Region:Middle East

Author(s):Shubham

Product Code:KRAD0848

Pages:97

Published On:November 2025

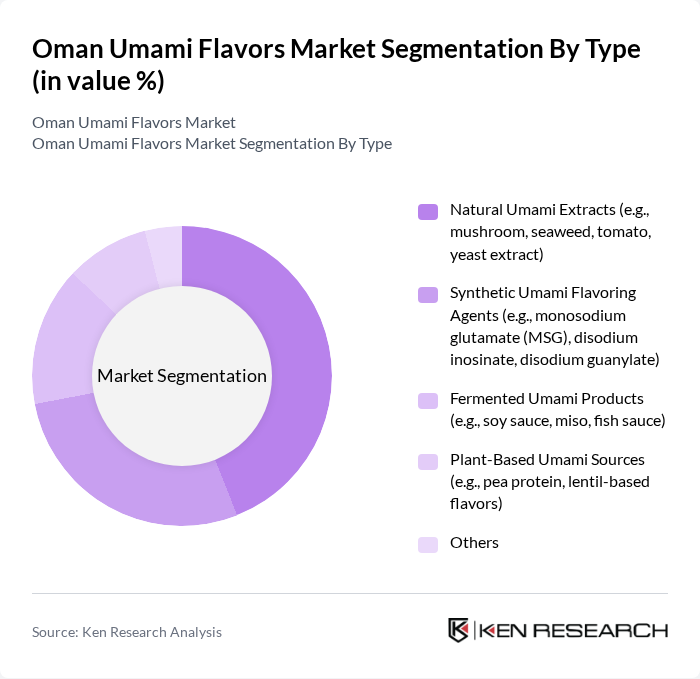

By Type:The market is segmented into various types of umami flavors, including Natural Umami Extracts, Synthetic Umami Flavoring Agents, Fermented Umami Products, Plant-Based Umami Sources, and Others. Among these, Natural Umami Extracts, such as mushroom and seaweed, are gaining popularity due to the increasing consumer shift towards healthier and more natural food options. The demand for synthetic agents like monosodium glutamate (MSG) remains strong due to their cost-effectiveness and widespread use in processed foods. The trend towards plant-based diets is also driving the growth of plant-based umami sources .

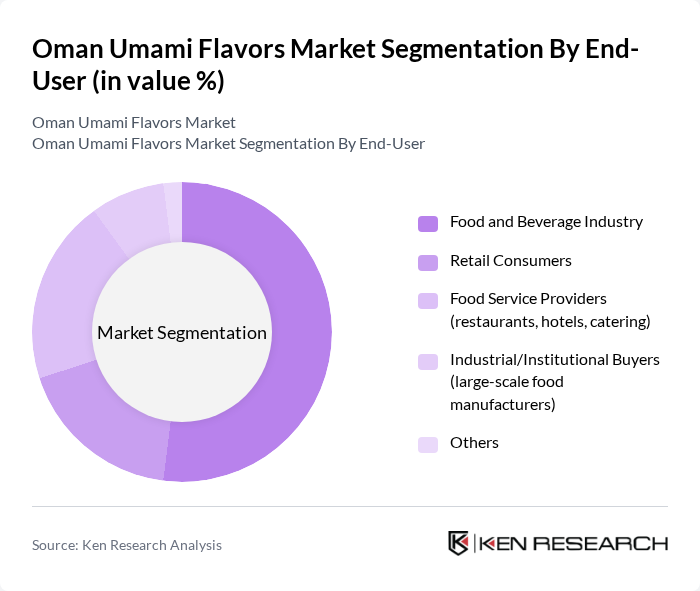

By End-User:The end-user segmentation includes the Food and Beverage Industry, Retail Consumers, Food Service Providers, Industrial/Institutional Buyers, and Others. The Food and Beverage Industry is the leading segment, driven by the increasing incorporation of umami flavors in various food products, including snacks, sauces, and ready-to-eat meals. Food service providers, such as restaurants and catering services, are also significant consumers of umami flavors, as they seek to enhance the taste profiles of their offerings to attract more customers .

The Oman Umami Flavors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., DSM Nutritional Products, Givaudan SA, International Flavors & Fragrances Inc. (IFF), Kerry Group plc, Symrise AG, Takasago International Corporation, Sensient Technologies Corporation, Firmenich SA, T. Hasegawa Co., Ltd., Flavorchem Corporation, Bell Flavors & Fragrances Inc., Mane SA, Robertet SA, Wild Flavors GmbH, Oman Foodstuff Factory LLC, National Biscuit Industries Ltd SAOG, Areej Vegetable Oils & Derivatives SAOC, Salalah Mills Co. SAOG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman umami flavors market appears promising, driven by evolving consumer preferences and a growing food processing sector. As awareness of umami flavors increases, manufacturers are likely to innovate and introduce new products that cater to health-conscious consumers. Additionally, the expansion of e-commerce platforms will facilitate wider distribution, allowing consumers to access a variety of umami products. This trend is expected to enhance market dynamics and foster growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Umami Extracts (e.g., mushroom, seaweed, tomato, yeast extract) Synthetic Umami Flavoring Agents (e.g., monosodium glutamate (MSG), disodium inosinate, disodium guanylate) Fermented Umami Products (e.g., soy sauce, miso, fish sauce) Plant-Based Umami Sources (e.g., pea protein, lentil-based flavors) Others |

| By End-User | Food and Beverage Industry Retail Consumers Food Service Providers (restaurants, hotels, catering) Industrial/Institutional Buyers (large-scale food manufacturers) Others |

| By Application | Sauces and Condiments Snacks and Savory Foods Processed Foods (ready meals, canned goods) Plant-Based Meat Alternatives Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores (gourmet, health food) Foodservice Distributors Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Consumer Demographics | Age Groups Income Levels Lifestyle Preferences (health-conscious, gourmet, convenience-focused) Others |

| By Product Form | Liquid Umami Flavors Powdered Umami Flavors Granulated Umami Flavors Paste Umami Flavors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 60 | Product Development Managers, Flavor Technologists |

| Restaurant Sector | 50 | Head Chefs, Restaurant Owners |

| Retail Grocery Chains | 40 | Category Managers, Purchasing Agents |

| Food Distributors | 40 | Sales Managers, Supply Chain Coordinators |

| Consumer Focus Groups | 50 | General Consumers, Food Enthusiasts |

The Oman Umami Flavors Market is valued at approximately USD 22 million, reflecting a growing consumer preference for savory flavors and natural ingredients in food products, as well as an increase in culinary applications of umami flavors.