Region:Middle East

Author(s):Geetanshi

Product Code:KRAC7894

Pages:94

Published On:December 2025

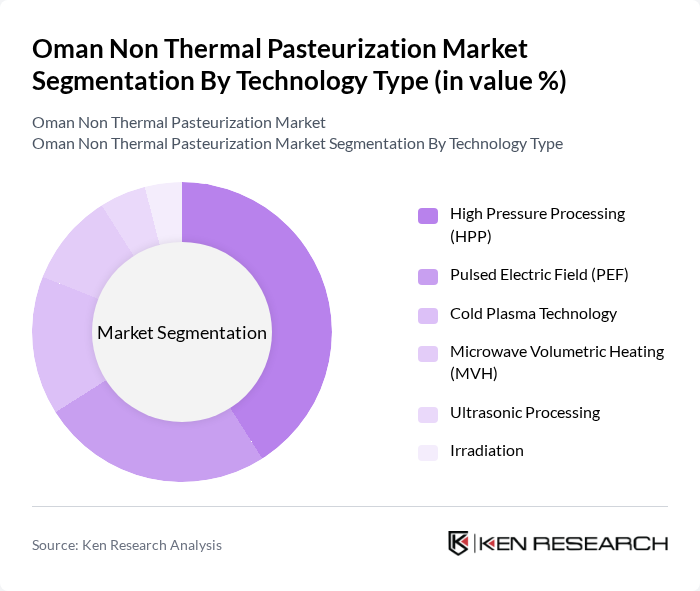

By Technology Type:The technology type segmentation includes various methods employed in non-thermal pasteurization. The leading sub-segment is High Pressure Processing (HPP), which is favored for its ability to maintain the quality and freshness of food products while effectively eliminating pathogens. Other notable technologies include Pulsed Electric Field (PEF) and Cold Plasma Technology, which are gaining traction due to their efficiency and minimal impact on food properties.

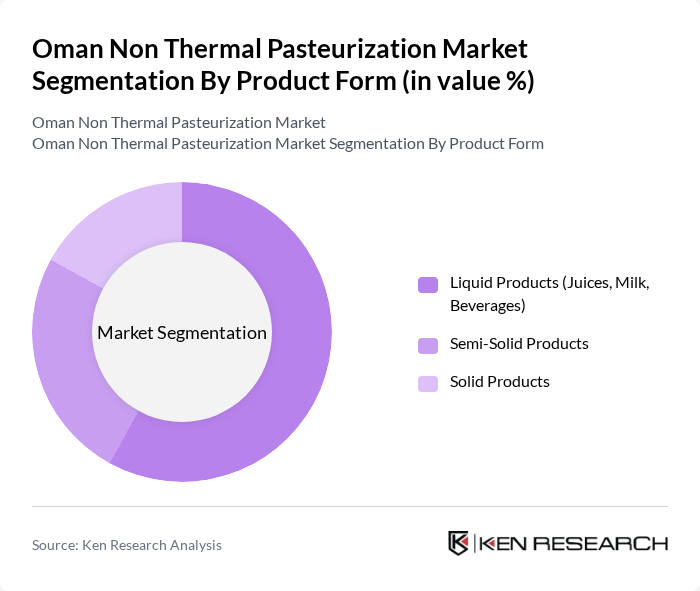

By Product Form:The product form segmentation encompasses various types of food products processed using non-thermal pasteurization. Liquid products, including juices and beverages, dominate this segment due to their high demand and the effectiveness of non-thermal methods in preserving flavor and nutrients. Semi-solid and solid products are also significant, catering to diverse consumer preferences and market needs.

The Oman Non Thermal Pasteurization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Oman Food Investment Holding Company (OFIHC), Al-Safi Danone, Oman Canning Company, Oman Fisheries Company, Dhofar Beverages Company, Oman Refreshment Company, National Dairy Company (Oman), Al-Jazeera Foods, Muscat Gases Company, Al-Hazaa Investment Group, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the non-thermal pasteurization market in Oman appears promising, driven by increasing consumer demand for safe and healthy food options. As technological advancements continue to evolve, producers are likely to adopt more efficient non-thermal methods, enhancing product quality and safety. Additionally, government support for food processing initiatives will likely create a conducive environment for market expansion. The focus on sustainability and organic products will further shape the market landscape, encouraging innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | High Pressure Processing (HPP) Pulsed Electric Field (PEF) Cold Plasma Technology Microwave Volumetric Heating (MVH) Ultrasonic Processing Irradiation |

| By Product Form | Liquid Products (Juices, Milk, Beverages) Semi-Solid Products Solid Products |

| By End-User Industry | Food and Beverage Manufacturing Dairy Processing Juice and Beverage Production Ready-to-Eat Meal Producers Meat and Seafood Processing |

| By Application | Dairy Products Juices and Beverages Ready-to-Eat Meals Meat and Poultry Products Seafood Products |

| By Distribution Channel | Direct Sales to Food Manufacturers Equipment Suppliers and Distributors Contract Manufacturing Services |

| By Geographic Region | Muscat (Capital Region) Salalah (Dhofar Region) Sohar (North Batinah Region) Nizwa (Dakhiliyah Region) Sur (South Sharqiyah Region) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Processing Sector | 100 | Production Managers, Quality Assurance Officers |

| Beverage Manufacturing | 80 | Operations Managers, R&D Specialists |

| Ready-to-Eat Meal Producers | 70 | Supply Chain Managers, Product Development Leads |

| Food Safety Regulatory Bodies | 40 | Food Safety Inspectors, Policy Makers |

| Non-Thermal Equipment Suppliers | 60 | Sales Managers, Technical Support Engineers |

The Oman Non Thermal Pasteurization Market is valued at approximately USD 42 million, reflecting a growing demand for safe and high-quality food products driven by consumer awareness of food safety standards and health consciousness.