Microfinance contribute to innovation, geographic expansion, and service delivery in this space , .

The Oman microfinance market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As fintech solutions gain traction, microfinance institutions are expected to adopt digital platforms for service delivery, enhancing accessibility. Furthermore, the increasing focus on social impact will likely lead to the development of innovative financial products tailored to the needs of underserved communities, fostering greater financial inclusion and economic empowerment across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Microloans Group Microloans Agricultural Microloans Business Microloans Emergency Microloans Education Microloans Micro-savings and Micro-insurance Others |

| By End-User | Micro Enterprises Small Business Owners Farmers Women Entrepreneurs Low-Income Households Students Others |

| By Loan Size | Microloans (up to OMR 1,000) Small Loans (OMR 1,001 - OMR 5,000) Medium Loans (OMR 5,001 - OMR 10,000) Large Loans (above OMR 10,000) Others |

| By Purpose | Business Expansion Asset Purchase Working Capital Education Health Emergencies Equipment Purchase Others |

| By Distribution Channel | Direct Lending Online Platforms Partnerships with NGOs Microfinance Institutions Banks and Financial Institutions Others |

| By Demographics | Age Group (18-30) Age Group (31-50) Age Group (51 and above) Gender (Male) Gender (Female) Others |

| By Risk Profile | Low Risk Medium Risk High Risk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Microfinance Client Satisfaction | 100 | Current Borrowers, Loan Officers |

| Impact of Microfinance on Small Businesses | 80 | Small Business Owners, Entrepreneurs |

| Awareness of Microfinance Products | 90 | Potential Borrowers, Community Leaders |

| Challenges Faced by Microfinance Institutions | 60 | Microfinance Executives, Financial Analysts |

| Regulatory Impact on Microfinance Growth | 40 | Policy Makers, Regulatory Officials |

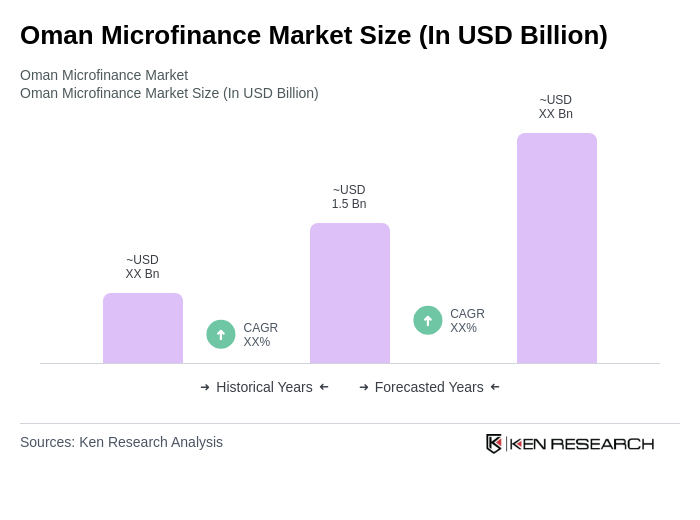

The Oman Microfinance Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by financial inclusion initiatives, government support, and increasing demand for small loans among low-income households and entrepreneurs.