Region:North America

Author(s):Dev

Product Code:KRAB1734

Pages:86

Published On:January 2026

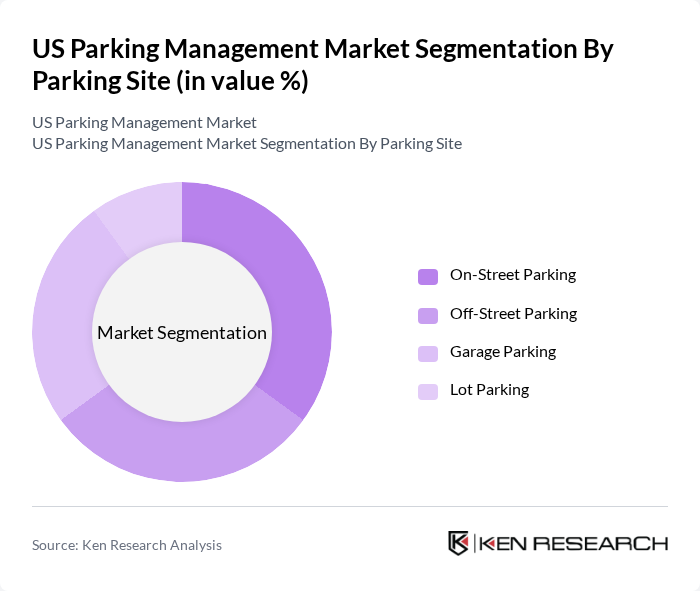

By Parking Site:The parking site segmentation includes various types of parking facilities that cater to different consumer needs. The subsegments are On-Street Parking, Off-Street Parking, Garage Parking, and Lot Parking. Each of these subsegments serves distinct purposes, with On-Street Parking being prevalent in urban areas due to space constraints and curbside management needs, while Off-Street Parking (including garages and structured parking) captures the largest share of parking management revenues in North America, driven by commercial, residential, and mixed-use developments. Garage Parking is often associated with residential and commercial buildings, airports, and downtown business districts, where automated access control and guidance systems are increasingly deployed, and Lot Parking is commonly used for events, campuses, stadiums, and large gatherings, where demand-based pricing and reservation systems are gaining traction.

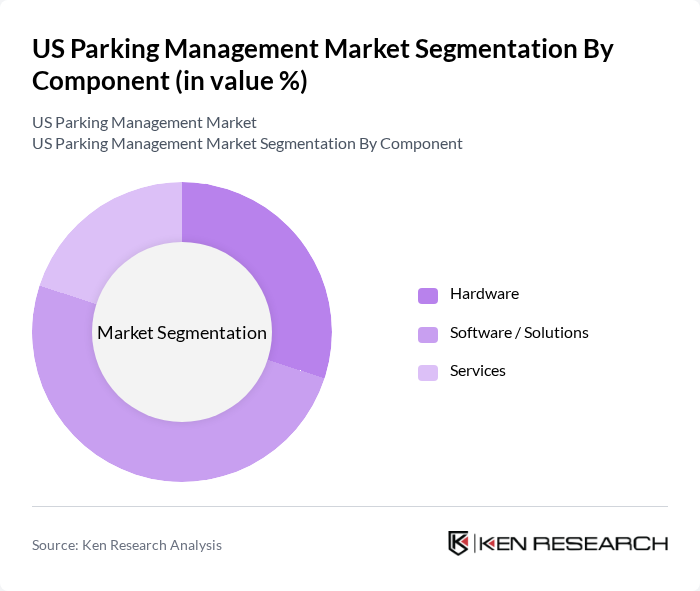

By Component:The component segmentation encompasses Hardware, Software / Solutions, and Services. Hardware includes physical equipment like parking meters, cameras, barriers, kiosks, and sensors that support automated fee collection and vehicle detection. Software / Solutions refers to the digital platforms that manage parking operations, such as parking guidance, reservation and permit management, mobile payment applications, and analytics dashboards, which collectively represent the largest revenue-generating component segment in recent US parking management deployments. Services cover the operational aspects, including system integration, monitoring, support, and maintenance, and are increasingly important as operators outsource day-to-day management and seek managed and cloud-based parking services to optimize operations and enhance user experience.

The US Parking Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as LAZ Parking, SP Plus Corporation (SP+), ABM Industries Incorporated, Propark Mobility, ParkMobile, ParkWhiz, SpotHero, Passport, T2 Systems, FlashParking (Flash), Flowbird, Parkopedia, ParkHub, Reef Parking (REEF Technology), and others contribute to innovation, geographic expansion, and service delivery in this space, with activities ranging from on?street and off?street operations to digital parking reservation and payment platforms.

As urbanization continues to accelerate, the US parking management market is expected to evolve significantly, driven by technological innovations and changing consumer preferences. The integration of AI and IoT technologies will enhance operational efficiency, while the shift towards sustainable practices will shape future developments. Additionally, the increasing adoption of electric vehicles will necessitate the expansion of charging infrastructure, creating new opportunities for parking management solutions that cater to these emerging needs and trends.

| Segment | Sub-Segments |

|---|---|

| By Parking Site | On-Street Parking Off-Street Parking Garage Parking Lot Parking |

| By Component | Hardware Software / Solutions Services |

| By Solution Type | Parking Revenue Management Parking Reservation Management Parking Access Control Parking Security and Surveillance Parking Guidance & Space Management Others |

| By Application | Transportation Facilities (Airports, Transit Hubs) Shopping Complex & Retail Corporate & Office Buildings Educational Institutions Healthcare Facilities Government & Municipal Residential Buildings Stadiums & Recreational Centers Hospitality Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Service Type | Valet Parking Services Parking Operations & Management Services Consulting, Integration & Maintenance Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Parking Authorities | 100 | City Planners, Parking Managers |

| Private Parking Operators | 80 | Facility Managers, Business Development Directors |

| Consumer Parking Preferences | 140 | Urban Commuters, College Students |

| Parking Technology Providers | 70 | Product Managers, Technology Developers |

| Real Estate Developers | 60 | Project Managers, Urban Development Specialists |

The US Parking Management Market is valued at approximately USD 5.2 billion, reflecting a significant growth driven by urbanization, increased vehicle ownership, and the demand for efficient parking solutions in congested urban areas.