Region:Middle East

Author(s):Shubham

Product Code:KRAA8483

Pages:85

Published On:November 2025

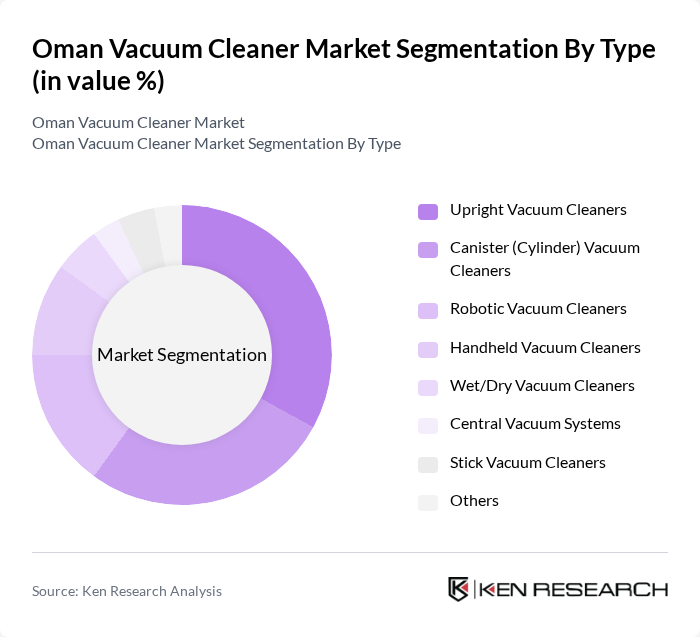

By Type:The market is segmented into various types of vacuum cleaners, including upright vacuum cleaners, canister vacuum cleaners, robotic vacuum cleaners, handheld vacuum cleaners, wet/dry vacuum cleaners, central vacuum systems, stick vacuum cleaners, and others. Among these, canister vacuum cleaners are particularly popular due to their versatility and effectiveness in cleaning different surfaces, followed by upright vacuum cleaners which are favored for their ease of use in larger carpeted areas. The adoption of robotic vacuum cleaners is rising, driven by increasing consumer interest in smart home technology and convenience .

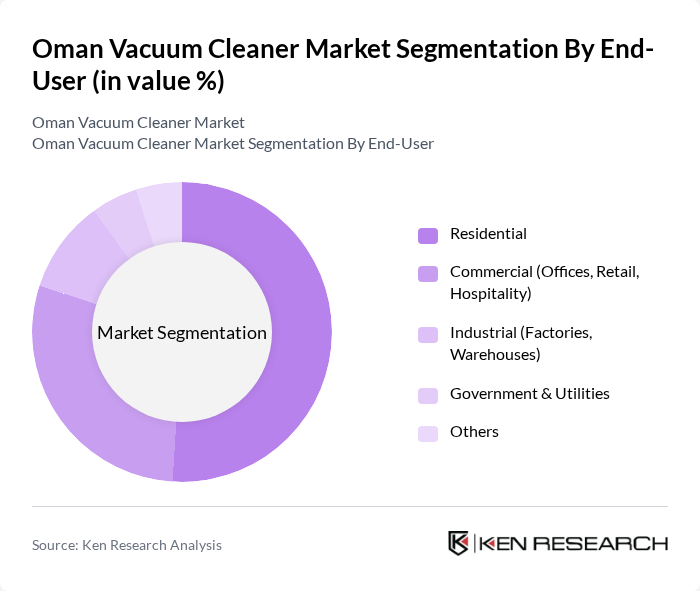

By End-User:The vacuum cleaner market is segmented by end-user into residential, commercial (offices, retail, hospitality), industrial (factories, warehouses), government & utilities, and others. The residential segment dominates the market, driven by increasing consumer awareness regarding cleanliness and hygiene, as well as the growing availability of affordable and technologically advanced vacuum cleaners. The commercial segment is also expanding, particularly in the hospitality and retail sectors, where maintaining cleanliness is crucial for customer satisfaction .

The Oman Vacuum Cleaner Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips, Dyson, Bissell, SharkNinja, Electrolux, Hoover, Black+Decker, LG Electronics, Samsung Electronics, iRobot, Miele, Panasonic, Tineco, Eureka Forbes, Vax, Bosch, Kenwood, Clikon, Geepas, Sanford contribute to innovation, geographic expansion, and service delivery in this space.

The Oman vacuum cleaner market is poised for significant growth as urbanization and disposable income continue to rise. The increasing focus on hygiene, driven by recent health concerns, will likely sustain demand for advanced cleaning solutions. Additionally, the integration of smart technologies and eco-friendly products will attract tech-savvy consumers. As e-commerce platforms expand, they will facilitate easier access to a wider range of vacuum cleaners, further enhancing market growth and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Upright Vacuum Cleaners Canister (Cylinder) Vacuum Cleaners Robotic Vacuum Cleaners Handheld Vacuum Cleaners Wet/Dry Vacuum Cleaners Central Vacuum Systems Stick Vacuum Cleaners Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial (Factories, Warehouses) Government & Utilities Others |

| By Region | Muscat Salalah Sohar Nizwa Sur Others |

| By Application | Home Cleaning Office Cleaning Industrial Cleaning Automotive Cleaning Hospitality Cleaning Others |

| By Power Source | Electric (Corded) Vacuum Cleaners Battery-Powered (Cordless) Vacuum Cleaners Manual Vacuum Cleaners Others |

| By Price Range | Budget Vacuum Cleaners Mid-Range Vacuum Cleaners Premium Vacuum Cleaners Others |

| By Brand Preference | Local Brands (e.g., Clikon, Geepas, Sanford) International Brands (e.g., Philips, Dyson, Bosch, Samsung, LG) Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Homeowners, Renters |

| Distribution Channel Analysis | 60 | Wholesalers, Distributors |

| Brand Perception Studies | 50 | Marketing Managers, Brand Strategists |

| Technological Adoption Trends | 40 | Product Development Engineers, Tech Enthusiasts |

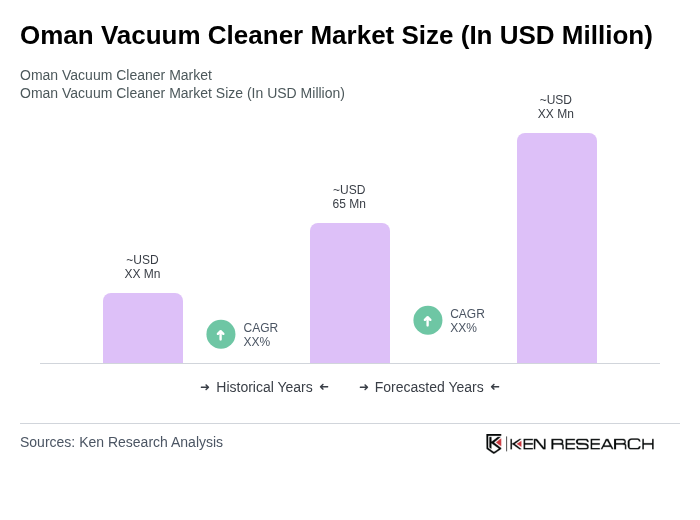

The Oman Vacuum Cleaner Market is valued at approximately USD 65 million, reflecting a five-year historical analysis. This growth is driven by urbanization, rising disposable incomes, and increased consumer awareness of hygiene and cleanliness.