Region:Middle East

Author(s):Dev

Product Code:KRAA8373

Pages:95

Published On:November 2025

By Type:The market is segmented into various types of heat pumps, including Air Source Heat Pumps, Ground Source (Geothermal) Heat Pumps, Water Source Heat Pumps, Exhaust Air Heat Pumps, Hybrid Heat Pumps, and Others. Each type serves different applications and has unique advantages, catering to diverse consumer needs.

TheAir Source Heat Pumpssegment is currently dominating the market due to their versatility, ease of installation, and cost-effectiveness. They are particularly favored in residential applications where space is limited, and they can efficiently provide both heating and cooling. The growing trend towards energy-efficient solutions, the increasing number of government incentives for renewable energy technologies, and the integration of advanced control systems and IoT-enabled features further bolster the demand for air source heat pumps. This segment is expected to maintain its leadership position in the market.

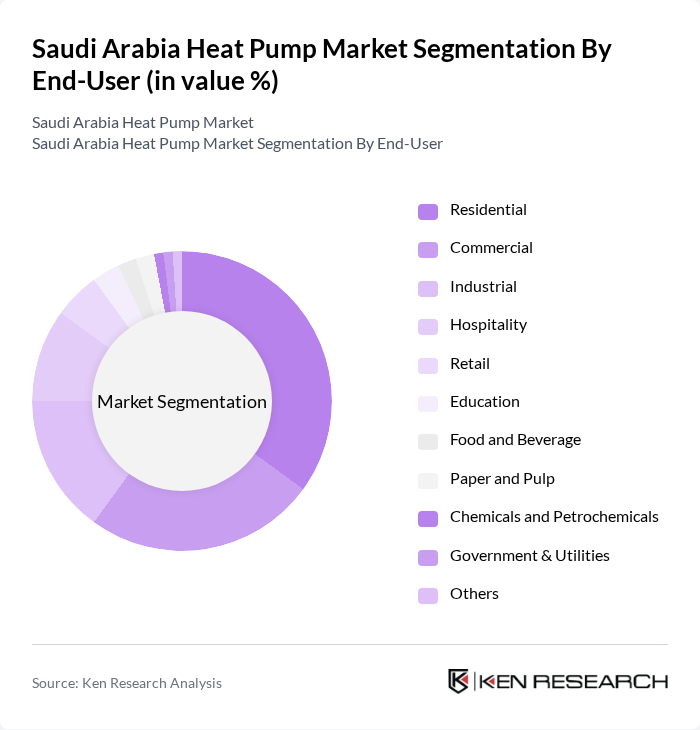

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, Hospitality, Retail, Education, Food and Beverage, Paper and Pulp, Chemicals and Petrochemicals, Government & Utilities, and Others. Each end-user segment has distinct requirements and preferences for heat pump solutions.

TheResidentialsegment is leading the market, driven by the increasing demand for energy-efficient heating and cooling solutions among homeowners. The growing trend of smart homes, rising awareness of environmental sustainability, and government incentives and regulations promoting energy efficiency in residential buildings further support the growth of this segment, making it a key player in the overall market landscape.

The Saudi Arabia Heat Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Middle East and Africa, Trane Technologies, Mitsubishi Electric, LG Electronics, Bosch Thermotechnology, Carrier Global Corporation, Rheem Manufacturing Company, Fujitsu General, Panasonic Corporation, Gree Electric Appliances, Aermec S.p.A., Stiebel Eltron, Viessmann Group, Ariston Thermo Group, Swegon Group, Johnson Controls – Hitachi Air Conditioning, Midea Group, Zamil Air Conditioners (Saudi Arabia), Petra Engineering Industries Co., Al Salem Johnson Controls (YORK Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia heat pump market is poised for significant growth, driven by increasing government support and consumer demand for energy-efficient solutions. As the nation progresses towards its Vision 2030 goals, the integration of heat pumps into residential and commercial sectors will likely accelerate. Additionally, advancements in technology and rising environmental awareness will further enhance market dynamics, creating a favorable environment for innovative heating solutions that align with sustainability objectives.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Source Heat Pumps Ground Source (Geothermal) Heat Pumps Water Source Heat Pumps Exhaust Air Heat Pumps Hybrid Heat Pumps Others |

| By End-User | Residential Commercial Industrial Hospitality Retail Education Food and Beverage Paper and Pulp Chemicals and Petrochemicals Government & Utilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Technology | Inverter Technology Non-Inverter Technology Smart Heat Pump Technology Others |

| By Application | Space Heating Water Heating Process Heating Cooling Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heat Pump Users | 120 | Homeowners, Property Managers |

| Commercial HVAC Decision Makers | 85 | Facility Managers, Building Owners |

| Industrial Energy Managers | 65 | Operations Directors, Energy Efficiency Officers |

| Government Energy Policy Makers | 45 | Regulatory Officials, Energy Advisors |

| HVAC Contractors and Installers | 55 | Contractors, Technical Service Providers |

The Saudi Arabia Heat Pump Market is valued at approximately USD 450 million, driven by the increasing demand for energy-efficient heating and cooling solutions, advancements in technology, and government initiatives promoting renewable energy technologies.