Region:Middle East

Author(s):Dev

Product Code:KRAD6337

Pages:93

Published On:December 2025

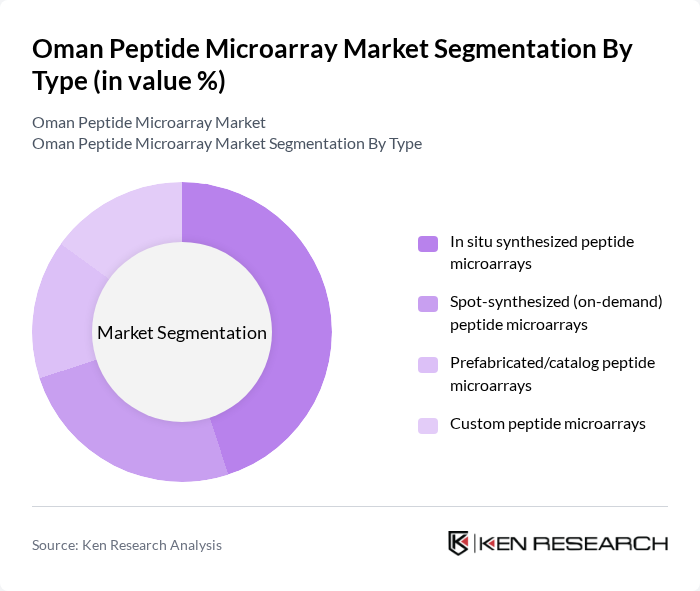

By Type:The market is segmented into four types of peptide microarrays: in situ synthesized peptide microarrays, spot-synthesized (on-demand) peptide microarrays, prefabricated/catalog peptide microarrays, and custom peptide microarrays. Among these, in situ synthesized peptide microarrays are leading the market due to their flexibility and ability to produce high-density arrays tailored for specific applications.

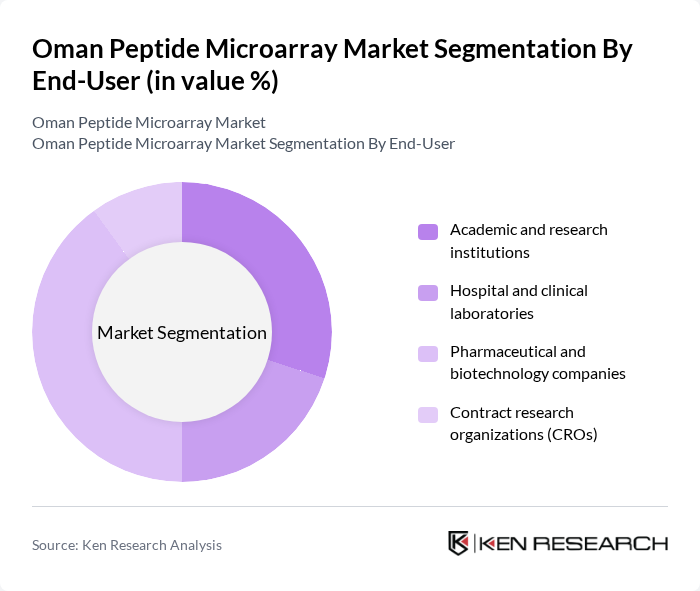

By End-User:The end-user segmentation includes academic and research institutions, hospital and clinical laboratories, pharmaceutical and biotechnology companies, and contract research organizations (CROs). The pharmaceutical and biotechnology companies segment is currently dominating the market, driven by the increasing need for drug discovery and development processes that utilize peptide microarrays for high-throughput screening.

The Oman Peptide Microarray Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Roche Diagnostics International AG, Bio-Rad Laboratories, Inc., PerkinElmer, Inc. (Revvity, Inc.), Merck KGaA (MilliporeSigma), JPT Peptide Technologies GmbH, PEPperPRINT GmbH, ProImmune Limited, RayBiotech Life, Inc., Arrayit Corporation, Sengenics Corporation Pte Ltd, LC Sciences, LLC, SciLifeLab-affiliated platforms and regional academic consortia, Local distributors and channel partners serving Oman (e.g., Gulf-based life science distributors) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman peptide microarray market is poised for significant growth, driven by increasing investments in biotechnology and healthcare infrastructure. As the government prioritizes healthcare innovation, collaborations between academic institutions and industry players are expected to flourish. Furthermore, the integration of artificial intelligence in data analysis will enhance the efficiency and accuracy of peptide microarray applications. These trends indicate a promising future for the market, with potential breakthroughs in personalized medicine and disease management on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | In situ synthesized peptide microarrays Spot-synthesized (on-demand) peptide microarrays Prefabricated/catalog peptide microarrays Custom peptide microarrays |

| By End-User | Academic and research institutions Hospital and clinical laboratories Pharmaceutical and biotechnology companies Contract research organizations (CROs) |

| By Application | Drug discovery and development Clinical diagnostics and companion diagnostics Biomarker and epitope discovery Autoimmune and infectious disease profiling |

| By Technology | Fluorescence-based detection Label-free detection (e.g., surface plasmon resonance) Electrochemical and multiplex detection platforms Other emerging detection technologies |

| By Region | Muscat Governorate Dhofar Governorate (including Salalah) Al Batinah North & South (including Sohar) Other governorates (e.g., Al Dakhiliyah, Al Sharqiyah, Dhahirah) |

| By Research Funding Source | Government research grants and national programs Private and venture capital investments Academic and institutional funding International collaborations and multilateral funding |

| By Market Segment | Research-use-only (RUO) segment Clinical and diagnostic segment Biopharmaceutical and CRO services segment Others (including government and non-profit projects) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biotechnology Research Institutions | 45 | Research Scientists, Lab Managers |

| Pharmaceutical Companies | 35 | Product Development Managers, Regulatory Affairs Specialists |

| Academic Institutions | 30 | Professors, Graduate Researchers |

| Clinical Laboratories | 25 | Laboratory Technicians, Quality Control Managers |

| Government Health Agencies | 15 | Policy Makers, Health Program Coordinators |

The Oman Peptide Microarray Market is valued at approximately USD 5 million, reflecting a five-year historical analysis. This valuation is influenced by advancements in biotechnology and increasing research activities in genomics and proteomics.