Region:Asia

Author(s):Rebecca

Product Code:KRAB0272

Pages:82

Published On:August 2025

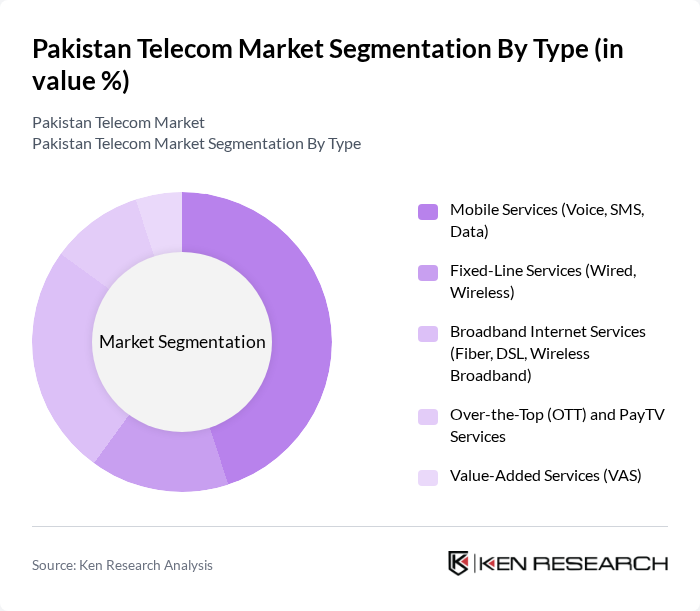

By Type:The segmentation by type includes Mobile Services (Voice, SMS, Data), Fixed-Line Services (Wired, Wireless), Broadband Internet Services (Fiber, DSL, Wireless Broadband), Over-the-Top (OTT) and PayTV Services, and Value-Added Services (VAS). Mobile services remain the largest segment, driven by widespread smartphone adoption and affordable data plans. Fixed-line services, though declining, still play a role in business and government connectivity. Broadband internet services are expanding rapidly, supported by fiber and wireless technologies. OTT and PayTV services are experiencing significant growth due to increased streaming and digital content consumption. Value-Added Services, including mobile banking and entertainment, are increasingly important in driving user engagement.

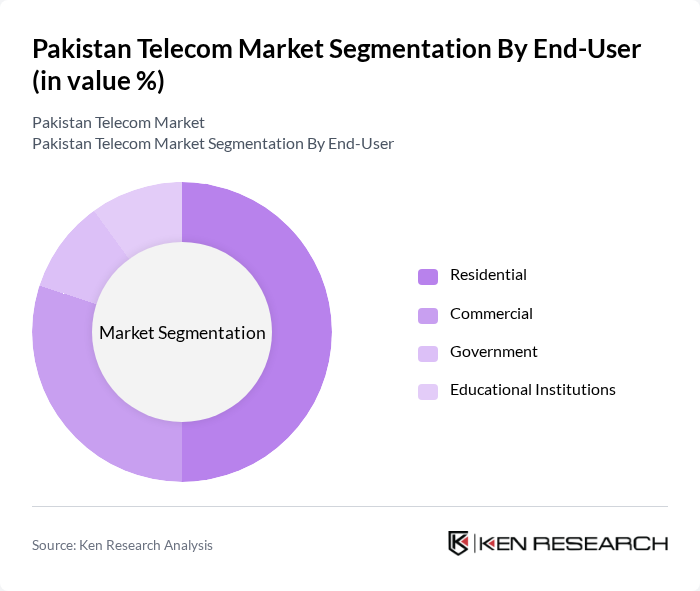

By End-User:The end-user segmentation includes Residential, Commercial, Government, and Educational Institutions. The residential segment is the largest, reflecting the widespread adoption of mobile and broadband services among households. Commercial users drive demand for advanced connectivity and enterprise solutions. Government and educational institutions require secure, reliable communication networks and are increasingly adopting digital platforms for public service delivery and learning.

The Pakistan Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pakistan Telecommunication Company Limited (PTCL), Pakistan Mobile Communications Limited (Jazz), Telenor Pakistan Limited, China Mobile Pakistan (Zong), Pak Telecom Mobile Limited (Ufone), Nayatel (Pvt.) Ltd., Wateen Telecom Limited, PTCL Smart TV, Qubee Pakistan, Transworld Associates (Pvt.) Ltd., Fiberlink (Pvt.) Ltd., StormFiber (Cybernet), LinkdotNet Pakistan, Worldcall Telecom Limited, Telenor Microfinance Bank Limited, Special Communications Organization (SCO) contribute to innovation, geographic expansion, and service delivery in this space. These companies are actively investing in network expansion, 5G technology deployment, and innovative service offerings to meet evolving consumer demands and drive market growth.

The future of the Pakistan telecom market appears promising, driven by technological advancements and increasing digital adoption. With the government prioritizing digitalization, investments in telecom infrastructure are expected to rise significantly. The anticipated growth in mobile financial services and IoT applications will further enhance connectivity and service offerings. As competition intensifies, operators will likely focus on improving customer experience and expanding their service portfolios to capture a larger market share, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (Voice, SMS, Data) Fixed-Line Services (Wired, Wireless) Broadband Internet Services (Fiber, DSL, Wireless Broadband) Over-the-Top (OTT) and PayTV Services Value-Added Services (VAS) |

| By End-User | Residential Commercial Government Educational Institutions |

| By Service Provider Type | Mobile Network Operators (MNOs) Internet Service Providers (ISPs) OTT/PayTV Providers Value-Added Service Providers |

| By Pricing Model | Prepaid Postpaid Bundled Services |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises |

| By Geographic Region | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-45, diverse socio-economic backgrounds |

| Broadband Subscribers | 80 | Households with internet access, urban and rural areas |

| Telecom Retailers | 50 | Store Managers, Sales Representatives in telecom retail |

| Corporate Clients | 40 | IT Managers, Procurement Officers from SMEs and large enterprises |

| Telecom Infrastructure Providers | 40 | Executives from companies providing telecom hardware and software solutions |

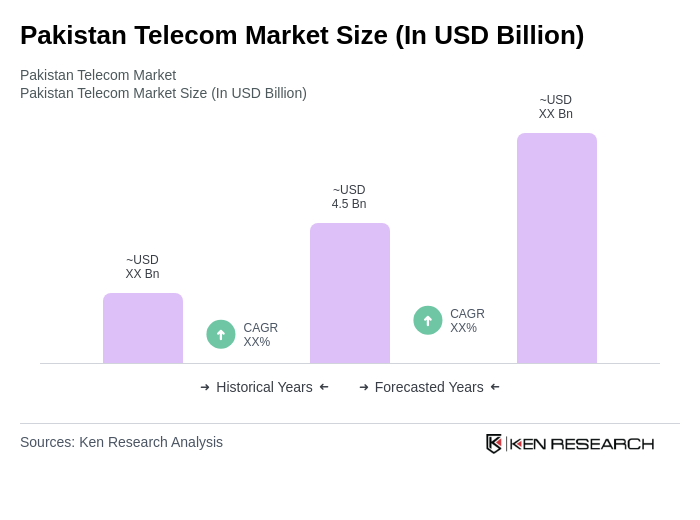

The Pakistan Telecom Market is valued at approximately USD 4.5 billion, driven by factors such as increasing smartphone penetration, rising internet usage, and the adoption of mobile financial services. This valuation is based on a five-year historical analysis.