Region:Middle East

Author(s):Dev

Product Code:KRAD7660

Pages:83

Published On:December 2025

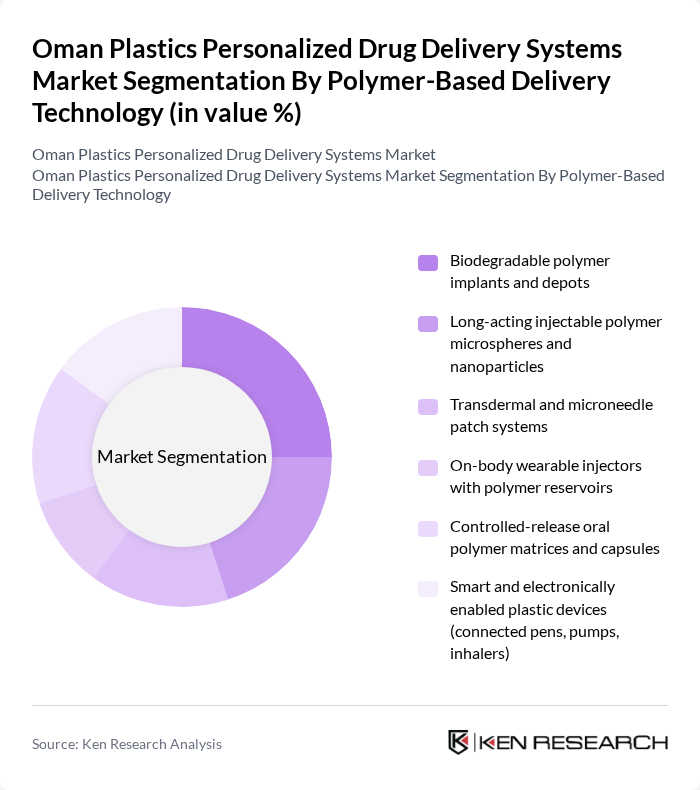

By Polymer-Based Delivery Technology:The polymer-based delivery technology segment is crucial in the market, with various innovative solutions being developed to enhance drug delivery efficiency. Among these, biodegradable polymer implants and depots are gaining traction due to their ability to provide sustained drug release while minimizing environmental impact. Long-acting injectable polymer microspheres and nanoparticles are also prominent, offering improved patient compliance through reduced dosing frequency. The demand for smart and electronically enabled plastic devices is on the rise, driven by the increasing trend towards connected healthcare solutions.

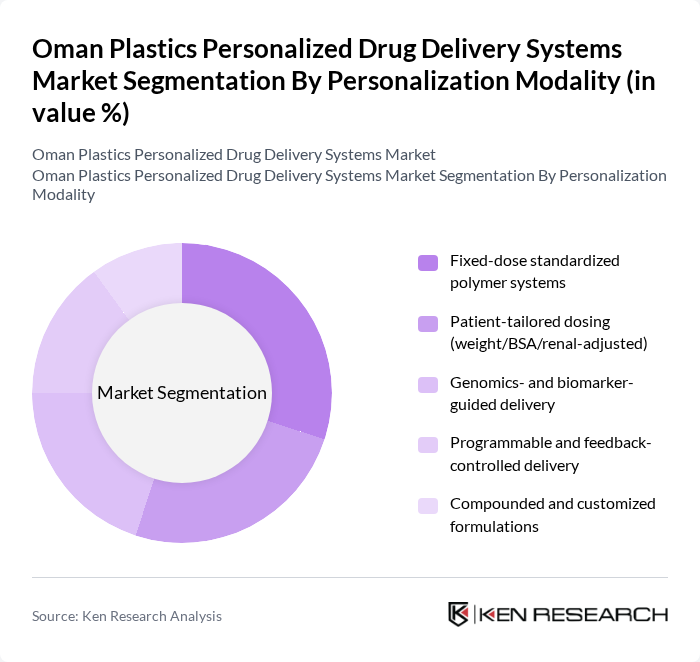

By Personalization Modality:The personalization modality segment is essential for tailoring drug delivery systems to individual patient needs. Fixed-dose standardized polymer systems remain popular due to their simplicity and ease of use. However, patient-tailored dosing, which adjusts medication based on individual characteristics such as weight and renal function, is gaining momentum as healthcare providers seek to optimize treatment outcomes. Genomics- and biomarker-guided delivery systems are also emerging, leveraging genetic information to enhance therapeutic efficacy.

The Oman Plastics Personalized Drug Delivery Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Julphar Gulf Pharmaceutical Industries PSC, Becton, Dickinson and Company (BD), Terumo Corporation, Medtronic plc, AstraZeneca plc, GlaxoSmithKline plc (GSK), Boehringer Ingelheim International GmbH, Oman Pharmaceutical Products Co. LLC, National Pharmaceutical Industries Co. SAOG, Muscat Pharmacy & Stores LLC, Dhofar International Development & Investment Holding Co. SAOG (Healthcare & pharma subsidiaries), Pharmax Pharmaceuticals FZ-LLC, Gulf Drug LLC, Lifecare Medical Supplies LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the personalized drug delivery systems market in Oman appears promising, driven by technological advancements and increasing healthcare investments. With the government focusing on enhancing healthcare infrastructure, the integration of AI and telemedicine is expected to revolutionize drug delivery methods. Additionally, the growing emphasis on patient-centric approaches will likely lead to the development of more effective and tailored therapies, positioning Oman as a key player in the regional healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Polymer-Based Delivery Technology | Biodegradable polymer implants and depots Long-acting injectable polymer microspheres and nanoparticles Transdermal and microneedle patch systems On-body wearable injectors with polymer reservoirs Controlled-release oral polymer matrices and capsules Smart and electronically enabled plastic devices (connected pens, pumps, inhalers) |

| By Personalization Modality | Fixed-dose standardized polymer systems Patient-tailored dosing (weight/BSA/renal-adjusted) Genomics- and biomarker-guided delivery Programmable and feedback-controlled delivery Compounded and customized formulations |

| By Therapy Area | Diabetes and metabolic disorders Respiratory diseases (asthma, COPD) Oncology and hematology Autoimmune and inflammatory diseases Pain management and CNS disorders Infectious diseases and vaccines |

| By Polymer Material Class | Biodegradable polyesters (PLA, PLGA, PCL) Polyolefins and engineering plastics (PE, PP, PC, ABS) Medical-grade elastomers and silicones Hydrogels and bioresorbable composites High-barrier and multilayer polymer structures |

| By Distribution Channel | Hospital and secondary care pharmacies Retail and chain pharmacies Online pharmacies and e-commerce Direct institutional and tender-based procurement Distributors and group purchasing organizations |

| By Region | Muscat Governorate Dhofar (including Salalah) Al Batinah (North & South, including Sohar) Ad Dakhiliyah (including Nizwa) Other Governorates (Sharqiyah, Dhahirah, Al Wusta, Musandam) |

| By Regulatory & Quality Compliance | Oman Ministry of Health device and drug approvals GCC and SFDA registrations ISO 13485 and ISO 10993 compliant products CE Marked devices US FDA and other international approvals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 60 | Product Managers, R&D Directors |

| Healthcare Providers | 50 | Doctors, Pharmacists |

| Patients Using Drug Delivery Systems | 100 | Chronic Disease Patients, Caregivers |

| Regulatory Bodies | 40 | Health Policy Makers, Regulatory Affairs Specialists |

| Research Institutions | 50 | Healthcare Researchers, Academics |

The Oman Plastics Personalized Drug Delivery Systems Market is valued at approximately USD 12 million, reflecting a five-year historical analysis that highlights growth driven by chronic disease prevalence and advancements in polymer technology.