Region:Middle East

Author(s):Rebecca

Product Code:KRAD4978

Pages:99

Published On:December 2025

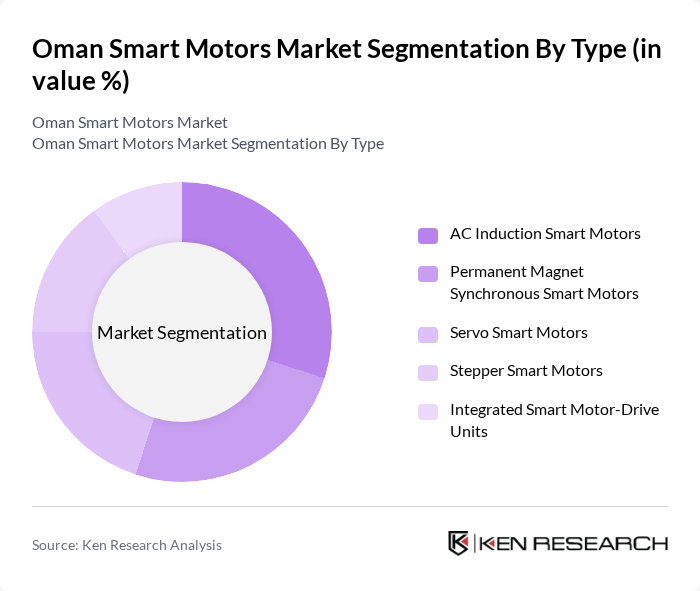

By Type:The market is segmented into various types of smart motors, each catering to different applications and industries. The key subsegments include AC Induction Smart Motors, Permanent Magnet Synchronous Smart Motors, Servo Smart Motors, Stepper Smart Motors, and Integrated Smart Motor-Drive Units. This structure is consistent with the broader smart and robotic motor classifications, where AC induction and permanent magnet synchronous motors dominate industrial and automation use cases, complemented by servo and stepper motors for precise motion control and integrated motor-drive units for compact, IIoT-ready solutions.

The AC Induction Smart Motors segment is currently dominating the market due to their widespread use in industrial applications, particularly in manufacturing plants, HVAC systems, pumps, compressors, and fans, mirroring usage patterns in the regional AC electric motor and smart/robotic motor markets. Their robustness, reliability, mature supply base, and cost-effectiveness make them a preferred choice among end-users, while the addition of smart features via integrated or external drives and sensors enables condition monitoring and energy optimization. Additionally, the increasing focus on energy efficiency, digitization, and automation in sectors such as oil and gas, water and wastewater, and commercial buildings is further propelling demand for these motors, supported by Industry 4.0 investments and the rollout of connected, remotely monitored assets.

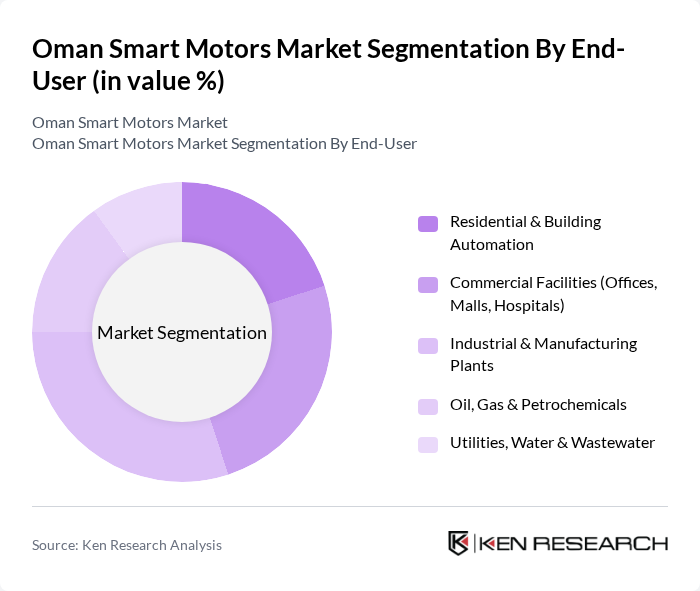

By End-User:The market is segmented based on end-user applications, which include Residential & Building Automation, Commercial Facilities (Offices, Malls, Hospitals), Industrial & Manufacturing Plants, Oil, Gas & Petrochemicals, and Utilities, Water & Wastewater. These segments reflect the main demand centers for efficient motor-driven systems in Oman, aligned with the country’s industrial, infrastructure, and building development profile.

The Industrial & Manufacturing Plants segment is the leading end-user in the Oman Smart Motors Market, driven by ongoing industrialization, investments in free zones and industrial estates, and the need for automation and process optimization in production lines and material-handling systems. The demand for smart motors in this sector is fueled by requirements for higher energy efficiency, reduced downtime through predictive maintenance, and alignment with national energy-efficiency initiatives and technical standards. Additionally, the oil, gas, and petrochemicals segment is a significant contributor, as operators upgrade rotating equipment, pumps, and compressors using advanced motor and drive technologies to improve reliability, enhance safety, and reduce energy consumption across upstream, midstream, and downstream facilities.

The Oman Smart Motors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric SE, Rockwell Automation, Inc., Mitsubishi Electric Corporation, Nidec Corporation, Emerson Electric Co., General Electric Company, Danfoss A/S, WEG S.A., Yaskawa Electric Corporation, Toshiba Corporation, Eaton Corporation plc, Hitachi, Ltd., CG Power and Industrial Solutions Limited contribute to innovation, geographic expansion, and service delivery in this space, offering portfolios of high?efficiency and intelligent motors, drives, and integrated automation solutions that are widely deployed in industrial, building, and infrastructure applications across the Gulf region.

The Oman Smart Motors Market is poised for significant transformation as technological advancements and government initiatives converge. In future, the integration of IoT and automation in industrial processes is expected to enhance operational efficiency. Additionally, the focus on sustainable practices will drive demand for energy-efficient solutions. As awareness increases and initial costs decrease, the market is likely to witness a surge in adoption, positioning Oman as a leader in smart motor technology within the region.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Induction Smart Motors Permanent Magnet Synchronous Smart Motors Servo Smart Motors Stepper Smart Motors Integrated Smart Motor-Drive Units |

| By End-User | Residential & Building Automation Commercial Facilities (Offices, Malls, Hospitals) Industrial & Manufacturing Plants Oil, Gas & Petrochemicals Utilities, Water & Wastewater |

| By Application | HVAC & District Cooling Systems Pumps, Fans and Compressors Material Handling & Conveyor Systems Robotics & Automated Production Lines Electric Vehicles & Charging Infrastructure |

| By Technology | Variable Speed Drives & Intelligent Motor Control IoT-Enabled & Remote Monitoring Motors Wireless Communication & Edge-Connected Motors Energy Harvesting & Regenerative Braking Motors |

| By Industry Vertical | Manufacturing & Industrial Automation Automotive & E-Mobility Oil & Gas, Refining and Petrochemicals Mining, Metals & Cement Power Generation, Water & Utilities |

| By Distribution Channel | Direct Sales to End-Users Appointed Local Distributors & System Integrators OEM Partnerships Online & E-Procurement Portals |

| By Policy Support | Energy Efficiency Programs & Rebates Tax Exemptions & Customs Incentives in Free Zones Green Building & Industrial Decarbonization Grants Public-Private Partnership (PPP) Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation Sector | 110 | Plant Managers, Automation Engineers |

| HVAC Systems Integration | 85 | HVAC Technicians, System Designers |

| Automotive Manufacturing | 75 | Production Managers, Quality Control Supervisors |

| Energy Efficiency Programs | 55 | Energy Managers, Sustainability Coordinators |

| Smart Motor Distributors | 95 | Sales Managers, Product Line Directors |

The Oman Smart Motors Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the demand for energy-efficient solutions and automation technologies across various sectors, including manufacturing and oil and gas.