Region:Middle East

Author(s):Dev

Product Code:KRAB7237

Pages:86

Published On:October 2025

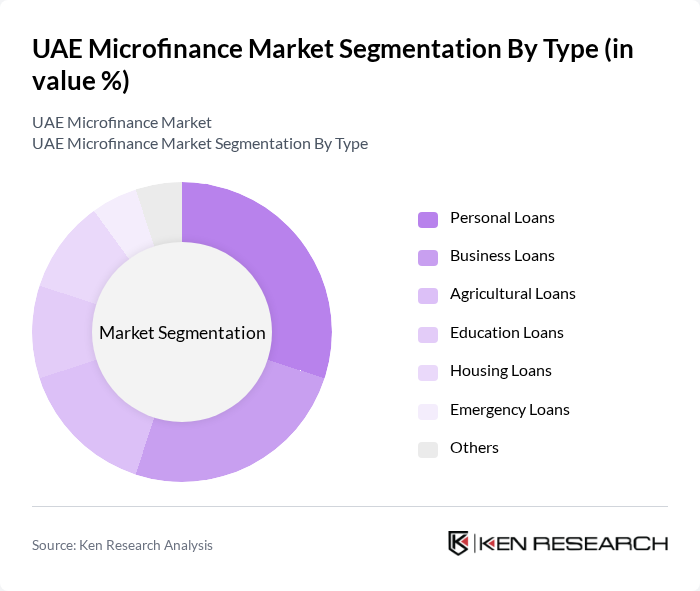

By Type:The microfinance market is segmented into various types of loans, including Personal Loans, Business Loans, Agricultural Loans, Education Loans, Housing Loans, Emergency Loans, and Others. Personal Loans are particularly popular due to their accessibility and flexibility, catering to individuals seeking financial support for personal needs. Business Loans are also significant, as they empower small enterprises to expand and innovate. The demand for Agricultural Loans is growing, driven by the UAE's focus on food security and sustainable agriculture.

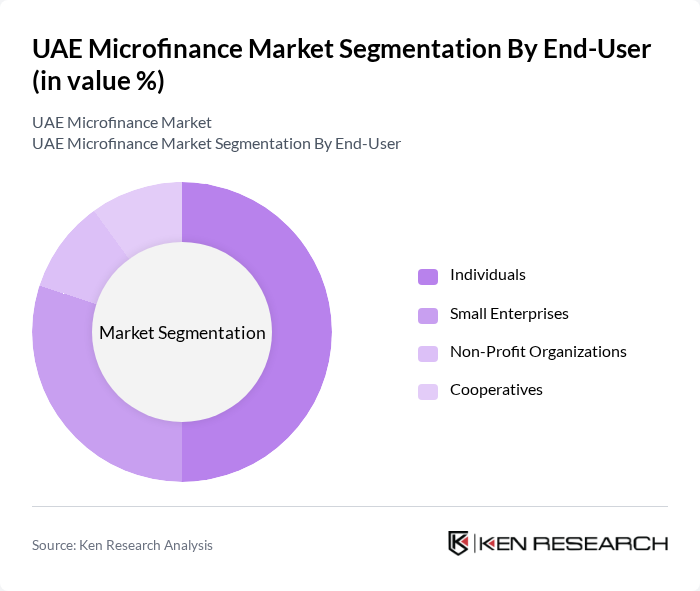

By End-User:The end-user segmentation includes Individuals, Small Enterprises, Non-Profit Organizations, and Cooperatives. Individuals represent a significant portion of the market, driven by the need for personal financing solutions. Small Enterprises are also a key segment, as they often rely on microfinance for growth and operational sustainability. Non-Profit Organizations and Cooperatives play a vital role in promoting financial literacy and providing access to microfinance services, particularly in underserved communities.

The UAE Microfinance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Microfinance Bank, Abu Dhabi Finance, Dubai Islamic Bank, Sharjah Islamic Bank, Al Baraka Banking Group, Noor Bank, Ajman Bank, First Abu Dhabi Bank, National Bank of Fujairah, RAK Bank, Abu Dhabi Commercial Bank, Emirates NBD, Dubai Investments, Al Hilal Bank, United Arab Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE microfinance market appears promising, driven by ongoing digital innovations and government support. As financial literacy initiatives gain traction, more individuals will likely engage with microfinance services. Additionally, the integration of advanced technologies, such as AI and blockchain, is expected to enhance risk assessment and streamline operations. These developments will create a more robust ecosystem, fostering sustainable growth and expanding access to financial services for underserved populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Agricultural Loans Education Loans Housing Loans Emergency Loans Others |

| By End-User | Individuals Small Enterprises Non-Profit Organizations Cooperatives |

| By Customer Segment | Low-Income Households Women Entrepreneurs Youth Startups Rural Communities |

| By Loan Size | Micro Loans (up to AED 10,000) Small Loans (AED 10,001 - AED 50,000) Medium Loans (AED 50,001 - AED 100,000) |

| By Distribution Channel | Direct Lending Online Platforms Partnerships with NGOs Microfinance Banks |

| By Purpose of Loan | Business Expansion Asset Purchase Working Capital Education Funding |

| By Geographic Focus | Urban Areas Rural Areas Specific Emirates (e.g., Dubai, Abu Dhabi) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Microfinance Clients in Urban Areas | 150 | Small Business Owners, Entrepreneurs |

| Microfinance Clients in Rural Areas | 100 | Agricultural Workers, Local Artisans |

| Microfinance Institutions' Executives | 80 | CEOs, Financial Analysts |

| Regulatory Bodies and Policy Makers | 50 | Government Officials, Financial Regulators |

| Community Leaders and NGOs | 70 | Community Organizers, Social Workers |

The UAE Microfinance Market is valued at AED 1.5 billion, reflecting significant growth driven by financial inclusion initiatives, the rise of small and medium-sized enterprises (SMEs), and increasing demand for personal loans among low-income households.