Peru Nutritional Supplements and Sports Nutrition Market Overview

- The Peru Nutritional Supplements and Sports Nutrition Market is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is primarily driven by rising health consciousness, increased participation in fitness activities, and a strong trend toward preventive healthcare. The market has experienced a notable increase in demand for nutritional products, especially among urban consumers, as awareness of the benefits of supplementation and functional foods grows .

- Lima, the capital city, leads the market due to its large urban population and modern lifestyle, which foster greater demand for health and wellness products. Arequipa and Trujillo are also important urban centers, where rising disposable incomes and increased health awareness are fueling market expansion. The high concentration of retail outlets, pharmacies, and fitness centers in these cities further enhances market accessibility and product availability .

- The Reglamento de Alimentos y Bebidas Procesadas para Consumo Humano, approved by the Ministry of Health of Peru in 2022, mandates that all nutritional supplements must undergo safety and efficacy evaluation before entering the market. This regulation requires manufacturers and distributors to comply with strict registration, labeling, and quality control standards to ensure consumer safety and product integrity .

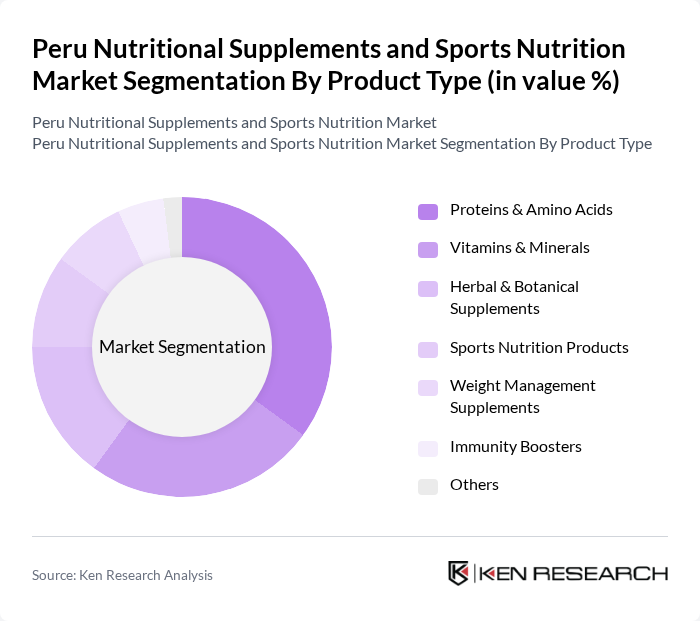

Peru Nutritional Supplements and Sports Nutrition Market Segmentation

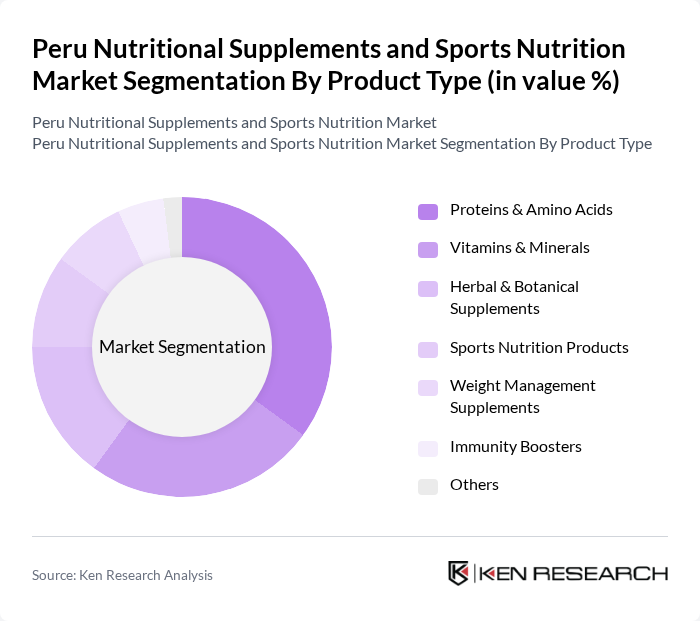

By Product Type:The product type segmentation includes Proteins & Amino Acids, Vitamins & Minerals, Herbal & Botanical Supplements, Sports Nutrition Products, Weight Management Supplements, Immunity Boosters, and Others. Proteins & Amino Acids are the leading segment, driven by the popularity of fitness and bodybuilding, which boosts demand for protein supplements. Vitamins & Minerals maintain a significant share as consumers focus on holistic health and wellness. There is also a growing trend toward natural and herbal products, supporting the Herbal & Botanical Supplements segment, while Sports Nutrition Products are increasingly adopted by athletes and fitness enthusiasts .

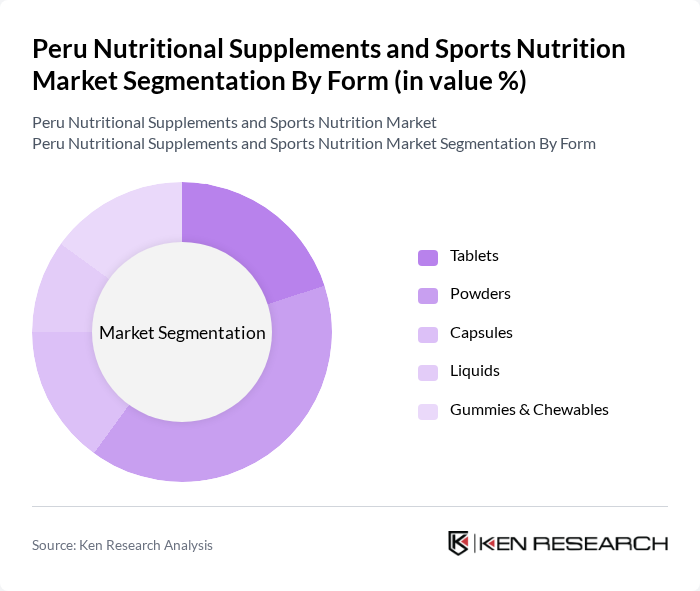

By Form:The form segmentation covers Tablets, Powders, Capsules, Liquids, and Gummies & Chewables. Powders are the most popular form, favored for their versatility and ease of use, especially among fitness enthusiasts. Tablets and Capsules are widely used for their convenience and precise dosing. Gummies & Chewables are gaining popularity, particularly among younger consumers, due to their palatable format. Liquids are preferred by those seeking rapid absorption and ease of consumption .

Peru Nutritional Supplements and Sports Nutrition Market Competitive Landscape

The Peru Nutritional Supplements and Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Nestlé Health Science, Abbott Laboratories, Glanbia plc, Optimum Nutrition (Glanbia), BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, Quest Nutrition, Farmakonsuma (Grupo Farma), Nature's Way Products, LLC, USANA Health Sciences, Inc., Isagenix International LLC, Dymatize Nutrition, MuscleTech contribute to innovation, geographic expansion, and service delivery in this space.

Peru Nutritional Supplements and Sports Nutrition Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Peruvian population is becoming increasingly health-conscious, with 60% of adults actively seeking healthier lifestyle choices. This trend is supported by a report from the Ministry of Health, indicating a 15% rise in health-related online searches. Additionally, the World Bank reports that healthcare spending in Peru will reach approximately $13 billion in the future, further driving demand for nutritional supplements as consumers prioritize wellness and preventive health measures.

- Rising Fitness Trends:The fitness industry in Peru is experiencing significant growth, with gym memberships increasing by 25% in the future. According to the National Institute of Statistics and Informatics, over 3 million Peruvians are now gym members, leading to a heightened demand for sports nutrition products. This trend is expected to continue, as the government invests in public health initiatives, promoting physical activity and nutrition education, which will further boost the market for supplements.

- Growth of E-commerce Platforms:E-commerce in Peru is projected to grow by 30% in the future, driven by increased internet penetration, which reached 75% in the most recent period available. A report by the Peruvian Chamber of E-commerce indicates that online sales of health and wellness products have surged, with nutritional supplements accounting for 20% of total online sales. This shift towards digital shopping is facilitating greater access to a variety of products, enhancing consumer choice and convenience in purchasing nutritional supplements.

Market Challenges

- Regulatory Compliance Issues:The nutritional supplements market in Peru faces significant regulatory hurdles, with over 50% of companies reporting difficulties in meeting local health regulations. The Ministry of Health has implemented stringent guidelines for product labeling and health claims, which can delay product launches. Additionally, the cost of compliance can be burdensome, particularly for small and medium-sized enterprises, limiting their ability to compete effectively in the market.

- High Competition:The Peruvian nutritional supplements market is characterized by intense competition, with over 200 brands vying for market share. This saturation leads to aggressive pricing strategies, which can erode profit margins. According to industry reports, the top five brands control only 30% of the market, indicating a fragmented landscape. As new entrants continue to emerge, established brands must innovate and differentiate their offerings to maintain their competitive edge.

Peru Nutritional Supplements and Sports Nutrition Market Future Outlook

The future of the nutritional supplements and sports nutrition market in Peru appears promising, driven by evolving consumer preferences and increasing health consciousness. As the demand for personalized nutrition rises, companies are likely to invest in tailored products that cater to individual dietary needs. Furthermore, the expansion of e-commerce platforms will facilitate greater access to diverse product offerings, enhancing consumer engagement. With a focus on sustainability and natural ingredients, brands that align with these trends are expected to thrive in the competitive landscape.

Market Opportunities

- Expansion into Rural Markets:There is a significant opportunity for nutritional supplement brands to penetrate rural areas, where access to health products is limited. With approximately 21% of Peru's population residing in rural regions, targeting these consumers can lead to substantial growth. By establishing distribution channels and educating consumers about health benefits, companies can tap into an underserved market segment.

- Development of Plant-Based Supplements:The demand for plant-based nutritional supplements is on the rise, with a 40% increase in consumer interest reported in the future. This trend aligns with global shifts towards veganism and sustainability. Companies that innovate and develop plant-based products can capture a growing segment of health-conscious consumers, particularly among younger demographics seeking natural and environmentally friendly options.