Region:Middle East

Author(s):Dev

Product Code:KRAD1672

Pages:82

Published On:November 2025

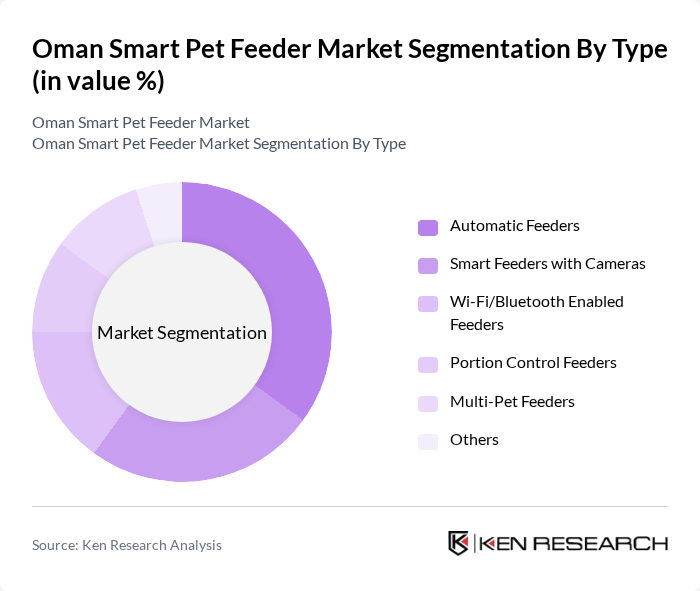

By Type:The market can be segmented into various types of smart pet feeders, including Automatic Feeders, Smart Feeders with Cameras, Wi-Fi/Bluetooth Enabled Feeders, Portion Control Feeders, Multi-Pet Feeders, and Others. Among these, Automatic Feeders are gaining significant traction due to their ease of use and convenience for pet owners. Smart Feeders with Cameras are also becoming popular as they allow owners to monitor their pets remotely, enhancing the pet care experience. Wi-Fi-based smart feeders are experiencing accelerated adoption, driven by their integration with smart home ecosystems, enabling users to manage feeding routines, video monitoring, health tracking, and voice interaction capabilities.

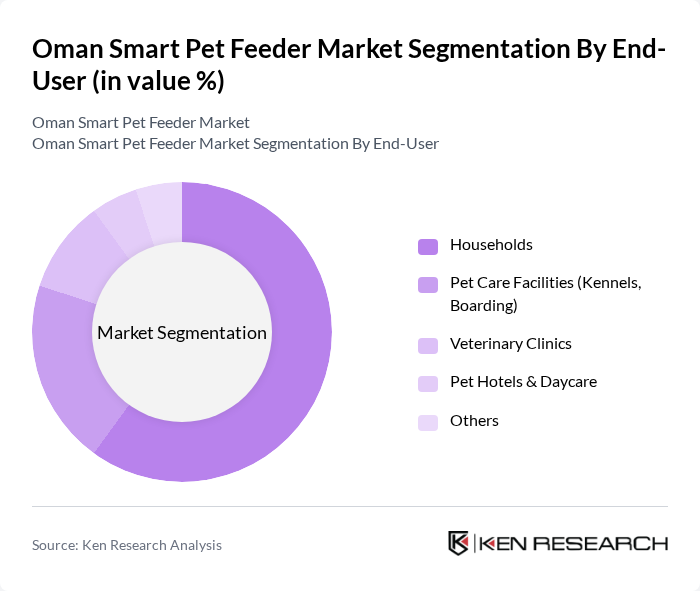

By End-User:The end-user segmentation includes Households, Pet Care Facilities (Kennels, Boarding), Veterinary Clinics, Pet Hotels & Daycare, and Others. Households dominate the market as pet owners increasingly seek automated solutions for feeding their pets. Pet Care Facilities are also significant users, as they require efficient feeding solutions to manage multiple pets simultaneously.

The Oman Smart Pet Feeder Market is characterized by a dynamic mix of regional and international players. Leading participants such as PetSafe, Sure Petcare (SureFeed), WOpet, Feed and Go, Petnet, Cat Mate (Pet Mate Ltd.), Arf Pets, PetFusion, iFetch, Petzi, Litter-Robot (Whisker), PetSafe Smart Feed, Xiaomi (Mi Smart Pet Feeder), PetKit, Pawbo (Acer Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman smart pet feeder market is poised for significant growth as consumer preferences shift towards convenience and technology-driven solutions. With increasing pet ownership and rising disposable incomes, the demand for innovative pet care products is expected to rise. Additionally, the integration of smart home technologies and a focus on pet health will further enhance market dynamics. As awareness grows, the market is likely to see a surge in adoption rates, paving the way for new entrants and product innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Automatic Feeders Smart Feeders with Cameras Wi-Fi/Bluetooth Enabled Feeders Portion Control Feeders Multi-Pet Feeders Others |

| By End-User | Households Pet Care Facilities (Kennels, Boarding) Veterinary Clinics Pet Hotels & Daycare Others |

| By Pet Type | Dogs Cats Small Animals (Rabbits, Hamsters, etc.) Birds Others |

| By Distribution Channel | Online Retail (E-commerce, Marketplaces) Offline Retail (Pet Stores, Hypermarkets) Veterinary Clinics/Professional Channels Direct Sales Others |

| By Price Range | Budget (Entry Level) Mid-Range Premium Luxury/High-End Others |

| By Brand | Local Omani Brands International Brands Private Labels Others |

| By Technology Features | App-Controlled Feeders Voice-Activated Feeders Smart Sensors (Portion/Weight/Presence) Video Monitoring/Two-way Audio Integration with Smart Home Ecosystems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owners in Urban Areas | 120 | Dog and cat owners, ages 25-45 |

| Retailers of Pet Products | 60 | Store Managers, Product Buyers |

| Veterinarians and Pet Care Professionals | 60 | Veterinarians, Pet Trainers, Groomers |

| Online Pet Product Consumers | 80 | Frequent online shoppers, ages 18-50 |

| Pet Industry Experts | 40 | Market Analysts, Industry Consultants |

The Oman Smart Pet Feeder Market is valued at approximately USD 18 million, reflecting growth driven by increasing pet ownership and demand for convenience among pet owners, alongside the integration of smart home technologies.