Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1050

Pages:91

Published On:October 2025

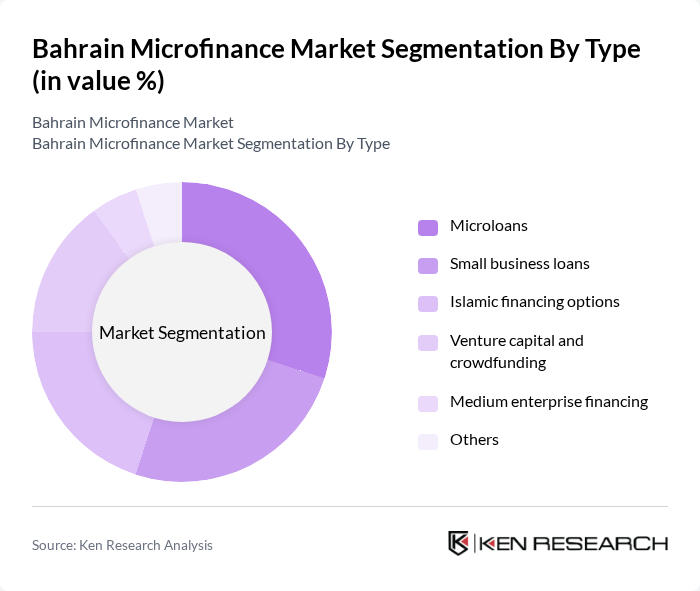

By Type:The microfinance market can be segmented into various types, including microloans, small business loans, Islamic financing options, venture capital and crowdfunding, medium enterprise financing, and others. Each of these segments caters to different financial needs and preferences of borrowers, contributing to the overall growth of the market. Microloans and small business loans are particularly prominent, driven by the operational needs of startups and SMEs, while Islamic financing options continue to expand due to Bahrain's strong Shariah-compliant finance sector .

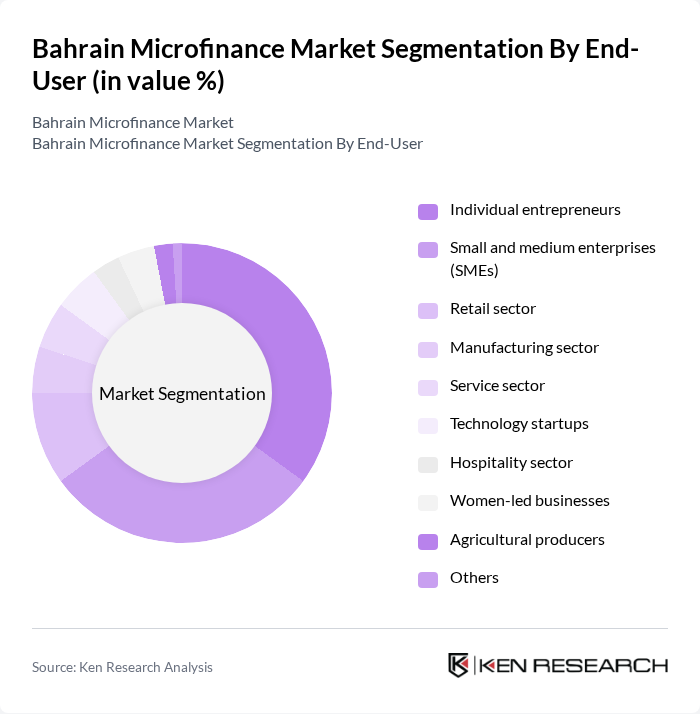

By End-User:The end-users of microfinance services include individual entrepreneurs, small and medium enterprises (SMEs), the retail sector, the manufacturing sector, the service sector, technology startups, the hospitality sector, women-led businesses, agricultural producers, and others. This diverse user base reflects the broad applicability of microfinance in supporting various economic activities. The retail sector is a leading end-user segment, driven by the growth of e-commerce and digital payments, while SMEs and individual entrepreneurs remain core beneficiaries .

The Bahrain Microfinance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Development Bank, Al Baraka Banking Group, Bahrain Islamic Bank, Tamkeen, Al Salam Bank, Gulf Finance House, Bahrain Microfinance Company, Ebdaa Bank Bahrain, Family Bank, National Bank of Bahrain, Bank of Bahrain and Kuwait, Arab Banking Corporation (Bank ABC), Kuwait Finance House (Bahrain), Ithmaar Bank, Al Ahli United Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microfinance market in Bahrain appears promising, driven by increasing government support and a growing entrepreneurial spirit among the population. As digital financial services continue to evolve, microfinance institutions are expected to adopt more innovative solutions, enhancing customer engagement and service delivery. Furthermore, the focus on financial literacy programs will likely improve repayment rates, fostering a more sustainable microfinance ecosystem that can effectively support economic development in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Microloans Small business loans Islamic financing options Venture capital and crowdfunding Medium enterprise financing Others |

| By End-User | Individual entrepreneurs Small and medium enterprises (SMEs) Retail sector Manufacturing sector Service sector Technology startups Hospitality sector Women-led businesses Agricultural producers Others |

| By Loan Purpose | Working capital Equipment purchase Business expansion Research and development Marketing and sales Education financing Others |

| By Funding Source | Bank loans Government grants Private equity Angel investors Microfinance institutions International NGOs Others |

| By Loan Size | Micro loans (up to BHD 5,000) Small loans (BHD 5,001 - BHD 20,000) Medium loans (BHD 20,001 - BHD 100,000) Large loans (over BHD 100,000) Others |

| By Repayment Period | Short-term financing (up to 1 year) Medium-term financing (1-5 years) Long-term financing (over 5 years) Others |

| By Geographic Coverage | Urban areas Rural areas Specific governorates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Microfinance Clients | 120 | Small Business Owners, Individual Borrowers |

| Microfinance Institutions | 60 | CEOs, Program Managers, Loan Officers |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| NGOs and Community Organizations | 50 | Project Coordinators, Community Leaders |

| Financial Analysts and Academics | 40 | Researchers, University Professors |

The Bahrain Microfinance Market is valued at approximately BHD 1.2 billion, reflecting significant growth driven by increasing demand for financial inclusion, particularly among low-income individuals and small businesses seeking microloans and financing options.