Region:Asia

Author(s):Shubham

Product Code:KRAC2844

Pages:84

Published On:October 2025

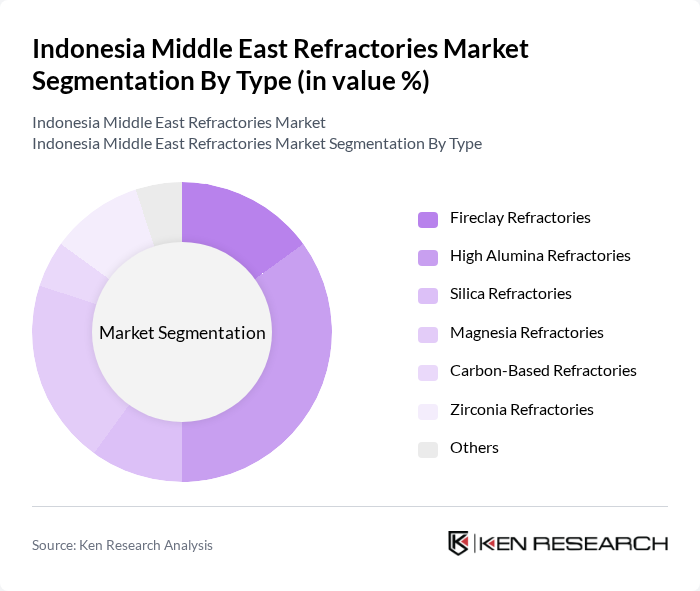

By Type:The refractories market is segmented into Fireclay Refractories, High Alumina Refractories, Silica Refractories, Magnesia Refractories, Carbon-Based Refractories, Zirconia Refractories, and Others. High Alumina Refractories are leading due to their superior thermal stability and resistance to corrosion, making them ideal for high-temperature applications in steel and cement industries. The trend toward electric arc furnace (EAF) steelmaking and the need for energy-efficient, durable linings further drive demand for high alumina and magnesia refractories .

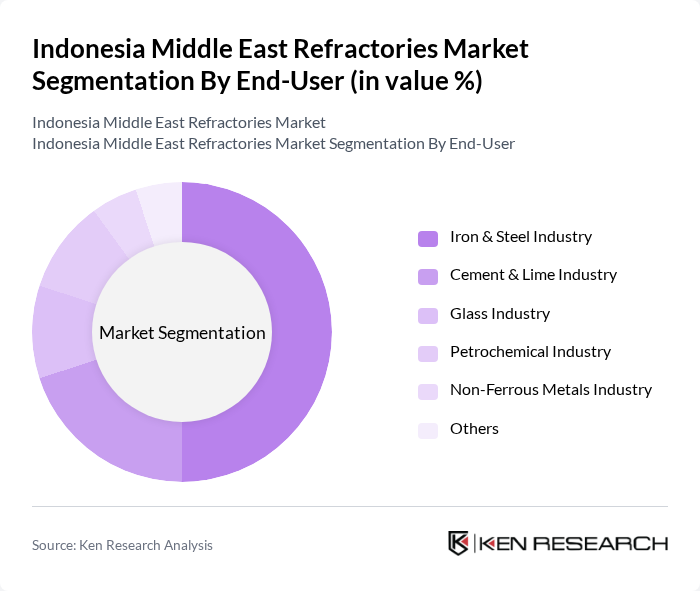

By End-User:The market is segmented by end-user industries, including Iron & Steel Industry, Cement & Lime Industry, Glass Industry, Petrochemical Industry, Non-Ferrous Metals Industry, and Others. The Iron & Steel Industry is the dominant segment, accounting for the largest share due to the high refractory consumption in steelmaking processes, especially with the region’s ongoing infrastructure and construction boom. Cement and lime production also represent significant demand, as kilns require frequent refractory replacement due to extreme operating temperatures .

The Indonesia Middle East Refractories Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Indoporlen Refractory, PT. Aneka Dharma Persada, PT. Benteng Api Technic, PT. Cipta Baja Trimatra, RHI Magnesita N.V., Saint-Gobain S.A., Krosaki Harima Corporation, Vesuvius PLC, Morgan Advanced Materials PLC, HarbisonWalker International, Shinagawa Refractories Co., Ltd., Almatis GmbH, Industrial Ceramics Middle East (ICLME), Al Karawan Group of Companies, Pennekamp Middle East LLC, Rath Group, Unifrax, Isolite Insulating Products Co., Ltd., and Luyang Energy Saving Materials Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia Middle East refractories market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly materials, the demand for innovative refractory solutions will rise. Additionally, the integration of digital technologies in manufacturing processes is expected to enhance efficiency and product customization. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for companies aiming to thrive in the evolving refractories sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fireclay Refractories High Alumina Refractories Silica Refractories Magnesia Refractories Carbon-Based Refractories Zirconia Refractories Others |

| By End-User | Iron & Steel Industry Cement & Lime Industry Glass Industry Petrochemical Industry Non-Ferrous Metals Industry Others |

| By Application | Linings Insulation Castables Precast Shapes Slide Gates Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Material Source | Domestic Sourcing Imported Materials Others |

| By Product Form | Bricks Monolithics Precast Shapes Others |

| By Technology | Slide Gates Tundish Ladle Rotary Kiln Others |

| By Fusion Temperature | Normal Refractory (1580-1780°C) High Refractory (1780-2000°C) Super Refractory (>2000°C) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Steel Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Cement Industry Applications | 60 | Procurement Managers, Operations Directors |

| Glass Manufacturing Processes | 50 | Technical Managers, R&D Heads |

| Foundry and Casting Operations | 40 | Foundry Managers, Process Engineers |

| Refractory Material Suppliers | 70 | Sales Managers, Product Development Specialists |

The Indonesia Middle East Refractories Market is valued at approximately USD 1.1 billion, driven by increasing demand from the iron and steel industry, as well as the expansion of the cement and glass sectors.