Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3951

Pages:95

Published On:November 2025

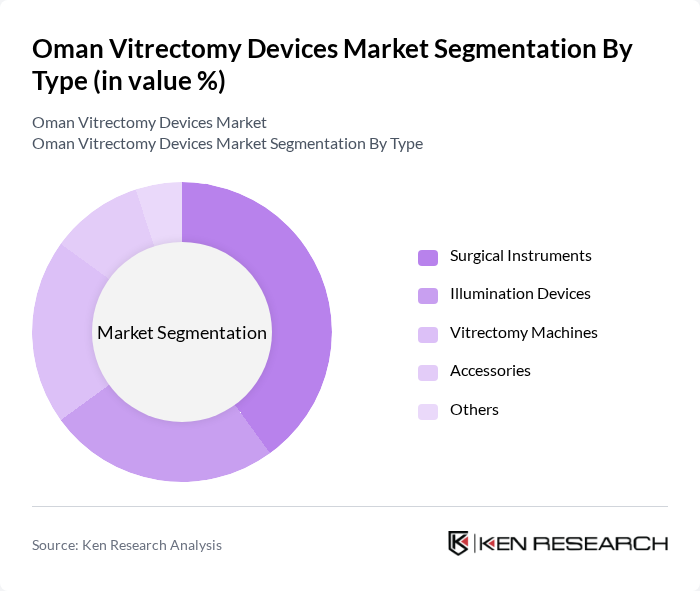

By Type:The market is segmented into various types of vitrectomy devices, including surgical instruments, illumination devices, vitrectomy machines, accessories, and others. Each of these sub-segments plays a crucial role in the overall market dynamics, with specific applications and technological advancements driving their demand.

The surgical instruments sub-segment dominates the market due to their essential role in vitrectomy procedures. These instruments, including forceps, scissors, and cutters, are critical for the successful execution of surgeries. The increasing number of retinal surgeries and the demand for precision in surgical procedures have led to a higher adoption of advanced surgical instruments, making them a key driver of market growth.

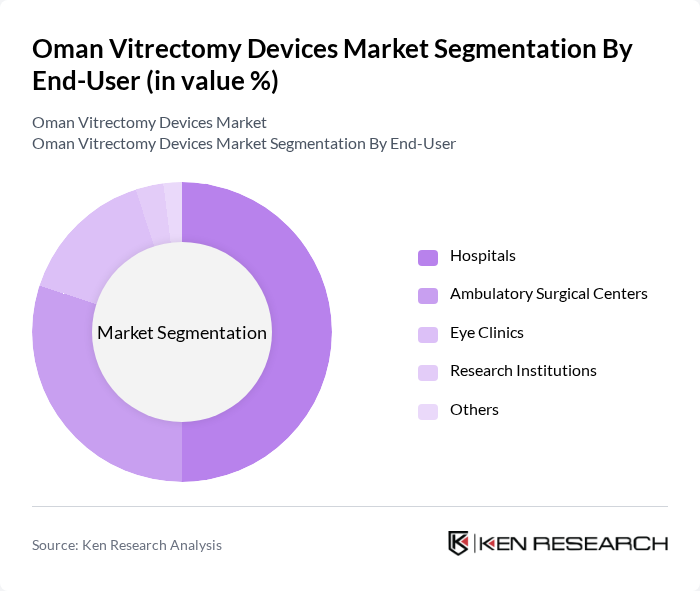

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, eye clinics, research institutions, and others. Each of these end-users has unique requirements and contributes differently to the overall market landscape.

Hospitals are the leading end-user segment in the Oman Vitrectomy Devices Market, primarily due to their comprehensive facilities and specialized departments for eye care. The presence of skilled ophthalmologists and advanced surgical equipment in hospitals enables them to perform a higher volume of vitrectomy procedures, thus driving the demand for vitrectomy devices significantly.

The Oman Vitrectomy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Laboratories, Inc., Bausch + Lomb, Carl Zeiss AG, Johnson & Johnson Vision, Haag-Streit AG, Topcon Corporation, Synergetics USA, Inc., Vitreoretinal Technologies, Inc., Optos plc, MedOne Surgical, Inc., Stryker Corporation, DORC International, Nidek Co., Ltd., Iridex Corporation, Retina Implant AG contribute to innovation, geographic expansion, and service delivery in this space.

The Oman vitrectomy devices market is poised for significant growth, driven by technological advancements and an increasing focus on patient-centric care. The integration of artificial intelligence in surgical planning is expected to enhance precision and outcomes, while the shift towards outpatient procedures will make surgeries more accessible. Additionally, the rise of telemedicine for pre and post-operative care will facilitate better patient management, ensuring that the market adapts to evolving healthcare needs and improves overall service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Instruments Illumination Devices Vitrectomy Machines Accessories Others |

| By End-User | Hospitals Ambulatory Surgical Centers Eye Clinics Research Institutions Others |

| By Application | Retinal Detachment Surgery Diabetic Vitrectomy Macular Hole Surgery Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Patient Demographics | Age Group (Pediatric, Adult, Geriatric) Gender (Male, Female) Socioeconomic Status (Low, Middle, High) Others |

| By Technology | Traditional Vitrectomy Microincision Vitrectomy Robotic-Assisted Vitrectomy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Surgeons | 100 | Vitreoretinal Surgeons, General Ophthalmologists |

| Hospital Procurement Managers | 80 | Medical Device Buyers, Supply Chain Managers |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Affairs Specialists |

| Clinical Researchers | 40 | Research Scientists, Academic Ophthalmologists |

The Oman Vitrectomy Devices Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by the increasing prevalence of retinal disorders and advancements in surgical techniques.