Region:Middle East

Author(s):Shubham

Product Code:KRAB4429

Pages:99

Published On:October 2025

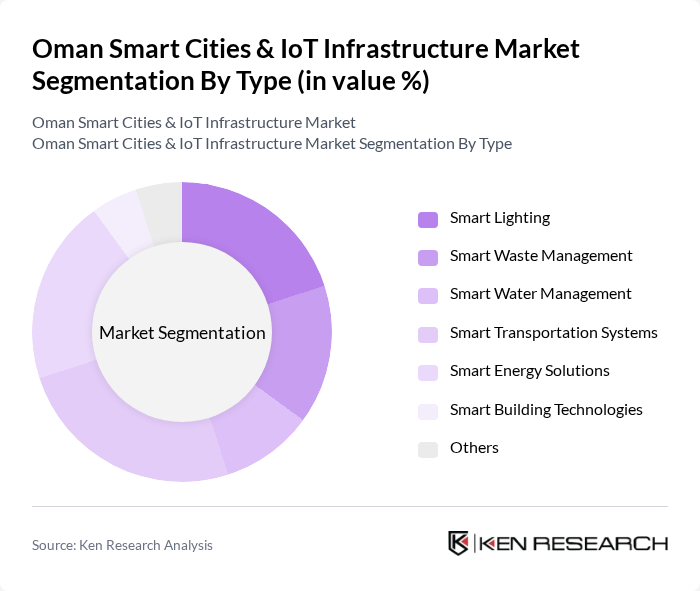

By Type:The market is segmented into various types, including Smart Lighting, Smart Waste Management, Smart Water Management, Smart Transportation Systems, Smart Energy Solutions, Smart Building Technologies, and Others. Each of these segments plays a crucial role in enhancing urban living and operational efficiency.

The Smart Transportation Systems segment is currently dominating the market due to the increasing need for efficient urban mobility solutions. With the rise in population and vehicle usage, cities are investing heavily in smart traffic management systems, which utilize IoT technologies to optimize traffic flow and reduce congestion. This segment is characterized by innovations such as real-time traffic monitoring and smart public transport systems, which enhance the overall commuting experience for residents.

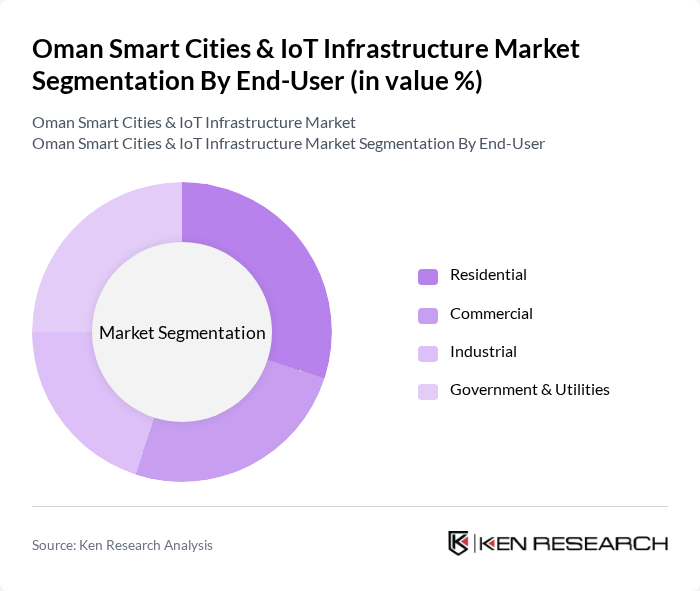

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and applications for smart city solutions.

The Residential segment is leading the market, driven by the growing demand for smart home technologies that enhance convenience, security, and energy efficiency. Consumers are increasingly adopting IoT-enabled devices such as smart thermostats, security systems, and lighting controls, which contribute to the overall growth of this segment. The trend towards sustainable living and energy conservation is also propelling the adoption of smart solutions in residential areas.

The Oman Smart Cities & IoT Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Telecommunications Company (Omantel), Ooredoo Oman, Siemens Oman, Cisco Systems, Inc., IBM Corporation, Schneider Electric, Honeywell International Inc., Huawei Technologies Co., Ltd., Ericsson, Nokia Corporation, Microsoft Corporation, Oracle Corporation, Accenture, SAP SE, General Electric Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Oman's smart cities and IoT infrastructure market appears promising, driven by ongoing urbanization and government support. As the nation invests in advanced technologies, the integration of AI and machine learning will enhance operational efficiencies. Furthermore, the expansion of 5G networks will facilitate real-time data processing, enabling smarter urban management. The focus on sustainable practices will likely lead to innovative solutions that address energy consumption and environmental challenges, positioning Oman as a regional leader in smart city development.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Lighting Smart Waste Management Smart Water Management Smart Transportation Systems Smart Energy Solutions Smart Building Technologies Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Urban Mobility Public Safety Environmental Monitoring Infrastructure Management Energy Management Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Grants and Funding |

| By Technology | IoT Sensors Cloud Computing Big Data Analytics Artificial Intelligence Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Smart City Initiatives | 100 | City Planners, Urban Development Officials |

| IoT Device Manufacturers | 80 | Product Managers, Sales Directors |

| Telecommunications Infrastructure Providers | 70 | Network Engineers, Business Development Managers |

| Public Transportation Systems | 60 | Transport Managers, Operations Supervisors |

| Community Engagement and Feedback | 90 | Community Leaders, Local Residents |

The Oman Smart Cities & IoT Infrastructure Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, government initiatives, and the demand for efficient resource management solutions.