Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7186

Pages:80

Published On:December 2025

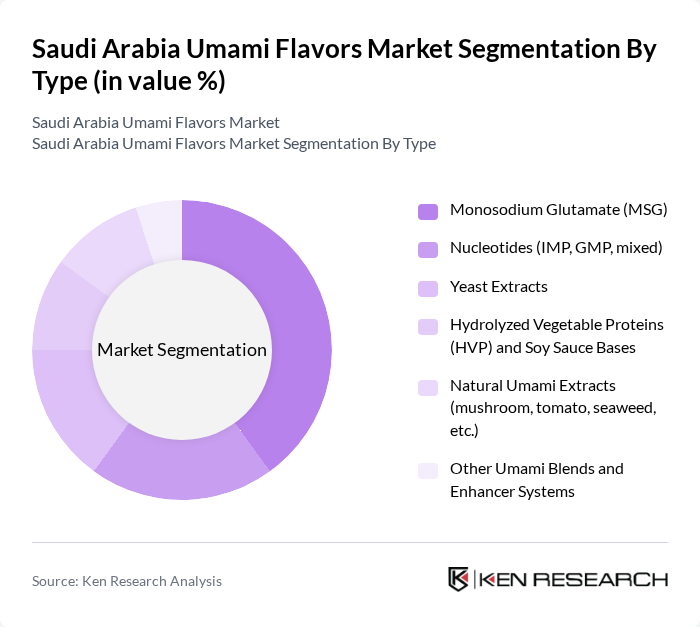

By Type:The umami flavors market can be segmented into various types, including Monosodium Glutamate (MSG), Nucleotides (IMP, GMP, mixed), Yeast Extracts, Hydrolyzed Vegetable Proteins (HVP) and Soy Sauce Bases, Natural Umami Extracts (mushroom, tomato, seaweed, etc.), and Other Umami Blends and Enhancer Systems. This structure is consistent with global umami portfolios, where MSG, yeast extracts, HVP, and other natural umami ingredients are the primary sources used by food and beverage manufacturers. Among these, Monosodium Glutamate (MSG) remains a major sub-segment due to its cost-effectiveness and strong performance in savory taste enhancement; however, yeast extracts, HVP, and other natural umami systems are gaining share as local and multinational brands in Saudi Arabia respond to clean-label, reduced-salt, and “natural flavor” positioning in snacks, instant foods, broths, and culinary bases.

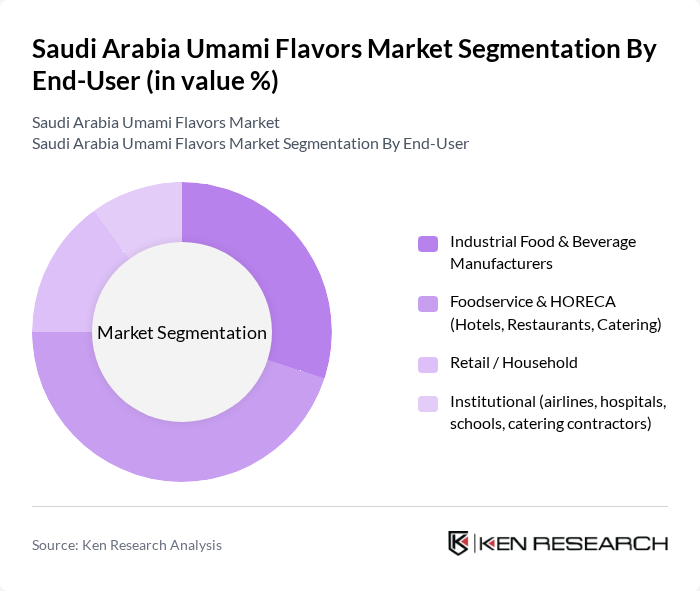

By End-User:The umami flavors market is segmented by end-user into Industrial Food & Beverage Manufacturers, Foodservice & HORECA (Hotels, Restaurants, Catering), Retail / Household, and Institutional (airlines, hospitals, schools, catering contractors). This segmentation reflects the key demand centers seen globally, where food and beverage manufacturers and foodservice operators are the primary users of umami solutions in snacks, sauces, seasonings, instant meals, and prepared dishes. The Foodservice & HORECA segment is currently the dominant end-user in Saudi Arabia, supported by rapid growth in quick-service restaurants, casual dining, international chains, and catering services in major cities, and by increasing consumer preference for flavorful, convenient, and diverse dining experiences, including Asian, fusion, and contemporary Saudi cuisine.

The Saudi Arabia Umami Flavors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Givaudan SA, International Flavors & Fragrances Inc. (IFF), Kerry Group plc, Symrise AG, Takasago International Corporation, Sensient Technologies Corporation, Firmenich SA (dsm-firmenich), T. Hasegawa Co., Ltd., Bell Flavors & Fragrances, Inc., MANE SA, Robertet SA, Synergy Flavours (Carbery Group), SAVOIR-FLAVOUR Co. Ltd. (regional savory systems supplier), Local and Regional Distributors Active in Saudi Arabia (e.g., Khalid & Abdulaziz Al-Fozan Co., Saudi-based ingredient traders) contribute to innovation, geographic expansion, and service delivery in this space, supplying MSG, yeast extracts, HVP, customized savory bases, and integrated taste solutions to Saudi food manufacturers and foodservice customers.

The future of the umami flavors market in Saudi Arabia appears promising, driven by evolving consumer preferences and a growing food and beverage sector. Innovations in flavor technology are expected to enhance product offerings, while the shift towards natural and clean label products will align with consumer demands for healthier options. Additionally, the expansion of e-commerce channels will facilitate greater accessibility to umami products, further stimulating market growth and encouraging new entrants to explore this lucrative segment.

| Segment | Sub-Segments |

|---|---|

| By Type | Monosodium Glutamate (MSG) Nucleotides (IMP, GMP, mixed) Yeast Extracts Hydrolyzed Vegetable Proteins (HVP) and Soy Sauce Bases Natural Umami Extracts (mushroom, tomato, seaweed, etc.) Other Umami Blends and Enhancer Systems |

| By End-User | Industrial Food & Beverage Manufacturers Foodservice & HORECA (Hotels, Restaurants, Catering) Retail / Household Institutional (airlines, hospitals, schools, catering contractors) |

| By Application | Snacks, Seasonings & Savory Snacks Instant Noodles, Soups & Broths Meat, Poultry & Processed Meat Products Sauces, Condiments & Marinades Ready Meals, Frozen & Convenience Foods Plant-based & Meat Analog Products Other Food & Beverage Applications |

| By Distribution Channel | Direct Sales to Food Manufacturers International Flavor Houses & Ingredient Distributors Local Importers and Traders Modern Retail (Supermarkets / Hypermarkets) Online & B2B E-commerce Other Channels |

| By Region | Central Region (including Riyadh) Eastern Region Western Region (including Makkah & Madinah) Southern Region Northern Region |

| By Consumer Demographics | National vs Expatriate Consumers Income Level Health- and Wellness-Oriented vs Conventional Consumers Age Group Others |

| By Product Form | Powder / Dry Blends Liquid & Paste Granules Encapsulated and Other Forms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 100 | Product Development Managers, Flavor Technologists |

| Retail Sector Insights | 80 | Category Managers, Purchasing Agents |

| Food Service Operators | 70 | Restaurant Owners, Executive Chefs |

| Consumer Preferences | 100 | General Consumers, Food Enthusiasts |

| Health and Nutrition Experts | 50 | Dietitians, Nutritionists |

The Saudi Arabia Umami Flavors Market is valued at approximately USD 180 million, reflecting its significant share within the broader Middle East and Africa umami flavors industry, driven by increasing demand for flavor enhancers in food and beverage applications.