Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7278

Pages:91

Published On:December 2025

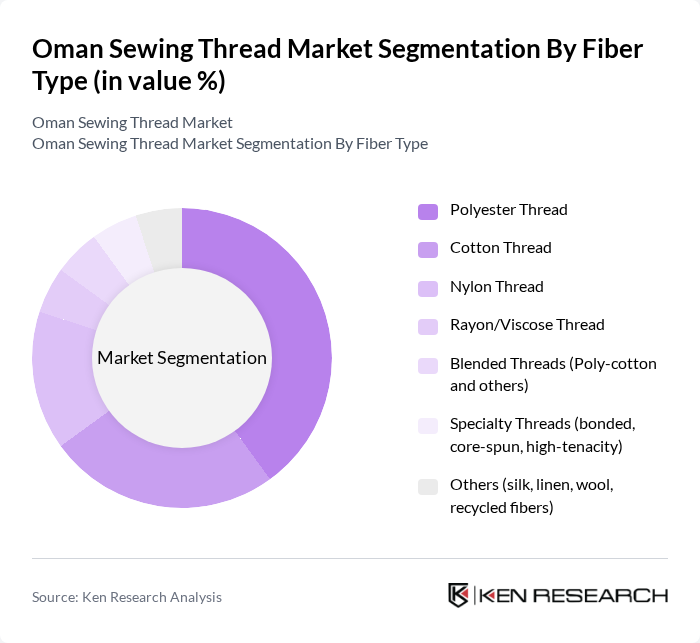

By Fiber Type:The fiber type segmentation includes various materials used in the production of sewing threads. The subsegments are Polyester Thread, Cotton Thread, Nylon Thread, Rayon/Viscose Thread, Blended Threads (Poly-cotton and others), Specialty Threads (bonded, core-spun, high-tenacity), and Others (silk, linen, wool, recycled fibers). Among these, Polyester Thread is the leading subsegment due to its durability, versatility, and cost-effectiveness, making it a preferred choice for both industrial and domestic applications.

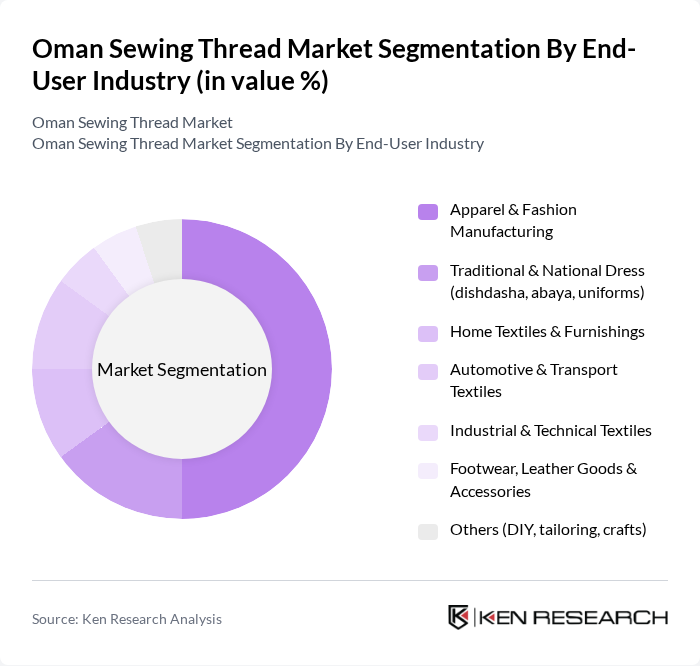

By End-User Industry:The end-user industry segmentation encompasses various sectors that utilize sewing threads, including Apparel & Fashion Manufacturing, Traditional & National Dress (dishdasha, abaya, uniforms), Home Textiles & Furnishings, Automotive & Transport Textiles, Industrial & Technical Textiles, Footwear, Leather Goods & Accessories, and Others (DIY, tailoring, crafts). The Apparel & Fashion Manufacturing segment dominates the market, driven by the growing fashion industry and consumer demand for customized clothing.

The Oman Sewing Thread Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coats Group plc, AMANN Group, A&E Gütermann GmbH, Durak Tekstil A.?., Fujix Ltd., Simtex International LLC (Oman), Oman Thread Co. LLC, Al Qurum Textile Trading LLC, Al-Farsi Textile & Sewing Accessories Trading, Al Kharusi Trading & Contracting Co. LLC (Textile Division), Madeira Garnfabrik Rudolf Schmidt KG, DMC Group, Superior Threads, LLC, Aurifil S.r.l., Mettler (Amann Mettler Thread brand) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman sewing thread market is poised for dynamic growth, driven by increasing consumer demand for textiles and the expansion of the fashion industry. As local manufacturers adopt advanced technologies, they will enhance product quality and efficiency. Additionally, the trend towards sustainable materials will likely shape future product offerings. With the rise of e-commerce platforms, manufacturers can reach broader markets, creating new opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Fiber Type | Polyester Thread Cotton Thread Nylon Thread Rayon/Viscose Thread Blended Threads (Poly-cotton and others) Specialty Threads (bonded, core-spun, high?tenacity) Others (silk, linen, wool, recycled fibers) |

| By End-User Industry | Apparel & Fashion Manufacturing Traditional & National Dress (dishdasha, abaya, uniforms) Home Textiles & Furnishings Automotive & Transport Textiles Industrial & Technical Textiles Footwear, Leather Goods & Accessories Others (DIY, tailoring, crafts) |

| By Application | Garment Assembly & Stitching Embroidery & Decorative Sewing Quilting & Upholstery Industrial Sewing (filters, safety wear, geotextiles) Automotive Interior Sewing (seats, airbags, seatbelts) Others |

| By Distribution Channel | Direct Sales to Garment & Textile Manufacturers Industrial Distributors & Importers Specialty Textile & Notions Stores General Wholesalers & Traders (souqs, local markets) Online B2B Platforms & E-commerce Others |

| By Region | Muscat Salalah Sohar Nizwa Others (Buraimi, Sur, Ibri, Duqm and rest of Oman) |

| By Price Range | Economy/Budget Mid-Range Premium High-Performance/Technical Others |

| By Thread Performance | Light Duty (domestic, tailoring) Medium Duty (general apparel, home textiles) Heavy Duty (upholstery, footwear, workwear) High Tenacity & Heat-Resistant Threads Specialty Performance (UV?resistant, flame?retardant, water?repellent) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Sewing Thread Manufacturers | 60 | Production Managers, Quality Control Supervisors |

| Distributors and Wholesalers | 55 | Sales Managers, Supply Chain Coordinators |

| Retail Outlets for Sewing Supplies | 50 | Store Managers, Merchandising Specialists |

| Textile Industry Experts | 40 | Consultants, Industry Analysts |

| End Consumers (Sewing Enthusiasts) | 70 | Hobbyists, Professional Seamstresses |

The Oman Sewing Thread Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for textiles in the apparel and home furnishing sectors, along with enhanced local manufacturing capabilities.