Region:Middle East

Author(s):Dev

Product Code:KRAD6343

Pages:91

Published On:December 2025

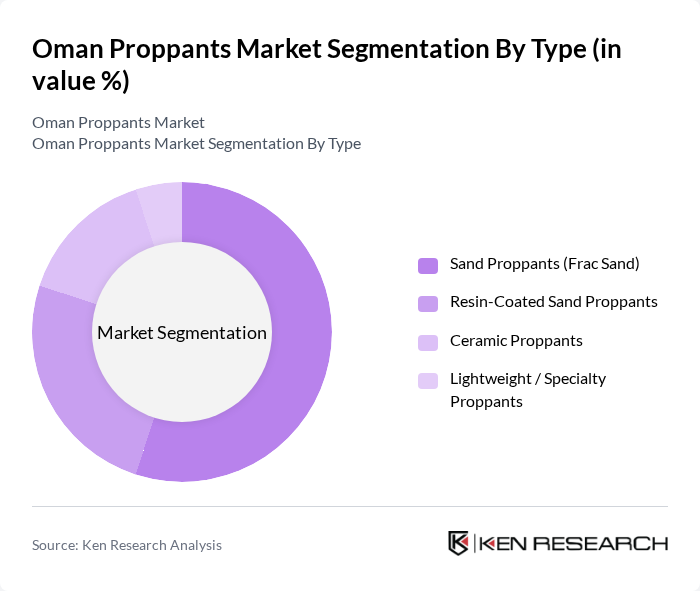

By Type:The proppants market can be segmented into four main types: Sand Proppants (Frac Sand), Resin-Coated Sand Proppants, Ceramic Proppants, and Lightweight/Specialty Proppants, in line with global proppant classifications. Among these, Sand Proppants (Frac Sand) dominate the market due to their cost-effectiveness and widespread use in hydraulic fracturing operations, mirroring the global trend where frac sand holds the largest share. The increasing adoption of multi-stage hydraulic fracturing in Omani tight gas and oil fields has led to a surge in demand for these sand-based proppants, as they provide the necessary support to keep fractures open during oil and gas extraction. Resin-Coated Sand Proppants are also gaining traction due to their improved crush resistance, reduced fines generation, and better performance under higher temperature and pressure conditions found in deeper Omani reservoirs.

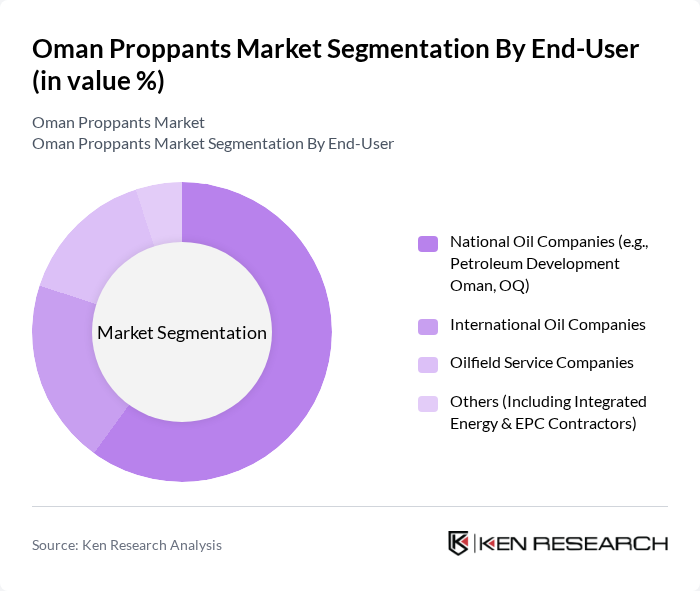

By End-User:The end-user segmentation includes National Oil Companies (e.g., Petroleum Development Oman, OQ), International Oil Companies, Oilfield Service Companies, and Others (including Integrated Energy & EPC Contractors). National Oil Companies are the leading consumers of proppants, driven by their extensive operated and partner-operated positions in Oman’s producing blocks and tight gas developments. The demand from International Oil Companies is also significant, as companies such as BP and Occidental are key operators in tight and unconventional reservoirs that rely heavily on hydraulic fracturing and therefore on proppant consumption. Oilfield Service Companies (for example Halliburton, Schlumberger, Baker Hughes, and NESR) play a crucial role in sourcing, logistics, and pumping of proppants for fracturing operations, making them a vital segment in the market despite typically acting as service integrators rather than final end-users.

The Oman Proppants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petroleum Development Oman LLC (PDO), OQ S.A.O.C. (Including OQ Upstream), Occidental Oman Inc., BP Oman (BP Exploration (Epsilon) Ltd.), Halliburton Company, Schlumberger Limited (SLB), Baker Hughes Company, National Energy Services Reunited Corp. (NESR), Omanfmt Proppants LLC / Local Frac Sand Suppliers, Al Tasnim Group (Mining & Minerals Division), Kunooz Oman Holding SAOC (Industrial Minerals), IMERYS Group, Covia Holdings LLC, U.S. Silica Holdings, Inc., Carbo Ceramics Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman proppants market is poised for growth, driven by increasing oil production and advancements in extraction technologies. As the country continues to explore unconventional oil reserves, the demand for high-quality proppants will rise. Additionally, the focus on sustainable practices and eco-friendly materials will shape the market landscape. Strategic partnerships with local firms will enhance production capabilities, while digital technologies will optimize operations, ensuring that Oman remains competitive in the evolving energy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Sand Proppants (Frac Sand) Resin-Coated Sand Proppants Ceramic Proppants Lightweight / Specialty Proppants |

| By End-User | National Oil Companies (e.g., Petroleum Development Oman, OQ) International Oil Companies Oilfield Service Companies Others (Including Integrated Energy & EPC Contractors) |

| By Application | Shale Gas & Tight Oil Hydraulic Fracturing Conventional Oil & Gas Well Stimulation Enhanced Oil Recovery (EOR) Projects Other Oilfield & Industrial Applications |

| By Distribution Channel | Direct Contracts with Operators Oilfield Service Providers & OFS Logistics Industrial Distributors / Trading Houses Others |

| By Geography | Muscat & North Oman Fields (e.g., PDO blocks) Central Oman (incl. unconventional & tight reservoirs) Southern Oman (e.g., Dhofar / Salalah region) Others (Including Offshore & Border Fields) |

| By Customer Type | National Oil & Gas Operators International Operators & Joint Ventures Oilfield Service & Drilling Contractors Traders / Aggregators & Others |

| By Product Form | Bulk Proppants (Road / Rail / Bulk Handling) Containerized / Silo-Based Proppants Bagged / Packaged Proppants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Service Providers | 90 | Operations Managers, Technical Directors |

| Proppant Manufacturers | 70 | Product Managers, Sales Executives |

| Oil and Gas Exploration Companies | 80 | Geologists, Reservoir Engineers |

| Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

| Research Institutions | 60 | Research Scientists, Industry Analysts |

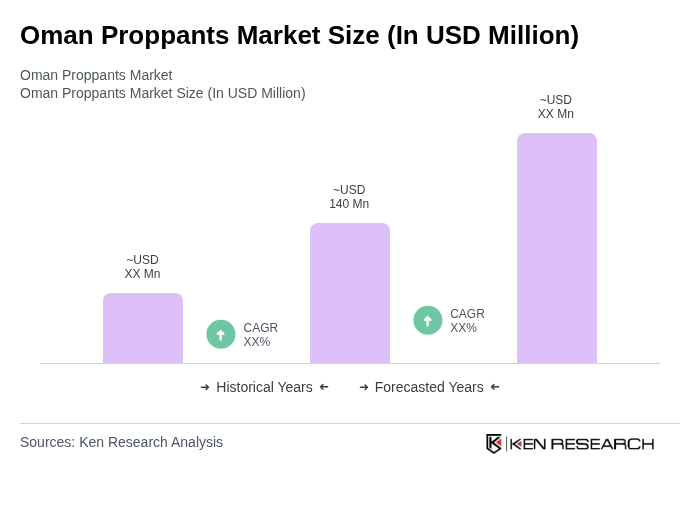

The Oman Proppants Market is valued at approximately USD 140 million, reflecting the country's significant role in the Middle East's hydraulic fracturing demand for oil and gas extraction, particularly in tight and unconventional reservoirs.