Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8314

Pages:94

Published On:November 2025

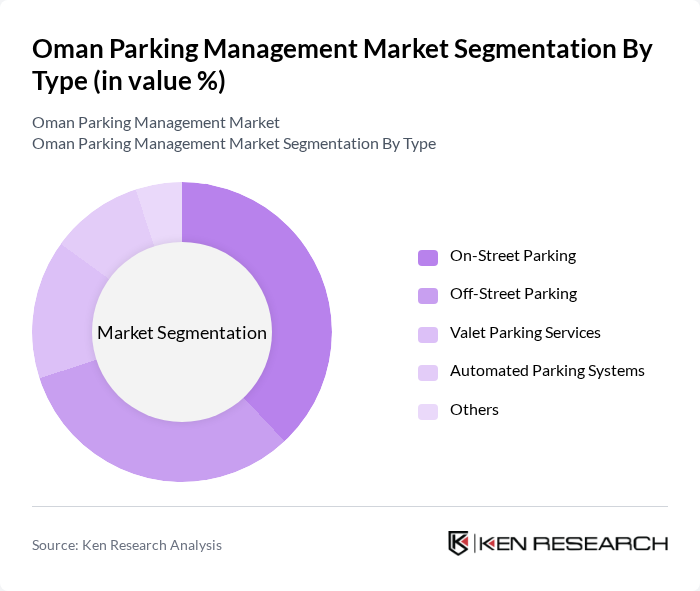

By Type:The market is segmented into On-Street Parking, Off-Street Parking, Valet Parking Services, Automated Parking Systems, and Others. Each segment addresses distinct consumer needs: **On-Street Parking** is most widely utilized due to accessibility and convenience in urban centers, while **Off-Street Parking** is gaining traction as urban planners prioritize dedicated parking facilities to reduce congestion and support commercial growth. **Automated Parking Systems** and **Valet Services** are increasingly adopted in premium commercial and hospitality locations, reflecting a trend toward technology-driven and customer-centric solutions.

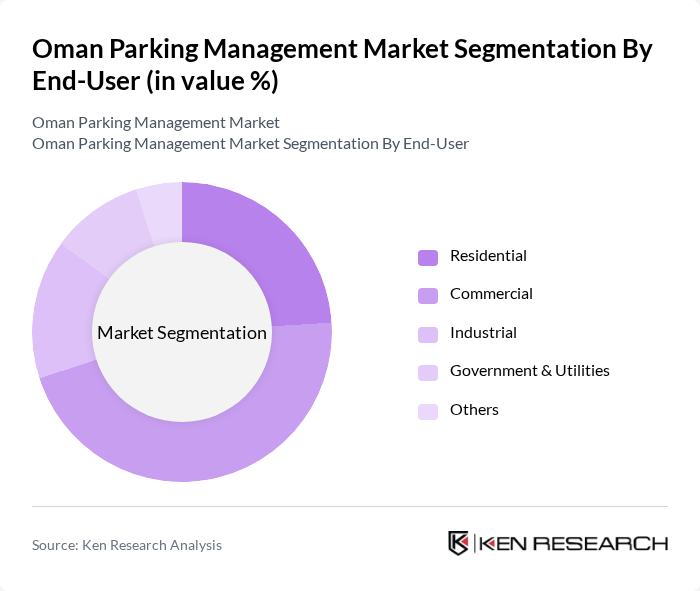

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, Government & Utilities, and Others. The **Commercial segment** leads the market, driven by the proliferation of shopping malls, office complexes, and entertainment venues with high parking demand. The **Residential segment** is significant, reflecting the growing urban population and the need for dedicated parking in new housing developments. **Industrial and Government & Utilities** segments are expanding as infrastructure investments and public sector modernization continue.

The Oman Parking Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Parking Company, Muscat Parking Solutions, Smart Parking Technologies Oman, Al Batinah Parking Services, Oman Parking Management LLC, Parking Solutions Oman, Gulf Parking Systems, Muscat Smart City Project, Oman Transport and Parking Authority, Integrated Parking Solutions Oman, Al Harthy Parking Services, Parking Innovations Oman, Urban Parking Management Oman, Parking Technologies Middle East, Oman Smart City Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The Oman parking management market is poised for significant transformation as urbanization accelerates and government initiatives gain momentum. In the future, the integration of smart technologies and sustainable practices will likely reshape parking solutions, enhancing efficiency and user experience. The focus on electric vehicle infrastructure and mobile payment systems will further drive innovation. As stakeholders collaborate to address challenges, the market is expected to evolve, creating a more organized and efficient parking landscape that meets the needs of a growing urban population.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Street Parking Off-Street Parking Valet Parking Services Automated Parking Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Parking Management System | Parking Guidance Systems Parking Reservation Systems Payment Management Systems Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Technology | IoT-Based Solutions Cloud-Based Solutions Mobile Applications Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Others |

| By Policy Support | Subsidies for Smart Parking Solutions Tax Incentives for Parking Infrastructure Grants for Sustainable Parking Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Parking Management | 120 | City Planners, Parking Authority Officials |

| Private Parking Operators | 100 | Operations Managers, Business Owners |

| Technology Providers for Parking Solutions | 80 | Product Managers, Sales Directors |

| Local Business Impact Assessment | 90 | Business Owners, Retail Managers |

| Resident Parking Needs | 110 | Local Residents, Community Leaders |

The Oman Parking Management Market is valued at approximately USD 120 million, reflecting a five-year historical analysis and regional benchmarking against the GCC smart parking sector. This valuation highlights the growing demand for efficient parking solutions in urban areas.