Region:Asia

Author(s):Geetanshi

Product Code:KRAA0554

Pages:90

Published On:December 2025

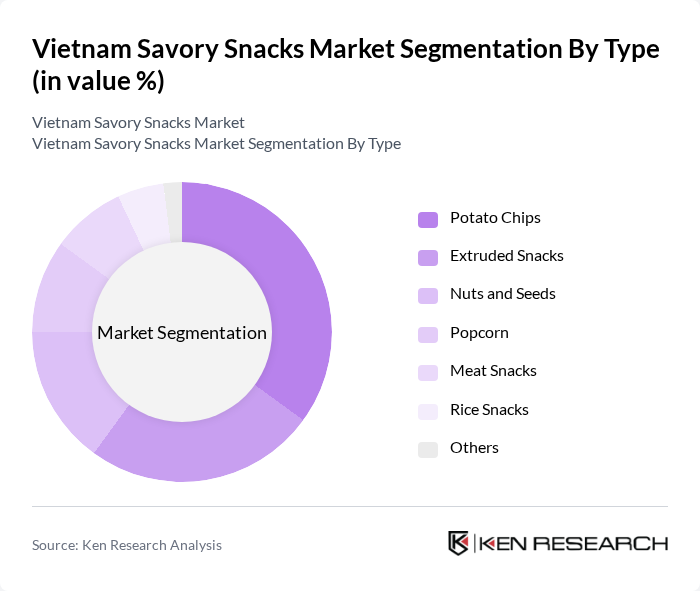

By Type:The savory snacks market is segmented into various types, including potato chips, extruded snacks, nuts and seeds, popcorn, meat snacks, rice snacks, and others. Among these, potato chips are the most popular, driven by their convenience and variety of flavors. Extruded snacks are also gaining traction due to their innovative shapes and textures, appealing to younger consumers. The demand for healthier options has led to a rise in nuts and seeds, while meat snacks are favored for their protein content.

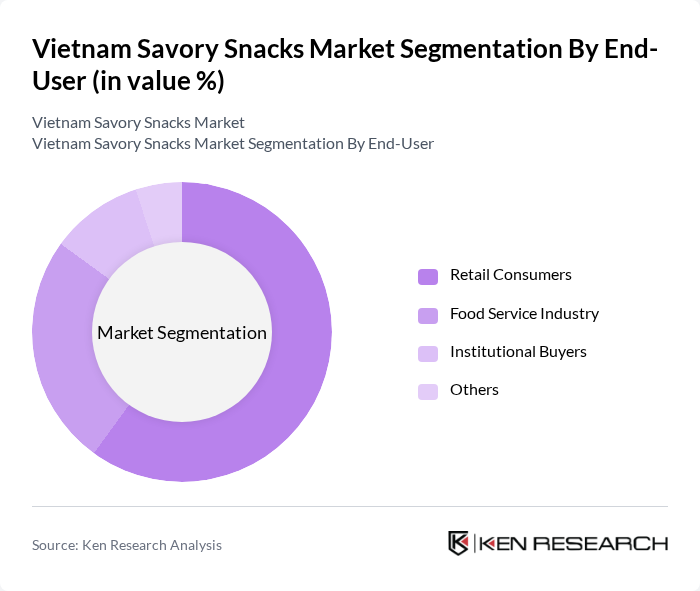

By End-User:The market is segmented by end-user into retail consumers, the food service industry, institutional buyers, and others. Retail consumers dominate the market, driven by the increasing trend of snacking among individuals and families. The food service industry is also significant, as restaurants and cafes increasingly offer savory snacks as part of their menus. Institutional buyers, including schools and hospitals, are emerging as a growing segment due to the demand for convenient snack options.

The Vietnam Savory Snacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinamilk, Masan Consumer, Mondelez International, PepsiCo Vietnam, Kinh Do Corporation, Hai Ha International, Binh Tay Food, TH True Milk, Nutifood, Unilever Vietnam, Orion Food Vina, Golden Gate Group, Vinasoy, Trung Nguyen Coffee, Banh Mi Phuong contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam savory snacks market appears promising, driven by increasing health consciousness among consumers and the rise of e-commerce platforms. As 86 percent of consumers prioritize ingredient transparency and health benefits, brands are likely to innovate with functional snacks. Additionally, the e-commerce market is projected to reach USD 32 billion by future, enhancing distribution channels and enabling brands to connect with tech-savvy consumers more effectively, thus shaping the market landscape positively.

| Segment | Sub-Segments |

|---|---|

| By Type | Potato Chips Extruded Snacks Nuts and Seeds Popcorn Meat Snacks Rice Snacks Others |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Flavor Profile | Spicy Savory Sweet Others |

| By Packaging Type | Bags Boxes Pouches Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Snack Outlets | 150 | Store Managers, Retail Buyers |

| Consumer Preferences for Savory Snacks | 200 | General Consumers, Snack Enthusiasts |

| Distribution Channels Analysis | 100 | Distributors, Wholesalers |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Health-Conscious Snack Options | 120 | Health and Nutrition Experts, Fitness Enthusiasts |

The Vietnam Savory Snacks Market is valued at approximately USD 750 million, reflecting a significant growth trend driven by changing consumer lifestyles, urbanization, and rising disposable incomes, alongside increased demand for convenient and health-oriented snack options.