Region:Middle East

Author(s):Rebecca

Product Code:KRAD5066

Pages:89

Published On:December 2025

By Product Type:The product type segmentation includes various categories of unitary heaters, each catering to different consumer needs and preferences. The primary subsegments are Gas-Fired Unitary Heaters, Electric Unitary Heaters, Oil-Fired Unitary Heaters, Hybrid/Condensing Unitary Heaters, and Others (Infrared, Radiant, etc.). In industrial and large commercial spaces, gas-fired and electric unitary heaters are the dominant technologies globally, favored for their balance of efficiency, availability of fuel or power, and relatively lower operating costs compared with many alternative localized heating options. In the Oman context, where many applications are tied to warehouses, logistics, and selective industrial facilities, gas-fired and electric unitary heaters together account for the majority of installed units, with gas-fired solutions often preferred where piped gas or LPG infrastructure is present and electric models gaining traction where electrification and easier installation are prioritized.

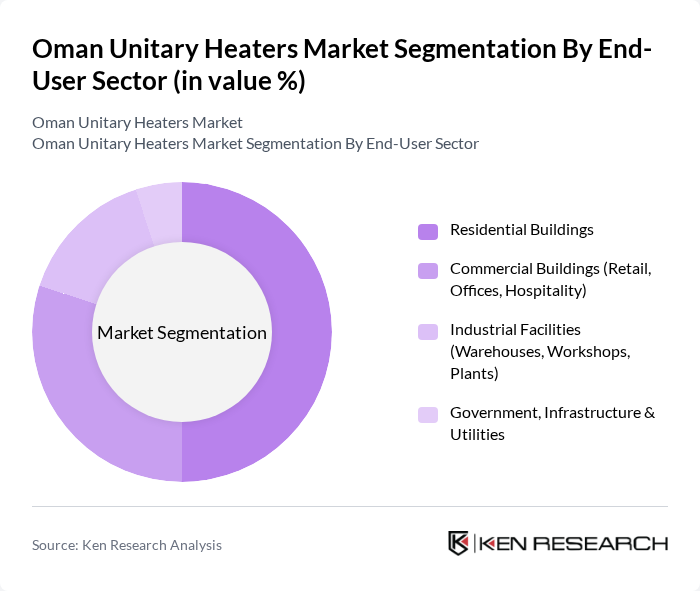

By End-User Sector:The end-user sector segmentation encompasses various applications of unitary heaters across different industries. The primary subsegments include Residential Buildings, Commercial Buildings (Retail, Offices, Hospitality), Industrial Facilities (Warehouses, Workshops, Plants), and Government, Infrastructure & Utilities. In line with broader heating equipment patterns in Oman, demand is concentrated in commercial and industrial facilities where localized heating is required for people comfort, process needs, or frost protection, such as warehouses, logistics centers, factories, and specific areas in public infrastructure. Residential use of unitary heaters remains comparatively limited and is typically associated with villas or apartments in cooler inland or high-altitude locations, as well as with supplemental heating needs during colder months.

The Oman Unitary Heaters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Middle East and Africa FZE, Trane Technologies plc (Trane Middle East), Carrier Global Corporation (Carrier Middle East), Rheem Manufacturing Company, Bosch Thermotechnology (Robert Bosch GmbH), Mitsubishi Electric Corporation, Lennox International Inc., Fujitsu General Limited, Johnson Controls International plc (York), Ariston Thermo Group, A. O. Smith Corporation, Viessmann Group, Panasonic Corporation, Glen Dimplex Group, Nortek Global HVAC (Nortek, Inc.) contribute to innovation, geographic expansion, and service delivery in this space, often supplying unitary heaters as part of broader HVAC and heating equipment portfolios through distributors and project-based sales into industrial, commercial, and infrastructure projects in Oman.

The Oman unitary heaters market is poised for significant transformation, driven by increasing consumer awareness and government support for energy-efficient technologies. As the construction sector expands, the integration of smart technologies in heating systems is expected to gain traction, enhancing user experience and energy management. Additionally, the focus on sustainability will likely lead to innovative product developments, positioning the market for robust growth as consumers seek eco-friendly heating solutions that align with national energy goals.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gas-Fired Unitary Heaters Electric Unitary Heaters Oil-Fired Unitary Heaters Hybrid / Condensing Unitary Heaters Others (Infrared, Radiant, etc.) |

| By End-User Sector | Residential Buildings Commercial Buildings (Retail, Offices, Hospitality) Industrial Facilities (Warehouses, Workshops, Plants) Government, Infrastructure & Utilities |

| By Region | Muscat Governorate Dhofar (Salalah) Al Batinah (incl. Sohar) Al Dakhiliyah (incl. Nizwa) Other Regions |

| By Application | Space Heating for Buildings Process & Industrial Heating Frost Protection / Equipment & Storage Heating Others |

| By Fuel / Energy Source | Natural Gas / Pipeline Gas LPG / Propane Electricity Diesel / Fuel Oil Others |

| By Mounting / Installation Type | Ceiling-Suspended Wall-Mounted Floor-Standing Portable / Mobile Units |

| By Service & Maintenance Model | Preventive / Annual Maintenance Contracts (AMCs) On-Demand / Emergency Repairs Retrofit & Replacement Services Others (Remote Monitoring, Performance Optimization) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heating Solutions | 100 | Homeowners, Property Managers |

| Commercial HVAC Systems | 80 | Facility Managers, Building Owners |

| Industrial Heating Applications | 60 | Operations Managers, Plant Engineers |

| Energy Efficiency Initiatives | 70 | Sustainability Officers, Energy Consultants |

| Market Trends and Innovations | 90 | Product Development Managers, R&D Specialists |

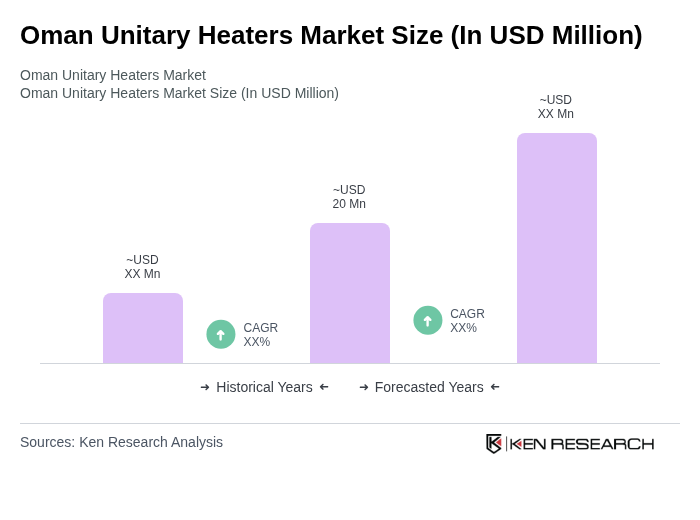

The Oman Unitary Heaters Market is valued at approximately USD 20 million, reflecting a steady growth trend driven by increasing demand for energy-efficient heating solutions across residential, commercial, and industrial sectors.